Bull of the Day: MYR Group Inc. (MYRG)

MYR Group Inc. MYRG is one of the largest specialty electrical construction contractors in the U.S. and one of the best pure-play stocks to buy within an increasingly critical behind-the-scenes industry required to fuel the artificial intelligence age.

MYRG is benefiting from the once-in-a-generation energy boom that’s just starting to help run the power-hungry AI arms race and a thriving growth economy aiming to electrify more and more.

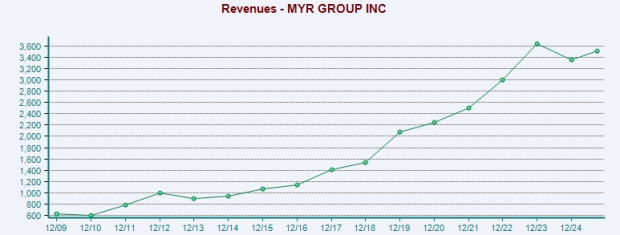

The Colorado-based firm, which already doubled its revenue between 2018 and 2022, is projected to post strong sales growth in the coming years and triple-digit earnings expansion in 2025.

MYRG’s upbeat earnings outlook earns the AI-boosted electric utility infrastructure stock a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Investors should also be pleased that MYR Group works under longer-term master service agreements and other long-term deals that provide high visibility and larger margins.

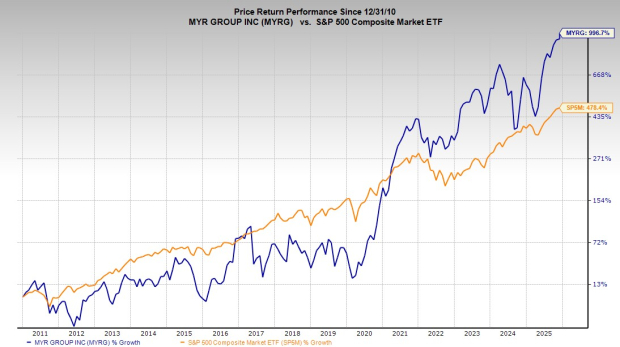

MYRG stock has soared over 300% in the past five years to blow away its sector and the S&P 500’s 90%. The electric infrastructure powerhouse has also doubled the benchmark over the past 15 years, up 997%. The stock looks to be on the brink of a technical breakout to new all-time highs.

The simplest bull case for MYR Group is that it’s one of the go-to electrical construction contractors for critical projects such as grid hardening and expansion, renewable energy integration, electrification, and the explosion of power-hungry AI data centers.

Why Long-Term Investors Should Buy MYRG Stock

MYR Group is one of the largest specialty electrical construction contractors in the U.S., focused on two main segments: Transmission & Distribution (T&D) and Commercial & Industrial (C&I).

The Colorado-based company builds, maintains, and repairs the high-voltage power lines, substations, and other key electrical infrastructure that keep the grid running.

On top of that, MYRG helps build large-scale electrical work inside renewable energy projects, EV charging networks, industrial facilities, airports, hospitals, and increasingly, AI data centers.

Image Source: Zacks Investment Research

MYR Group’s growth runway is massive as the U.S. races to expand the energy and electricity infrastructure across the country to support the AI arms race, electrification, and a thriving growth economy.

The U.S. energy sector faces a ~$578 billion investment gap by 2033, according to the American Society of Civil Engineers. The AI age is projected to help drive a 25% increase in U.S. electricity demand by 2030 and a 75% increase by 2050.

Image Source: Zacks Investment Research

Big tech, big government, and Wall Street are all-in on helping the U.S. win the AI arms race. Massive and rapid energy and electricity expansion are increasingly looking like the most difficult part of the AI growth equation.

The U.S. government, AI hyperscalers, and other key pillars of the economy are attempting to quadruple nuclear energy capacity by 2050, double transmission capacity, and achieve other costly and difficult efforts that are essential to revamping and expanding the U.S. energy ecosystem and broader economy.

The Electric Utility Infrastructure Company’s Growth Outlook

The company went on a massive run between 2017 and 2023 (including doubling its revenue between 2018 and 2022). MYRG faced short-term setbacks in 2024, driven by project delays, cost overruns in clean energy contracts, and more.

But MYR Group is back on track, having crushed our earnings per share estimates by an average of 67% in the past four quarters.

MYRG’s 2026 earnings estimate surged 6% since its Q3 FY25 release at the end of October. The company’s upbeat earnings outlook earns it a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

“The accelerating pace of electrification, future project demand, load growth, and the need for resilient infrastructure are driving investment in electrical infrastructure, which positions us well for continued success in the future,” CEO Rick Swartz said in prepared Q3 remarks.

MYR Group is projected to grow its adjusted EPS by 275% in 2025 to hit $6.87 a share, up from $1.83 in 2024.

It is set to follow that up with another 21% bottom-line expansion in 2026 to $8.32 a share. Meanwhile, MYRG is expected to grow its revenue by 6% in 2025 and 8% next year to pull in $3.82 billion.

Buy AI Energy Infrastructure Stock MYRG Before It Soars?

The electric utility construction stock climbed nearly 1,000% (997%) in the past 15 years, crushing the Utilities sector’s 55% and doubling the S&P 500’s 478%. MYR Group’s run includes a 315% charge in the past five years, to more than triple the benchmark.

The stock has surged 55% in 2025. MYRG stock jumped nearly 5% on Thursday as it fights to return to its early November highs.

The nearby chart shows that it found buyers at its 50-day moving average and near its brief summer breakout highs. Once MYR Group overtakes its November highs, it could break out into a brand-new trading range.

Image Source: Zacks Investment Research

On the valuation front, MYRG trades at a 15% discount to its highs at 26.8X forward 12-month earnings. The stock is also trading at only a relatively small premium to the S&P 500 despite its long-term and short-term outperformance.

All in, MYR Group is set to ride the massive energy and electrification infrastructure spending boom that’s just kicking off due to soaring AI-boosted demand and decades of underspending across critical infrastructure.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MYR Group, Inc. (MYRG): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com