Bear of the Day: Boise Cascade Company (BCC)

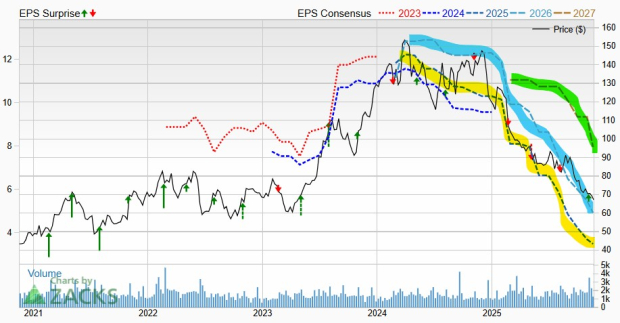

Boise Cascade Company BCC is an engineered wood products and plywood giant. BCC stock has tumbled 50% in the past 12 months as Wall Street dumps the stock based on a variety of industry-specific headwinds and macroeconomic challenges.

The engineered wood products maker provided disappointing guidance once again when it reported its third quarter 2025 results on November 3.

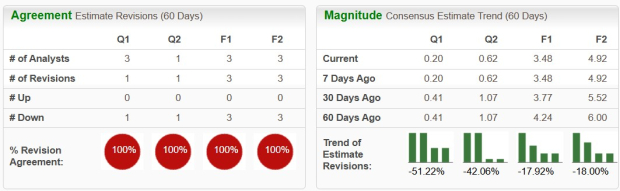

Boise Cascade’s negative earnings per share (EPS) revisions following its release earn the stock a Zacks Rank #5 (Strong Sell) and prolong its string of downward EPS revisions.

Should Investors Stay Away from BCC Stock for Now?

Boise Cascade is a leading producer of engineered wood products and plywood. The company is also a huge player in the wholesale distribution of building products in the U.S.

BCC posted an impressive stretch of top-line expansion between 2012 and 2022, highlighted by 18% growth in 2020 and 45% in 2021, driven by the wild Covid-driven housing and home improvement boom.

Boise Cascade followed that up with another 6% sales growth in 2022 before tumbling against a tough to compete against stretch and broader headwinds that are challenging the entire housing-related market.

Image Source: Zacks Investment Research

Mortgage rates soared off their lows, while housing prices and inflation have skyrocketed as well, drying up the housing market, crushing demand. On top of that, commodity prices are hurting Boise Cascade. The massive Covid-era pull forward is also hard to overstate and overcome in the short run since it disrupted so much.

The company’s sales fell 19% in 2023 and 2% in 2024, while its earnings tanked roughly 40% and 20%, respectively. Most recently, Boise Cascade adjusted EPS plummeted 75% YoY in Q3 FY25 on 3% lower sales, as it faces “subdued demand and commodity pricing headwinds.”

BCC’s Q4 earnings estimate tanked 51% since its early November release, with its fiscal 2025 estimate 18% lower and its FY26 consensus down 18%. This backdrop lands Boise Cascade its Zacks Rank #5 (Strong Sell), extending its nearly two-year run of plummeting earnings estimates.

Image Source: Zacks Investment Research

The company did announce on November 18 that it reached an agreement to purchase “Humphrey Company, Inc., a leading two-step distributor of building materials located in Chicopee, Massachusetts, with approximately $145 million in revenue over the last 12 months.” The move helps BCC expand its reach and grow in the key northeast region.

The stock could also possibly benefit from a potential rotation out of tech. Investors high on Boise Cascade long-term might consider adding BCC to their watchlists instead of buying it right now amid all the headwinds and unknowns surrounding the housing market.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boise Cascade, L.L.C. (BCC): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com