Arm Holdings' Lofty Valuation Raises Short-Term Caution

Arm Holdings ARM continues to command attention with its sky-high valuation, trading at a price-to-earnings (P/E) ratio of 173.72 and a forward P/E of 84.25, significantly higher than the semiconductor industry average of approximately 37.61. While such figures underscore strong investor confidence in the company’s long-term prospects, they also leave minimal margin for error.

The British chip designer’s increased R&D spending, coupled with rising competition from China’s growing focus on RISC-V chip architecture, adds further pressure. Additionally, potential friction with existing partners could emerge if ARM ventures deeper into CPU manufacturing, an area traditionally served by its licensees.

Still, the company’s fundamentals remain robust. ARM maintains an impressive 99% share in mobile chip design and is steadily strengthening its presence in AI data centers, a critical growth frontier. Its strong gross margins and healthy $2.9 billion cash position provide a financial cushion to support innovation and expansion.

However, despite these positives, analysts are signaling caution in the near term. The stock’s rich valuation, combined with execution risks and competitive uncertainties, makes it less appealing for short-term investors seeking immediate upside. For those with a long-term horizon, ARM’s dominance in mobile and its growing role in AI infrastructure still paint a promising picture, but patience and a careful entry point may be key.

In short, ARM’s story remains compelling, yet its current valuation demands disciplined optimism rather than aggressive buying.

Beyond ARM: NVIDIA and Qualcomm Are Better Valued

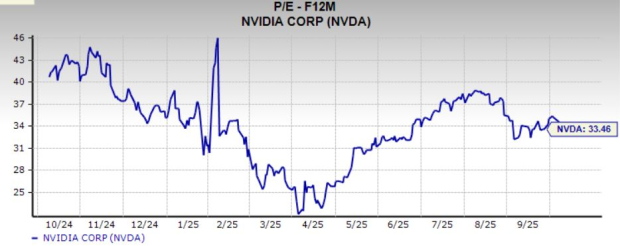

While ARM’s valuation may prompt caution, investors looking for semiconductor exposure with clearer financial traction might consider NVIDIA NVDA and Qualcomm QCOM. NVIDIA, with a forward 12-month P/E of 33.46, continues to dominate the AI accelerator space, driven by strong revenue and earnings growth, fueled by surging demand for its GPUs. The company’s leadership in AI infrastructure makes NVIDIA a favorite among growth-oriented investors.

Image Source: Zacks Investment Research

Meanwhile, Qualcomm, trading at just 14.12x forward earnings, offers a more diversified chip portfolio spanning smartphones, automotive, and IoT. Its solid royalty business and increasing footprint in AI-powered edge devices position Qualcomm for steady expansion. Both NVIDIA and Qualcomm have demonstrated the ability to monetize their innovations more effectively than ARM, making them compelling alternatives.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

ARM stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

ARM Holdings PLC Sponsored ADR (ARM): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com