Bull of the Day: Vertiv Holdings Co (VRT)

Wall Street loves picks-and-shovels artificial intelligence stock Vertiv Holdings Co VRT. Investors still have a great chance to buy one of the best-in-class AI infrastructure stocks for long-term upside after it confirmed its bullish outlook with strong Q3 results on October 22.

The digital infrastructure and continuity solutions company stands to be a long-term AI winner no matter which tech giants come out on top or how AI evolves.

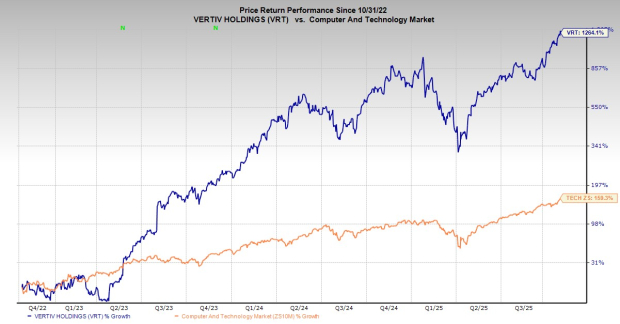

VRT stock soared 1,250% in the past three years to blow away Tech’s 160% and every Mag 7 tech stock outside of Nvidia’s 1,400%.

It posted another solid beat-and-raise quarter as it benefits from the “fast-growing, AI-driven market.” Vertiv works directly with Nvidia to solve some of the biggest behind-the-scenes challenges in AI.

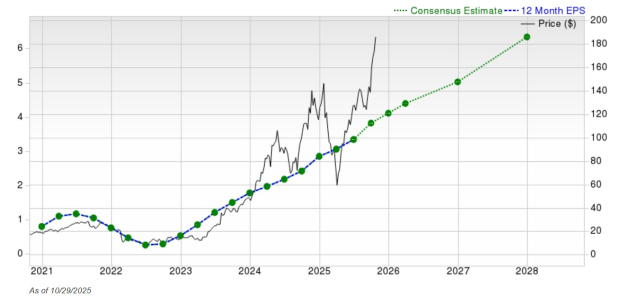

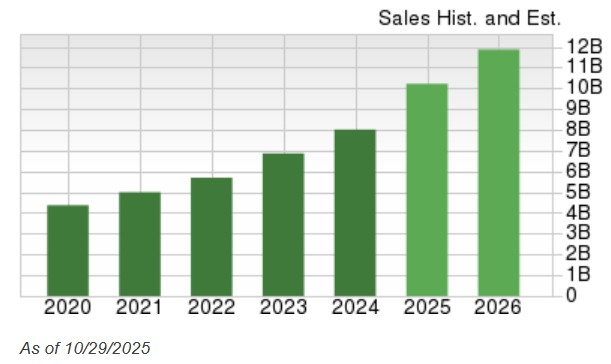

Vertiv is projected to double its revenue between 2022 and 2026 and nearly 10X its earnings (from $0.53 to $5.17 a share). And its recent upward earnings revisions land VRT a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Vertiv is a Must-Buy AI Stock for Long-Term Investors

The trite, but true saying about the gold rush was that many of the real winners were the people selling the prospectors the picks and shovels. Of course, people did strike gold, just like some AI companies will eventually successfully monetize various applications.

Vertiv is an AI tech stock that investors should buy because it will play a growing and significant role in future AI developments, regardless of how AI applications evolve and which AI hyperscalers might eventually grab more market share.

Image Source: Zacks Investment Research

Vertiv’s hardware, software, analytics, and ongoing services portfolio is focused on power, cooling, and IT infrastructure, operating across AI data centers, communication networks, and commercial/industrial environments.

The Ohio-based firm’s growing portfolio helps make sure the high-density computing power that drives technological innovation and the economy is running as smoothly as possible 24/7. VRT also boasts a partnership with AI chip titan and the world’s largest tech company, Nvidia NVDA, to help solve critical challenges such as cooling.

The AI stock has a solid balance sheet, and 17 of the 24 brokerage recommendations Zacks has are “Strong Buys.”

Vertiv’s Recent Growth and Strong AI-Boosted Outlook

Vertiv averaged 16% revenue growth between 2021 and 2024. Vertiv expanded its adjusted earnings per share (EPS) from $0.76 in 2021 to $2.85 a share in FY24.

