Can AI-Driven DRAM Demand Sustain Micron's Revenue Upswing?

Micron Technology, Inc.’s MU recent revenue surge has been driven largely by a sharp rise in DRAM demand tied to artificial intelligence (AI) workloads. In the first quarter of fiscal 2026, MU’s DRAM revenues soared 69% year over year and 20% sequentially to $10.8 billion and accounted for 79% of total revenues. DRAM bit shipments increased slightly sequentially, while average selling prices surged nearly 20% during the first quarter.

As AI models grow larger and more complex, memory has become a critical performance bottleneck. AI servers require far more memory than traditional servers, especially for training and inference tasks. High-capacity and high-bandwidth memory (HBM) is now essential to keep graphics processing units and custom accelerators fully utilized. This trend is pushing up both DRAM content per server and average selling prices, directly benefiting Micron Technology’s revenues as well as margins.

Micron Technology’s HBM business is advancing quickly, with the company now preparing for a transition to HBM4. Early samples have shown industry-leading bandwidth and power efficiency, giving it a competitive edge as major customers finalize their next-generation platform plans. The firm is also expanding its customer base and has already secured pricing agreements for most of its 2026 HBM3E supply, signaling strong revenue growth visibility.

Tight DRAM supply is another factor supporting Micron Technology’s growth outlook. Limited industry capacity additions are expected to keep supply constrained, giving Micron Technology greater pricing power. At the same time, broader demand from AI personal computers, smartphones and automobiles is adding more support to DRAM consumption.

Analysts are also optimistic about the company’s DRAM revenue growth prospects. The Zacks Consensus Estimate for Micron Technology’s fiscal 2026 DRAM revenues is currently pegged at $59.76 billion, indicating a year-over-year increase of 109%.

Micron’s Competitors in the Memory Chip Race

Although there are no U.S. stock exchange-listed direct competitors for MU in the memory chip space, Intel Corporation INTC and Broadcom Inc. AVGO play key roles in the HBM supply chain and AI hardware ecosystem.

Intel is expanding its AI memory chip portfolio by integrating HBM into its high-performance accelerators. Intel's flagship AI accelerator, the Gaudi 3, features 128GB of HBM2e memory to provide high memory bandwidth for large-scale AI training and inference workloads.

Broadcom is expanding its AI chip business by developing high-performance custom AI accelerators and integrated advanced networking solutions that enable hyperscalers to utilize vast amounts of HBM effectively. Broadcom is co-designing and producing proprietary custom AI chips for companies like OpenAI, Google, Meta and ByteDance.

Micron’s Price Performance, Valuation and Estimates

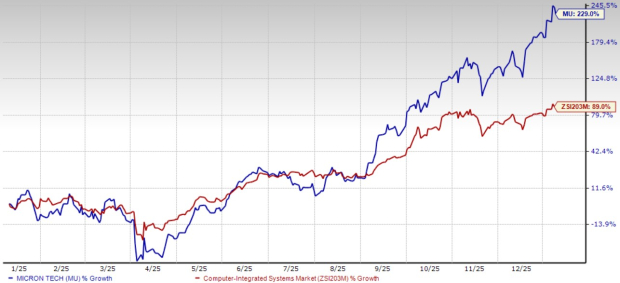

Shares of Micron have surged around 229% over the past year compared with the Zacks Computer – Integrated Systems industry’s gain of 89%.

Micron One-Year Price Return Performance

Image Source: Zacks Investment Research

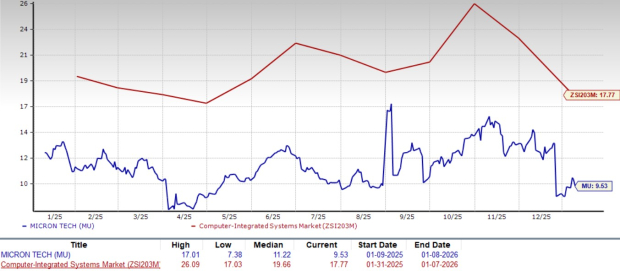

From a valuation standpoint, MU trades at a forward price-to-earnings ratio of 9.53, significantly lower than the industry’s average of 17.77.

Micron Forward 12-Month P/E Ratio

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Micron Technology’s fiscal 2026 and 2027 earnings implies a year-over-year increase of 278.3% and 26.2%, respectively. Bottom-line estimates for fiscal 2026 and 2027 have been revised upward in the past 30 days.

Image Source: Zacks Investment Research

Micron Technology currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the "first wave" of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks' AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com