Bear of the Day: Cracker Barrel (CBRL)

Cracker Barrel Company Overview

Based in Lebanon, TN, and founded in 1969, Zacks Rank #5 (Strong Sell) stock Cracker Barrel Old Country Store (CBRL) owns and operates full-service restaurants with attached retail stores across the United States. The company operates 660 company-owned locations across 43 states. Cracker Barrel is best known for its home-style country food, including meatloaf, homemade chicken n’ dumplings, as well as its signature biscuits, which use an old family recipe. Meanwhile, its attached retail stores sell unique gifts and trinkets that have an Americana twist.

Cracker Barrel’s Disastrous Rebranding Effort

Over its long history, Cracker Barrel has built a brand that allows its consumers to escape American highways for a piece of coziness and a trademark southern comfort vibe. However, in August, Cracker Barrel management took a considerable risk. The company removed its iconic “Uncle Herschel” man from its logo in an effort to reach a broader customer base. Additionally, the company began removing many of the American trinkets that fill its restaurants, making them far less distinctive.

Following the rebrand, CBRL shares dumped 7% in a single session, erasing $140 million in market cap as customer backlash began to set in. Worse, President Donald Trump weighed in on social media, suggesting the company return to its iconic and well-known branding. Though Cracker Barrel rescinded its rebranding plans amid the backlash, the damage was already done as many right-leaning customers saw the move as an appeal to the “woke” movement. Despite the retraction, CBRL shares have underperformed and been weak ever since.

Image Source: Zacks Investment Research

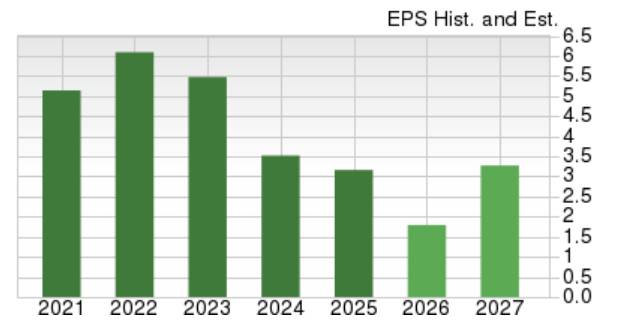

Cracker Barrel’s Growth is Stagnant

Cracker Barrel is in the midst of a multi-year turnaround effort, with initiatives spanning food quality kitchen optimization, loyalty expansion, and capital allocation. Thus far, there has been little evidence that Cracker Barrel’s turnaround efforts will bear fruit. As a result, Wall Street analysts expect earnings growth to remain stagnant for the foreseeable future.

Image Source: Zacks Investment Research

Cracker Barrel Competition

Cracker Barrel faces cutthroat competition in the fast casual space from competitors like Darden Restaurants (DRI), Bloomin’ Brands (BLMN), Denny’s (DENN), and Texas Roadhouse (TXRH).

Bottom Line

Cracker Barrel’s attempt to modernize its brand backfired severely, resulting in a significant stock drop and erosion of trust with its customer base. Despite quickly reversing the changes, the damage has been done.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cracker Barrel Old Country Store, Inc. (CBRL): Free Stock Analysis Report

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

Texas Roadhouse, Inc. (TXRH): Free Stock Analysis Report

Denny's Corporation (DENN): Free Stock Analysis Report

Bloomin' Brands, Inc. (BLMN): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com