Alphabet Dethrones Apple Amid Tech Stock Shuffle

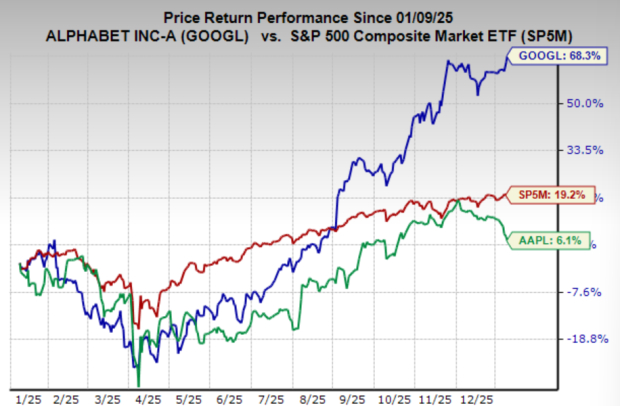

In a notable shift at the top of the stock market, Alphabet (GOOGL) has officially overtaken Apple (AAPL) as the world’s second most valuable public company, trailing only Nvidia (NVDA), which now sits near a $4.6 trillion market capitalization. It marks the first time since 2019 that Alphabet has surpassed Apple, underscoring a broader reordering underway within the technology sector.

The divergence has been driven by sharply different market narratives in 2025. Alphabet shares surged roughly 65% over the last year, the strongest performance among the Magnificent Seven, as investors responded positively to accelerating adoption of its Gemini 3 AI models and the company’s expanding role across the AI stack. By contrast, Apple shares lagged as the company struggled to articulate a clear and differentiated artificial intelligence strategy, despite its dominant consumer ecosystem.

Image Source: Zacks Investment Research

What Drove Alphabet Share Gains

Alphabet’s sharp rally in 2025 has been driven by a decisive shift in how investors perceive the company’s role in artificial intelligence. The November launch of the Gemini 3 model marked a turning point, with industry feedback positioning it as a best-in-class large language model across multiple benchmarks. For the first time in several years, Alphabet moved from being viewed as a defensive internet incumbent to a company actively setting the pace in AI.

That shift has been reinforced by Alphabet’s vertically integrated AI stack. By controlling both the underlying software models and the custom hardware they run on, Tensor Processing Units (TPUs), Alphabet has been able to optimize its system in ways competitors are unable to match. This integration gives the company greater flexibility to iterate quickly, tailor AI systems, and scale new capabilities.

Industry data suggesting a slowdown in ChatGPT traffic following Gemini 3’s release has added fuel to the narrative that Alphabet is regaining share in the most strategically important layer of the AI ecosystem. While usage trends remain fluid, the perception that Alphabet is once again competing from a position of strength has been enough to drive a meaningful re-rating in the stock.

Apple and Alphabet Shares Converge

While Alphabet has surged since the start of the year, Apple has moved in the opposite direction. Apple shares have fallen roughly 5% over six consecutive sessions, while Tim Cook’s impending retirement has only added to the uncertainty.

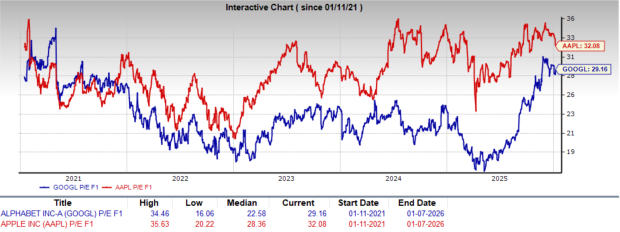

The speed of this turn in fortunes was intense, with Alphabet having traded at an earnings multiple in the teens as recently as mid-2025, as concerns that its mature search-based business was losing relevance. Despite a strong rally since then, Alphabet still trades at a discount to Apple.

Image Source: Zacks Investment Research

What Can Investors Expect for Mag 7 Stocks Going Forward

The rotation at the top of the market reflects the emerging hierarchy within the AI leaders. Nvidia remains in a category of its own as the primary beneficiary of AI infrastructure spending, while Alphabet has emerged as a second in command.

Alphabet’s surge over the past year highlights how closely tracking developments in artificial intelligence can give investors a meaningful edge. It also underscores that compelling opportunities to outperform still exist, even among the world’s largest and most widely followed companies.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com