Bull of the Day: Interactive Brokers (IBKR)

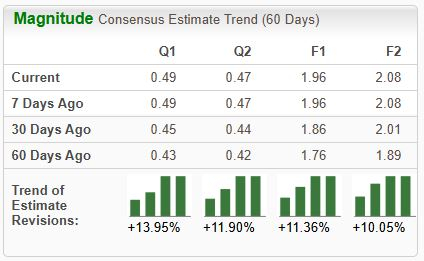

Interactive Brokers Group IBKR operates as an automated global electronic market maker and broker. Analysts have positively revised expectations across the board, landing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

In addition to favorable earnings estimate revisions, the stock resides in the Zacks Financial – Investment Bank industry, which is currently ranked in the top 5% of all Zacks industries. Let’s take a closer look at how the company stacks up.

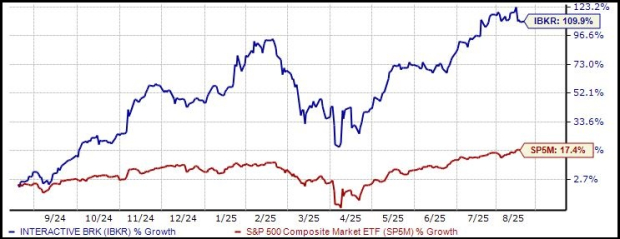

IBKR Shares Double

IBKR shares have delivered a strong performance over the past year, up nearly 110% and widely outperforming relative to the S&P 500. Favorable quarterly results have aided the move, with shares seeing nice strength following its latest print.

Image Source: Zacks Investment Research

The company’s results have been aided by higher customer trading volumes, with volumes in stocks, options, and futures increasing 31%, 24% and 18%, respectively, throughout its latest period. Commission revenue of $516 million throughout the period shot 27% higher year-over-year.

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

In addition, customers continue flocking to the platform, with customer accounts growing a notable 32% year-over-year to 3.9 million throughout the period.

Valuation multiples have expanded considerably, with the current 31.1X forward 12-month earnings multiple well above the 18.9X five-year median. The current PEG ratio works out to 2.5X, again above the 0.8X five-year median.

The stock sports a Style Score of ‘C’ for Value.

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

Interactive Brokers IBKR would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com