Bull of the Day: Celsius (CELH)

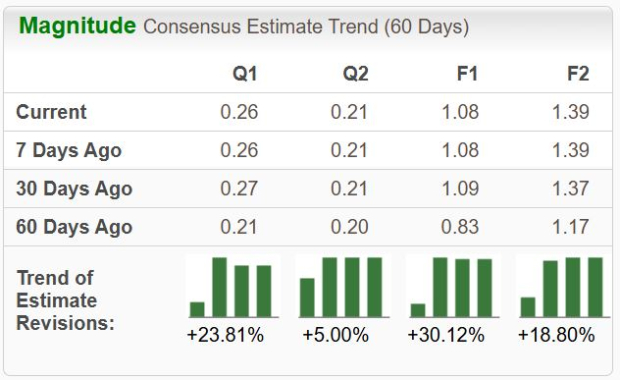

Celsius Holdings, Inc. CELH is a global beverage company and maker of premium, lifestyle energy drink CELSIUS. The stock boasts the highly coveted Zacks Rank #1 (Strong Buy), with EPS expectations increasing across the board over recent months.

Image Source: Zacks Investment Research

Most are familiar with the company’s energy drinks, which saw great reception among consumers over recent years. Let’s take a closer look at how it currently stacks up.

Celsius Breaks Sales Record

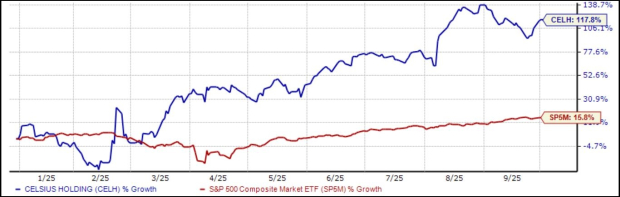

CELH shares have had an interesting story, notably hot in the post-COVID period before experiencing a drastic plunge in the back half of 2024. But shares have rebounded in a big way in 2025 so far, up nearly 120% and widely outperforming.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

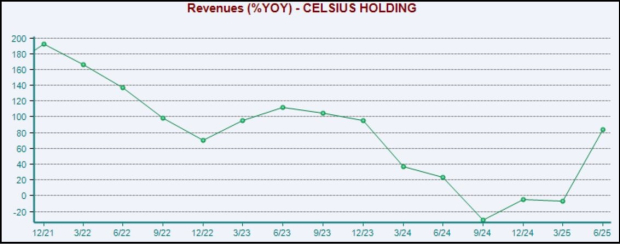

The share plunge was driven by weakening sales growth rates, as we can see below. After experiencing years of sizable year-over-year growth percentages, the -30% decline in the September 2024 period reflected a massive red flag for growth-focused investors.

But sales growth turned positive again in its latest period on a YoY basis, helping the stock see some post-earnings gains. Please note that the chart below tracks YoY % change in sales, not actual sales numbers.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

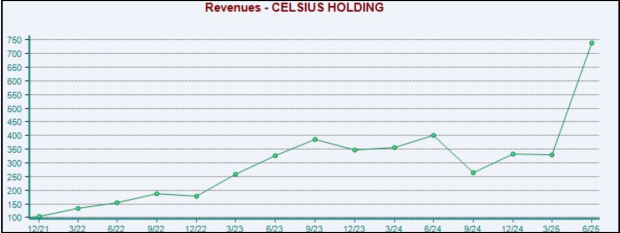

Its latest set of quarterly results came in well above expectations, with CELH crushing the Zacks Consensus EPS estimate by more than 100% and reporting sales nearly 15% ahead of consensus expectations. Sales of $740 million reflected a record and soared more than 80% year-over-year, whereas adjusted EPS was up a sizable 70% YoY.

It’s critical to note that its Alani Nu acquisition is also reflected in these sales numbers, helping explain why it’s such an outlier. The acquisition accounted for $301.2 million.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

Celsius Holdings, Inc. CELH would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the "first wave" of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks' AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Celsius Holdings Inc. (CELH): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com