CEO Giordano Albertazzi said earlier this year that its “partnership with Nvidia and our reference designs for their GB200 and GB300 NVL72 platforms position Vertiv at the forefront of AI factory deployment at industrial scale.”

Image Source: Zacks Investment Research

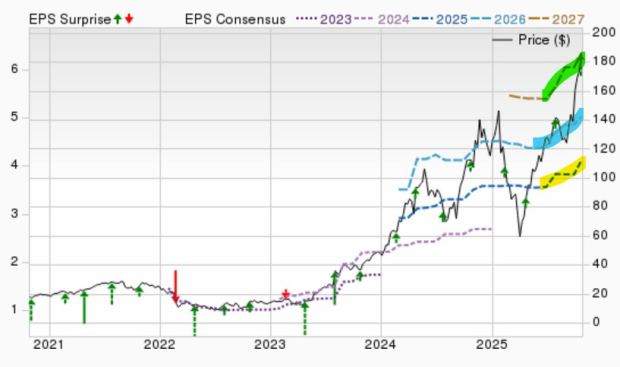

The company posted another beat-and-raise report on October 22 that cemented its AI bull case, with Q3 organic orders up ~60% and 20% sequentially.

VRT expanded its adjusted EPS by 63% to $1.24 a share, topping our estimate by 24% on 29% higher sales. Its growth was boosted by VRT's “increasingly strong competitive position and unique capabilities to enable our customers' most advanced infrastructure needs at scale.”

VRT’s upbeat outlook raised its FY25 consensus by 8% and its FY26 estimate by 7%, helping it land its Zacks Rank #1 (Strong Buy) and restarting its upward earnings revisions trends.

“We've built a durable foundation—one that's not easily replicated—and we're leveraging it to unlock value in a fast-growing, AI-driven market. The digital age is just beginning, and Vertiv is continuing to lead,” Executive Chairman Dave Cote said in Q3 remarks.

Image Source: Zacks Investment Research

Vertiv is projected to grow its revenue by 27% in 2025 and 20% next year to reach $12.29 billion in FY26—more than doubling its sales from 2022 ($5.69 billion).

The company is projected to grow its adjusted EPS by 44% and 26%, respectively, following 60% growth in 2024 and 236% expansion in 2023—growing from $0.53 in 2022 to $5.17 in 2026.

Buy Soaring AI Stock Vertiv Now?

Vertiv stock has ripped 1,260% in the past three years, lagging not too far behind Nvidia’s 1,400% and blowing away the next closest Mag 7 stock, Meta’s 620%. VRT has slightly outperformed NVDA over the last two years and crushed Tech’s 100%.

Image Source: Zacks Investment Research

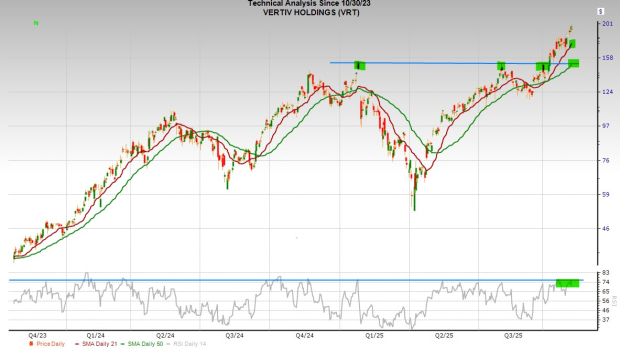

VRT is up 20% in the past month, driven in part by its post-earnings release jump that pushed it to new all-time highs on October 29. That said, the AI stock’s recent run and the broader charge across tech and the AI-everything trade have left Vertiv and the market a bit overheated heading into November.

VRT is sitting at some of its most overbought RSI levels over the past three years. That said, there’s no telling how long the current rally will last. Investors playing the market-timing game could be left potentially watching Vertiv climb higher before its next significant pullback.

Image Source: Zacks Investment Research

Some investors might want to buy some shares now and then buy more Vertiv stock the next time it falls to various technical support levels, such as the 21-day, 50-day, or its previous peak from January and August.

Vertiv’s valuation is a bit stretched, trading near its all-time highs (43.9X) at 40.9X forward 12-month earnings. That said, its price-to-earnings to growth (PEG) ratio, which factors in its huge EPS growth, sits at 1.37, marking a 20% discount to Tech.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Vertiv Holdings Co. (VRT): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com