Berkshire's Strategic Acquisitions: A Driver of Long-Term Growth?

Berkshire Hathaway Inc. (BRK.B) boasts an impressive acquisition portfolio. This conglomerate, with Warren Buffett at its helm, targets businesses with durable earnings power, strong returns on equity with modest debt and skilled management—acquired only at sensible valuations. This consistent framework, followed for decades, has shaped Berkshire’s identity. While ownership shifts to Berkshire, the subsidiaries continue operating autonomously, preserving their organizational culture and operational agility.

Berkshire follows two acquisition paths: transformative large-scale deals and smaller bolt-on purchases integrated into existing subsidiaries. Its landmark acquisitions such as Burlington Northern Santa Fe (BNSF) and Berkshire Hathaway Energy (BHE) have substantially lifted its earnings power, while bolt-on acquisitions like Clayton Homes and HomeServices of America have steadily compounded value.

The acquisition of Pilot Travel Centers broadened Berkshire’s presence in transportation and fuel retailing, complementing its railroad and energy holdings. In insurance, deals like Alleghany strengthened underwriting capacity and float, the low-cost funding source that underpins much of Berkshire’s investment strategy. As insurance operations expand, so too does the float available to finance new opportunities.

These acquisitions have collectively fueled Berkshire’s growth by adding resilient cash-generating businesses, diversifying income streams and expanding its investment base. With more than $300 billion in liquidity, Berkshire is well-positioned to deploy capital when markets dislocate. Acquisitions remain central to compounding shareholder value over the long term.

What About BRK.B’s Competitors?

Progressive Corporation’s PGR acquisition strategy focuses on building scale, technology, and distribution while reinforcing its insurance portfolio. Progressive pursues disciplined, selective deals that deliver strategic value and complement its core strengths. Through targeted acquisitions, Progressive enhances efficiency and customer reach, ensuring long-term competitiveness in a dynamic insurance landscape.

.

Travelers Companies’ TRV acquisition strategy emphasizes reinforcing core insurance strengths while expanding into complementary markets. Travelers seeks disciplined acquisitions that enhance underwriting, technology and distribution capabilities. With a focus on sustainable shareholder value, Travelers carefully evaluates opportunities that bolster its competitive edge while maintaining a conservative balance sheet..

BRK.B’s Price Performance

Shares of BRK.B have gained 7.6% year to date, outperforming the industry.

Image Source: Zacks Investment Research

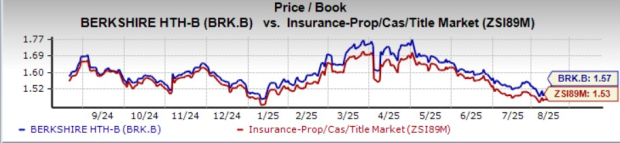

BRK.B’s Expensive Valuation

BRK.B trades at a price-to-book value ratio of 1.57, above the industry average of 1.53. It carries a Value Score of D.

Image Source: Zacks Investment Research

No Estimate Movement for BRK.B

The Zacks Consensus Estimate for BRK.B’s third-quarter and fourth-quarter 2025 EPS has witnessed no movement over the past 30 days. The consensus estimate for full-year 2025 and 2026 EPS has also witnessed no movement over the past 30 days.

Image Source: Zacks Investment Research

The consensus estimates for BRK.B’s 2025 and 2026 revenues indicate year-over-year increases. While the consensus estimate for BRK.B’s 2025 EPS indicates a decline, the same for 2026 suggests an increase.

BRK.B stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

See our %%CTA_TEXT%% report – free today!

7 Best Stocks for the Next 30 DaysWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

Berkshire Hathaway Inc. (BRK.B): Free Stock Analysis Report

The Progressive Corporation (PGR): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com