AI News: Chatbot Wars, Soaring Valuations, & Disruption

Artificial intelligence is all the hype currently on Wall Street. Below are three of the most important Ai stories that are worth following:

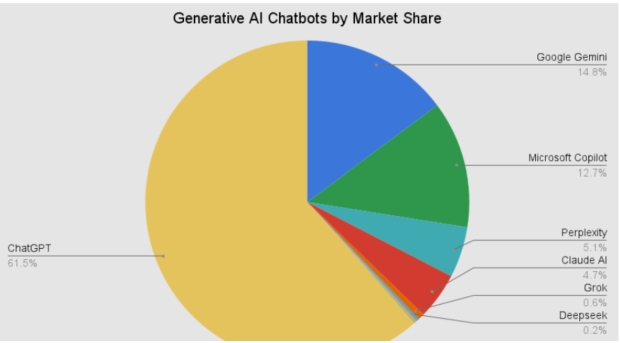

1. AI Chatbot Race Tightens Amid Gemini Success

OpenAI, which is closely partnered with tech juggernaut Microsoft (MSFT), is responsible for ushering in the AI revolution with the 2022 launch of the wildly popular “ChatGPT” large language model. However, the race for generative AI chatbot supremacy has tightened recently amid rising competition from Alphabet’s (GOOGL) “Gemini” chatbot. According to data sourced from Similarweb, ChatGPT holds 68% of the AI chatbot market, down from 87.2% a year ago. Meanwhile, Google’s Gemini has become the fastest-growing competitor, increasing its share of the pie to 18.2% from just 5.4% in January 2025.

Image Source: Vertu

2. AI Valuations Soar Amid Fresh Investments, Breakthroughs

OpenAI Valuation Soars as SoftBank Invests $30 Billion

Despite intensifying chatbot competition, deep-pocketed investors remain keen to get their hands on the privately-held OpenAI. According to “The Wall Street Journal”, SoftBank is in talks to invest up to $30 billion more into OpenAI’s most recent round of $100 billion. If confirmed, the news would mean OpenAI’s valuation could soar to as high as $830 billion.

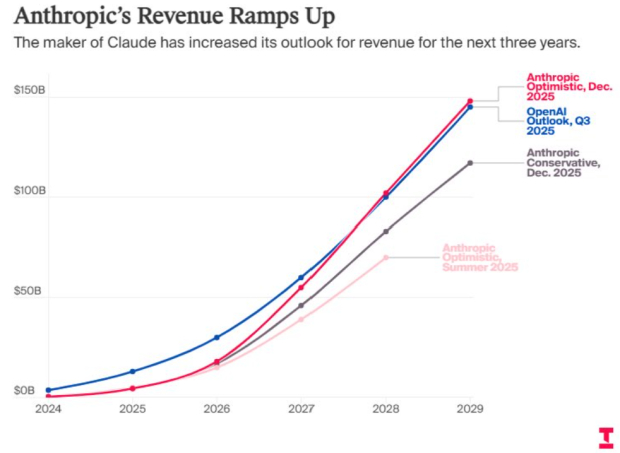

Anthropic Transforms Coding, Ups Revenue Forecast

Anthropic’s “Claude Cowork platform is enjoying its “ChatGPT” moment. In fact, in recent comments at the “World Economic Forum” (WEF) last week, Anthropic CEO Dario Amodei predicted that AI models will be able to do ‘most, maybe all’ of what software engineers do end-to-end within 6 to 12 months, effectively shifting engineers to editors. Meanwhile, Anthropic upped its 2026 revenue forecast by 20% to $55 billion.

Image Source: Zacks Investment Research

Zoom (ZM) shares surged recently amid Anthropic’s success. The company invested $53 million in Anthropic in 2023. Today, ZM’s stake is estimated to be at least $2 billion. Other tech giants, such as Amazon (AMZN), also hold stakes in Anthropic.

3. ‘Clawdbot’ Ushers in the Era of Agentic AI

‘Agentic AI’ refers to AI technology that independently achieves complex, multi-step goals with limited human oversight. Unlike generative AI that is reactive, agentic AI is proactive. Clawdbot (now known as Moltbot due to trademark considerations from Anthropic) was created by developer Peter Steinberger. Clawdbot has gone viral recently for its ability to automate AI-driven workflows. Investors appear to be selling traditional software stocks like DocuSign (DOCU) amid fears of disruption.

Bottom Line

The AI “Chatbot Wars” are heating up as ‘Gemini’ steals market share from ‘ChatGPT.’ Despite the intensifying competition, AI valuations are soaring. Meanwhile, the real story of 2026 so far is the rise of agentic AI.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Docusign Inc. (DOCU): Free Stock Analysis Report

Zoom Communications, Inc. (ZM): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com