AMD vs. NVDA: What's the Better AI Stock?

A big chunk of the S&P 500 has already reported 2025 Q4 results, though the reporting docket remains stacked for weeks to come. We’ve already heard from six of the Magnificent Seven members, with NVIDIA NVDA the only one yet to report from the beloved group.

A peer to NVIDIA, namely Advanced Micro Devices AMD, has already delivered its results, with the stock facing pressure post-earnings. AMD shares have lagged relative to NVDA over the past three months by a fairly wide margin, as shown in the chart below.

Image Source: Zacks Investment Research

Were AMD’s results bad, or was it more a reflection of profit-taking after a big run over the past year? And what can investors expect from NVIDIA earnings? Let’s take a closer look at the results from AMD and expectations for NVDA.

AMD Earnings

AMD’s results were positive across the board, breaking records across many key metrics. Q4 revenue grew by 34% year-over-year to a record $10.3 billion, and importantly, Data Center revenue of $5.4 billion also reached a new all-time high. Both metrics clearly paint a strong demand picture for the company, underpinned by the broader AI frenzy that won’t be slowing anytime soon.

Below is a chart illustrating AMD’s Data Center sales on a quarterly basis.

Image Source: Zacks Investment Research

The overall revenue acceleration over recent periods can be seen below. Please note that the chart below does not show actual sales figures but rather the YoY growth rates.

Image Source: Zacks Investment Research

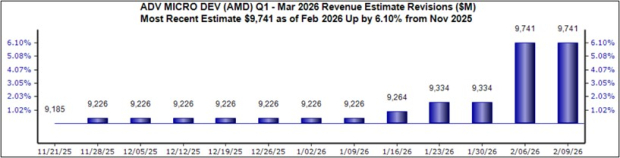

Sales acceleration is a key factor in share outperformance, particularly so for stocks involved in the AI trade. The sales acceleration paired with favorable sales revisions for its upcoming period (2026 Q1) reflects a notably bullish pairing, with the $9.7 billion expected in the next release suggesting a 32% YoY growth rate.

As shown below, the sales estimate has been revised 6% higher since roughly mid-November of 2025, with the biggest revisions happening more recently.

Image Source: Zacks Investment Research

The company’s EPS outlook for the upcoming release (2026 Q1) is also bullish, with the current $1.27 Zacks Consensus EPS estimate up 7% since mid-November and suggesting 33% YoY growth. The outlook for shares continues to remain bright, with the recent weakness in shares post-earnings also giving shares a nice, healthy breather after a massive run.

The valuation picture here isn’t overly rich, either, relative to its history, with the current 31.0X forward 12-month earnings multiple well off the 38.0X five-year median. The current multiple reflects a 34% premium to the S&P 500, reflecting investors’ above-average growth expectations but remains well below the 77% five-year median premium.

NVIDIA Earnings Expectations

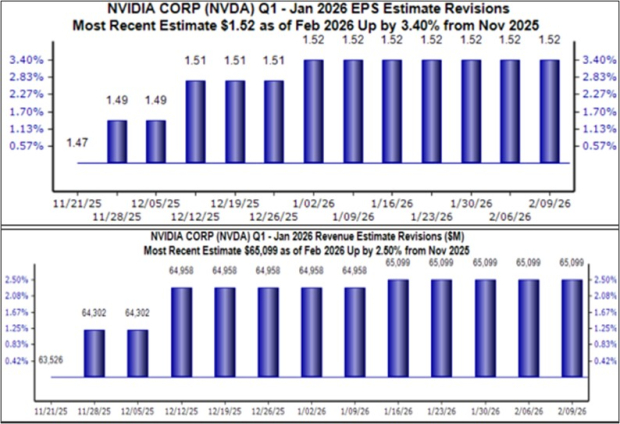

NVIDIA is always a ‘late reporter’ in the earnings cycle, with its results coming well after many of the notable tech players. EPS and sales revisions for the upcoming release, expected on Feb. 25th after the close, have remained both stable and bullish since mid-November, up by 3.4% and 2.5%, respectively.

While no upward revisions have occurred since the beginning of the new year, the stability here is a big positive. Below is a chart illustrating how the EPS and sales revisions trends have evolved over recent months.

Image Source: Zacks Investment Research

Concerning the Data Center, undoubtedly the most important metric for NVIDIA nowadays, the Zacks Consensus estimate stands at $58.7 billion, suggesting a 65% YoY growth rate. Keep in mind that NVDA has regularly exceeded our consensus estimate over recent periods, penciling in five beats over the last six quarters.

Below is a chart illustrating NVDA’s data center sales on a quarterly basis, with our consensus $58.7 billion estimate also blended in.

Image Source: Zacks Investment Research

Shares aren’t rich by any stretch despite the massive run, with the current 25.8X forward 12-month earnings multiple nearly half of the 41.3X five-year median while reflecting just a 12% premium relative to the S&P 500. Keep in mind that shares traded well above current valuation levels in 2021 and 2022, when the AI theme had not yet been fully recognized by the market.

Image Source: Zacks Investment Research

Putting Everything Together

Both stocks reflect great options for those seeking AI exposure, though it’s undeniable that NVIDIA NVDA remains the leader of the pair, underpinned by CUDA, its software platform that has let developers use GPUs for general computing, not just graphics. It was launched way back in 2006, providing a big head start.

Advanced Micro Devices AMD remains a powerhouse in its own right, but it continues to trail NVIDIA, particularly in market penetration. NVIDIA currently ranks as a Zacks Rank #2 (Buy), whereas Advanced Micro Devices is currently a Zacks Rank #3 (Hold).

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com