BD Merges Biosciences & Diagnostics Business With Waters

Becton, Dickinson and Company BDX, popularly known as BD, recently announced that it has completed the previously disclosed spin-off of its Biosciences & Diagnostic business, followed by the merger of the separated entity with Waters Corporation, thereby concluding the strategic transaction.

Pursuant to the transaction, BD shareholders will receive 0.135 shares of Waters common stock for each BD share they held at the close of business on Feb. 5, 2026 — the record date for the spin-off, with cash issued in lieu of any fractional Waters shares. As disclosed previously, BD received cash proceeds of $4 billion from the transaction.

Per management, the combination of BD’s Biosciences & Diagnostic Solutions business with Waters represents the final step in executing its 2025 strategy and positions BD to enter its next phase as a more focused, pure-play MedTech organization aligned with the evolving landscape of healthcare.

In recent years, BD has intentionally reshaped its portfolio through the divestiture of three significant non-core assets and the completion of more than 20 targeted tuck-in acquisitions, increasing exposure to attractive healthcare segments. The company expects to benefit from key industry trends, such as the expansion of connected and AI-enabled medical technologies, the ongoing migration of care to more convenient settings and continued technological advances in chronic disease management.

Likely Trend of BDX Stock Following the News

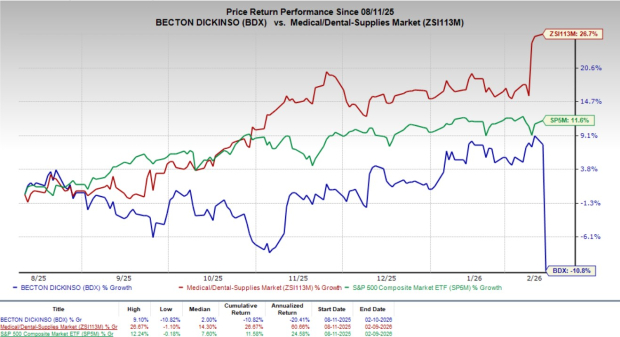

Shares of BDX have lost 17.2% since the announcement on Monday. Over the past six months, shares of the company declined 10.8% against the industry’s 26.7% growth and the S&P 500’s 11.6% rise.

In the long run, the completion of the Biosciences & Diagnostic Solutions transaction strengthens BD’s strategic focus, positioning the company as a streamlined MedTech player with enhanced growth visibility. The $4 billion cash proceeds support shareholder value creation through share repurchases and debt reduction, improving capital structure flexibility.

By sharpening its portfolio and concentrating on high-growth segments such as connected medical devices, AI-enabled technologies and chronic disease solutions, BD expects to drive durable revenue expansion, improve return metrics and strengthen long-term cash flow generation, reinforcing its competitive positioning and ability to capitalize on evolving healthcare delivery trends.

BDX currently has a market capitalization of $59.09 billion.

Image Source: Zacks Investment Research

More on the Spin-Off & Strategic Shift

Following completion, BD shareholders collectively owned Waters shares equal to 39.2% of the combined company’s fully diluted outstanding shares. Waters shareholders will hold 60.8% of the combined company’s fully diluted outstanding shares. Based on the closing price of Waters’ common stock on Feb. 6, 2026, the BD Biosciences & Diagnostic Solutions business was valued at $18.8 billion. BD intends to deploy $2 billion of the proceeds toward an accelerated share repurchase program and use the remaining $2 billion for debt reduction, with both actions expected to be executed in the near term.

Tom Polen, Chairman, CEO and President of BD, added that the company is advancing execution through its Excellence Unleashed strategy, focused on strengthening its commercial capabilities, driving differentiated innovation and enhancing operational quality and efficiency. Supported by the company’s global scale, strong market positions across most of its served markets and a highly recurring consumables-driven revenue model, BD believes it is well positioned to deliver sustained revenue growth, margin expansion and solid cash flow generation, supporting long-term shareholder value creation.

Under the terms of the transaction, Claire M. Fraser, Ph.D., has joined the Waters Corporation's board of directors effective at closing and has stepped down from BD’s Board after 20 years of service.

Other News

In January, BD announced the global commercial launch of BD Research Cloud 7.0, advancing its AI strategy in flow cytometry and life sciences research. The release features BD Horizon Panel Maker, an AI-driven tool that automates panel design — an essential step in immunology and oncology experiments to improve data quality and reliability. The cloud-based platform supports collaboration, workflow optimization and laboratory management.

BD announced an expanded collaboration with Ypsomed to support the fast-growing biologics market by developing a 5.5 mL version of the BD Neopak XtraFlow glass prefillable syringe. The new syringe is intended to be fully compatible with Ypsomed’s YpsoMate 5.5 autoinjector platform, broadening delivery solutions for pharmaceutical companies and improving options for patients requiring large-volume self-injection therapies.

The company obtained FDA 510(k) clearance for the EnCor EnCompass Breast Biopsy and Tissue Removal System, an advanced multi-modality breast biopsy platform expected to be commercially launched in early 2026.

BDX’s Zacks Rank & Key Picks

Currently, BDX carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the broader medical space are Veracyte VCYT, Cardinal Health CAH andThe Cooper CompaniesCOO.

Veracyte, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 51 cents, which surpassed the Zacks Consensus Estimate by 59.4%. Revenues of $131.8 million beat the Zacks Consensus Estimate by 5.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

VCYT has an estimated earnings recession rate of 3% for 2026 compared with the industry’s 17.3% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 45.1%.

Cardinal Health, currently carrying a Zacks Rank #2 (Buy), reported second-quarter fiscal 2026 adjusted EPS of $2.63, which surpassed the Zacks Consensus Estimate by 10%. Revenues of $65.6 billion beat the Zacks Consensus Estimate by 0.9%.

CAH has an estimated long-term earnings growth rate of 15% compared with the industry’s 9.5% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 9.3%.

The Cooper Companies, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of $1.15, which surpassed the Zacks Consensus Estimate by 3.6%. Revenues of $1.06 billion beat the Zacks Consensus Estimate by 0.5%.

COO has an estimated long-term earnings growth rate of 7.8% compared with the industry’s 9.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 2.4%.

Zacks' Research Chief Picks Stock Most Likely to "At Least Double"

Our experts have revealed their Top 5 recommendations with money-doubling potential – and Director of Research Sheraz Mian believes one is superior to the others. Of course, all our picks aren’t winners but this one could far surpass earlier recommendations like Hims & Hers Health, which shot up +209%.

See Our Top Stock to Double (Plus 4 Runners Up) >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Becton, Dickinson and Company (BDX): Free Stock Analysis Report

Cardinal Health, Inc. (CAH): Free Stock Analysis Report

The Cooper Companies, Inc. (COO): Free Stock Analysis Report

Veracyte, Inc. (VCYT): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com