Bull of the Day: Micron Technology (MU)

Still flying somewhat under the radar, Micron Technology MU has become a leader in the AI infrastructure boom due to strong demand for its high-bandwidth memory (HBM) solutions.

With HBM being essential to powering generative AI models, Micron’s stock has started to rebound toward its 52-week highs of $129 a share, with some analysts' price targets calling for new all-time peaks.

Considering such, and in correlation with a trend of very positive earnings estimate revisions, Micron stock sports a Zacks Rank #1 (Strong Buy) and lands the Bull of the Day.

Micron’s AI Infrastructure Advantage

Attributing to its AI infrastructure dominance, Micron is a key supplier for Nvidia’s NVDA Blackwell GB200 and AMD’s AMD Instinct MI350 GPUs, which require massive memory bandwidth.

More intriguing, and leading to Micron’s AI Infrastructure advantage, is its pricing power as HBM products are complex to manufacture and wafer-intensive, making supply tight. Notably, Micron has sold out its HBM output for 2025 and is seeing strong demand into 2026, with the scarcity boosting its margins.

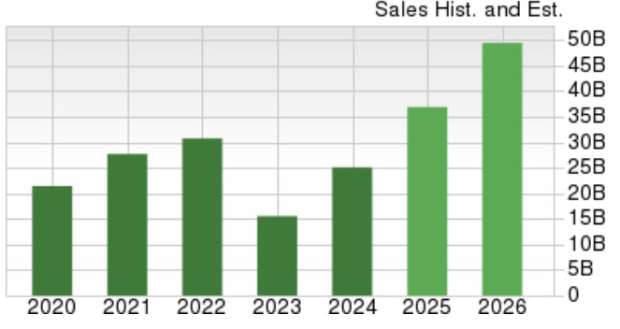

Micron’s Stellar Growth

Based on Zacks' estimates, Micron’s total sales are now expected to spike 47% in fiscal 2025 to $36.91 billion compared to $25.11 billion last year. Plus, FY26 sales are projected to climb another 34% to $49.43 billion.

Image Source: Zacks Investment Research

Even more captivating is Micron’s increased profitability, with annual earnings currently slated to skyrocket over 500% this year to $8.04 per share versus EPS of $1.30 in 2024. Better still, FY26 EPS is forecasted to pop another 62% to $13.05.

Leading to bullish sentiment for Micron stock is that FY25 and FY26 EPS estimates have soared 16% and 23% over the last 60 days, respectively, as shown below.

Image Source: Zacks Investment Research

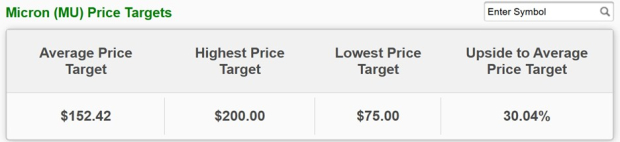

Micron’s Attractive Valuation & Analyst Upgrades

Considering the high premiums AI-infrastructure related stocks are commanding, MU shares still trade at a very reasonable 14.5X forward earnings multiple and at 3.5X forward sales, which are both significant discounts to the S&P 500’s averages.

Image Source: Zacks Investment Research

The culmination of Micron’s execution, along with its reasonable valuation, has led to analysts raising their price targets for MU. It’s noteworthy that JPMorgan JPM raised its price target for MU from $165 to $185, citing stronger DRAM (Dynamic Random-Access Memory) pricing.

Meanwhile, other firms like Mizuho and Needham have remained bullish on Micron’s HBM upside. At the moment, the Average Zacks Price Target of $152.42 suggests 30% upside in Micron stock, which is roughly on par with its all-time high.

Image Source: Zacks Investment Research

Bottom Line

Dominating the AI memory space, now appears to be an ideal time to invest in Micron Technology stock, with MU shaping up to be a viable investment for 2025 and beyond.

One Big Gain, Every Trading Day

To help you take full advantage of this market, you’re invited to access every stock recommendation in all our private portfolios - for just $1.

Zacks private portfolio services that closed 256 double and triple-digit winners in 2024 alone. That’s about one big gain every day the market was open. Of course, not all our picks are winners, but members have seen recent gains as high as +627% +1,340%, and +1,708%.

Imagine how much you could profit with a steady stream of real-time picks from all our services that cover a number of strategies to suit a variety of investing and trading styles.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Micron Technology, Inc. (MU): Free Stock Analysis Report

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com