Bear of the Day: Toll Brothers, Inc. (TOL)

Toll Brothers, Inc. TOL is one of the top luxury homebuilders in the country. TOL provided downbeat earnings guidance when it posted its fourth quarter 2025 earnings results on December 8, as it faces “soft demand across many markets” and other setbacks that are hitting the entire homebuilding and housing market.

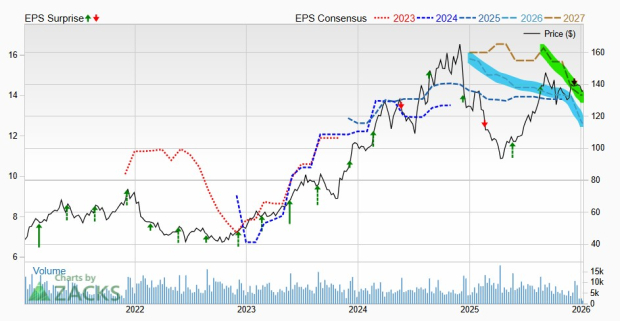

Toll Brothers’ recent downward earnings revisions trend earns the luxury homebuilder stock a Zacks Rank #5 (Strong Sell).

Stay Away from Toll Brothers Stock Right Now?

Toll Brothers is a diversified luxury homebuilder that operates its own architectural, engineering, mortgage, title, and land development subsidiaries, as well as other offerings.

TOL also runs its own lumber distribution, house component assembly, and manufacturing segments that help it build houses across 24 states and 60 markets from Arizona and California to New York and North Carolina.

Despite being in the luxury home market, Toll Brothers caters to nearly every aspect of the market, including first-time, move-up, empty-nester, active-adult, and second-home buyers. TOL posted revenue growth in FY24 and FY25 even after the huge Covid-driven pull forward across the housing market.

Image Source: Zacks Investment Research

That said, it offered downbeat 2026 guidance in early December as numerous factors put pressure on margins and profits.

Toll Brothers is projected to see its revenue fall -4.2% YoY in FY26 and its earnings drop -6.5%. TOL’s consensus earnings estimates have dropped by over -10% for FY26 and FY27 since its Q4 release.

These downward revisions earn TOL stock a Zacks Rank #5 (Strong Sell) right now. On top of that, its Building Products-Home Builders industry sits in the bottom 3% of nearly 250 Zacks industries. This puts added pressure on TOL stock since studies have shown that roughly half of a stock's price movement can be attributed to a stock's industry group.

The entire housing and homebuilding industry is suffering from higher mortgage rates, higher home prices, and beyond. That said, Toll Brothers and the broader industry offer long-term upside since the U.S. is in desperate need of more housing supply.

Plus, TOL’s Q4 and full-year results showed that its “luxury business is differentiated, as we serve a more affluent customer who is less impacted by affordability pressures,” according to its CEO.

Still, investors might want to stay away from Toll Brothers until its earnings revisions start to trend in the right direction again.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toll Brothers Inc. (TOL): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com