Bull of the Day: Array Technologies (ARRY)

The risk-to-reward appears to be very favorable for Array Technologies ARRY stock, which sports a Zacks Rank #1 (Strong Buy) and belongs to the strongly-rated Zacks Solar Industry that is currently in the top 10% of over 240 Zacks industries.

To that point, there are still several ongoing clean energy policies that are actively supporting solar companies in the United States. This includes tax credits for solar companies under the Inflation Reduction Act (IRA), which has directly driven Array's expansion.

Furthermore, Array is indirectly benefiting from other domestic incentives for solar manufacturing as one of the world’s leading providers of solar tracker systems that are used in large-scale solar power plants. In other words, more utility-scale solar = more trackers = more demand for Array’s products.

Leadership Changes Signal Confidence

Array recently promoted two senior leaders: Darin Green to Global Chief Revenue Officer and Nick Strevel to Chief Product Officer. Moves like this often signal internal confidence and a push toward scaling revenue and product innovation, which can boost investor sentiment.

Right on cue, Array has announced that its North American segment is already showing significant improvement under the new Chief Revenue Officer’s leadership.

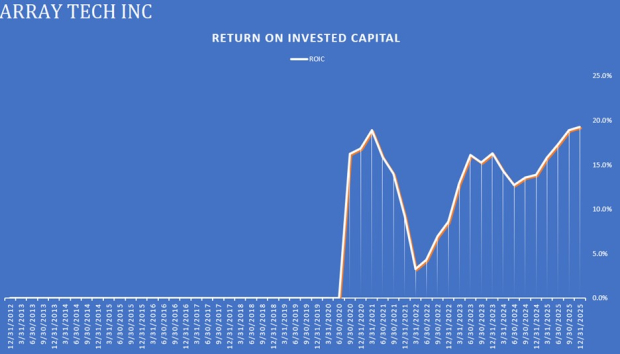

Array’s Increasing ROIC

Starting to suggest long-term shareholder value since going public in 2020, Array’s return on invested capital (ROIC) has seen a sharp uptick toward the often admirable level of 20% or higher. Showing the ability to effectively turn invested capital into profits, Array’s ROIC is currently at 19% and tops industry giant First Solar’s FSLR 13%.

Considering many solar companies are still in the early stages of their development, strong ROIC separates those that will potentially compound wealth from those that simply burn cash or waste resources.

Image Source: Zacks Investment Research

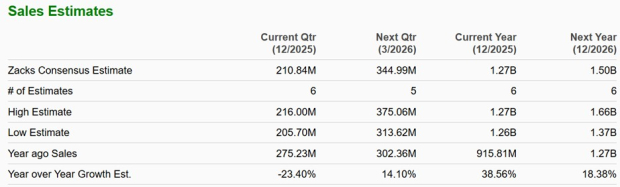

Steady Growth & Attractive Valuation

Indicative of its future earnings potential, Array is already on the cusp of bringing in over $1 billion in annual sales, a rather robust top line for a stock that investors are paying under $10 a share for.

Array is thought to have ended fiscal 2025 with annual earnings rising 11% to $0.67 per share. Plus, FY26 EPS is projected to soar another 44% to $0.97. The company will be reporting Q4 2025 results on February 26, after most recently crushing Q3 EPS and sales estimates by 42% and 25%, respectively.

Image Source: Zacks Investment Research

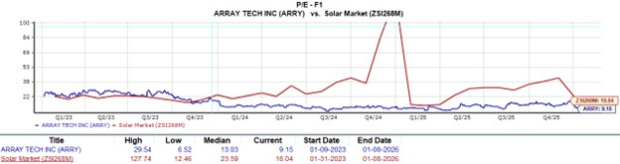

More intriguing is that Array’s stock trades at 9X forward earnings, well below the Solar industry average of 18X and an even steeper discount to the benchmark S&P 500. ARRY is also trading at just 1X forward sales, with the industry average being closer to 2X and the S&P 500’s average at nearly 6X.

Image Source: Zacks Investment Research

Bottom Line

Array Technologies stock has a lot of potential in one of the largest and fastest-growing energy industries, making the risk-to-reward scenario very appealing. Magnifying its strong buy rating, ARRY checks an overall “A” Zacks Style Scores grade for the combination of Value, Growth, and Momentum.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Array Technologies, Inc. (ARRY): Free Stock Analysis Report

First Solar, Inc. (FSLR): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com