Bear of the Day: Dave & Buster's (PLAY)

Despite rumors, Dave & Buster's PLAY is not closing down and is actually expanding with new locations under construction and strategic growth plans in place.

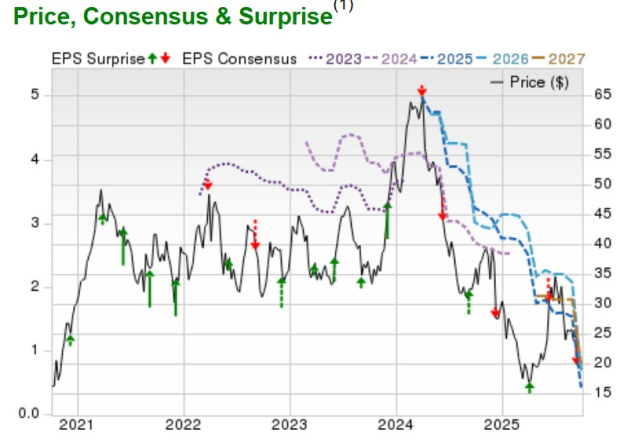

However, this transition has taken a toll on investor sentiment as Dave & Buster’s has had a slow recovery from pandemic-related struggles and a more infation conscious consumer. Trying to navigate a challenging operating environment, Dave & Buster’s stock has drifted toward new multi-year lows at under $20 a share.

That said, PLAY shares could have more downside risk ahead, with it noteworthy that Dave & Buster’s Zacks Retail-Restaurants Industry is currently in the bottom 21% of over 240 Zacks industries.

Image Source: Zacks Investment Research

Profitability Collapse & Cautious Outlook

Coming off a disappointing Q2 report, the decline in Dave & Buster’s profitability is more concerning due to a cautious outlook from its new CEO, Tarun Lal, who took over in May of 2024. Acknowledging strategic missteps and operational inefficiencies, Lal’s remarks have suggested a long road to recovery, which has further weighed on investor confidence.

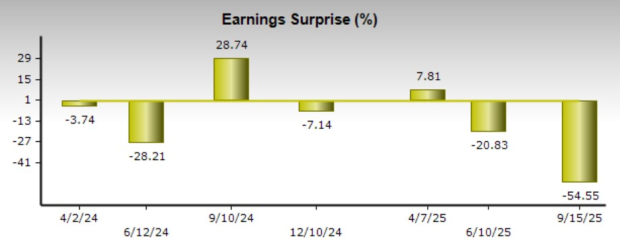

This comes as Dave & Buster’s reported Q2 EPS of $0.40 last month, which plummeted from $1.12 per share in the comparative quarter and missed expectations of $0.88 by a grizzly 54%. Furthermore, Dave & Buster’s has missed EPS expectations in three of its last four quarterly reports with an average earnings surprise of -18.68%.

Highlighting Dave & Buster’s profitability collapse, Q2 net income was down 67% to $11.4 million versus $40.3 million a year ago. Dave & Buster’s EBITDA margins dropped to 23.3% from 27.2% in Q2 2024, attributed to rising operating costs and stagnant revenue.

Image Source: Zacks Investment Research

Declining EPS Revisions

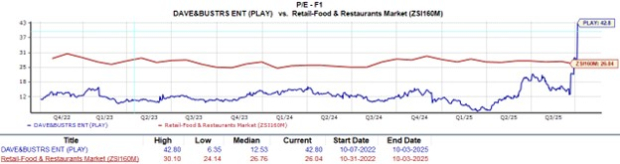

Correlating with a Zacks Rank #5 (Strong Sell) and landing Dave & Buster’s stock the Bear of the Day, fiscal 2025 and FY26 EPS estimates have dropped mightily in the last 60 days.

Plummeting over 70% in the last two months, FY25 EPS estimates have gone to $0.44 from $1.56. While Dave & Buster’s bottom line is projected to stabilize and rebound in FY26, EPS revisions have fallen 65% from $2.03 eight weeks ago to $0.71.

Image Source: Zacks Investment Research

Dave & Buster’s Deteriorating Valuation

Of course, such a steep decline in earnings estimate revisions is starting to deteriorate Dave & Buster’s valuation, which is illustrated in the fast spike to a 3-year high forward P/E multiple of 42.8X, with the industry average at 26X and closer to the benchmark S&P 500.

Image Source: Zacks Investment Research

Summary

PLAY has had the remnants of a value trap for quite some time, but the cat is out of the bag now, considering Dave & Buster's diminishing EPS outlook. Following a disappointing Q2 report that continued to show a decline in profitability and was met with cautious guidance from its new CEO, it may still be best to avoid Dave & Buster's stock for now.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dave & Buster's Entertainment, Inc. (PLAY): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com