Bear of the Day: Comcast (CMCSA)

Comcast Company Overview

Zacks Rank #5 (Strong Sell) stock Comcast (CMCSA) is one of the largest global media and technology companies. The Philadelphia-based company has two primary business segments, including:

· Connectivity & Platforms: Contains the company’s broadband and wireless connectivity business operated under the Xfinity and Comcast brands in the United States and the Sky Brand in Europe. It also includes Comcast video service businesses and the Sky-branded entertainment television channels. Comcast also offers residential broadband and wireless connectivity services.

· Content & Experiences: Comcast’s content and experiences business serves three smaller business segments – media, studios, and theme parks. Media includes NBCUniversal’s television and streaming platforms, including national and regional cable networks like NBC, Telemundo, and Peacock, as well as the company’s direct-to-consumer streaming service. Additionally, CMCSA operates several ‘Universal’ theme parks across the US and Asia.

Comcast Risk: Broadband is an Oversaturated Market

Broadband accounts for ~65% of Comcast’s total revenue. Comcast’s most impactful business has reached a troubling tipping point. Internet subscriber growth has stalled as the market has reached maturity. Meanwhile, competition from providers like T-Mobile (TMUS) and Verizon (VZ) has intensified. Furthermore, Comcast is at risk of disruption from Starlink, the leader in satellite broadband. Starlink currently has 7,000 satellites with plans to grow rapidly in the coming years.

Comcast’s Cable Business is Becoming Obsolete

Although older generations still predominantly watch traditional cable, younger generations are migrating toward lower-cost streaming services like Alphabet’s (GOOGL) YouTube TV. Additionally, more young people are relying on independent podcasts for news than traditional cable stations like NBC. For instance, ‘The Joe Rogan Experience’ podcasts regularly reach more than 15 million views per month. Instead of paying for expensive legacy cable, these subscribers are opting for low-cost options like Spotify (SPOT).

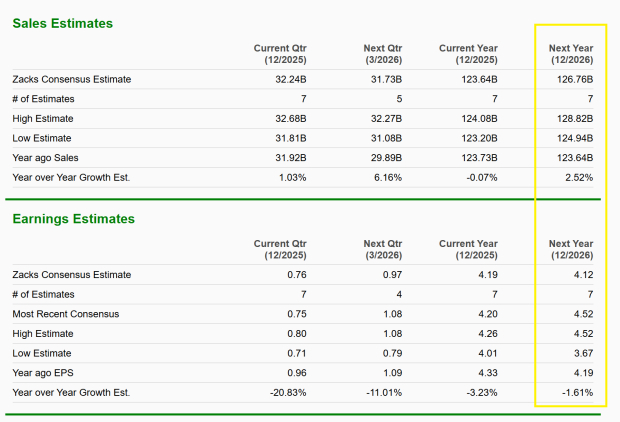

Comcast: Stagnant Earnings and Sales Growth

Comcast lost 257,000 video subscribers in Q3 2025. As the company’s two main businesses slow, Zacks Consensus Analyst Estimates suggest that EPS growth will be negative in 2026, while revenue is expected to be a feeble 2.52%.

Image Source: Zacks Investment Research

Comcast: Relative Weakness & Bear Flag Pattern

CMCSA shares have underperformed the general market, losing 45% over the past 5 years. Meanwhile, the stock is currently breaking down out of a daily bear flag.

Image Source: TradingView

Bottom Line

Although Comcast remains a dominant name in media and connectivity, the company is being squeezed on multiple fronts as its legacy cable and broadband businesses mature and face disruptive competition. With weak growth expectations and persistent subscriber erosion, the stock’s outlook remains bleak.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Comcast Corporation (CMCSA): Free Stock Analysis Report

T-Mobile US, Inc. (TMUS): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Spotify Technology (SPOT): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com