Can Allstate Beat Q4 Earnings on Property-Liability Strength?

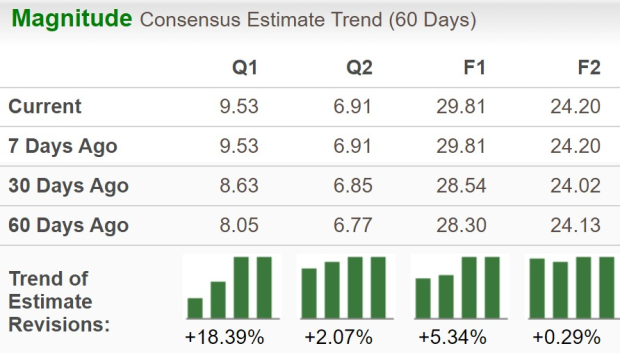

Insurance provider The Allstate Corporation ALL is set to report its fourth-quarter 2025 results on Feb. 4, 2026, after the closing bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings is currently pegged at $9.53 per shareon revenues of $17.52 billion.

The fourth-quarter earnings estimate witnessed four upward revisions against one downward movement over the past month. The bottom-line projection indicates a year-over-year jump of 24.3%. Also, the Zacks Consensus Estimate for quarterly revenues suggests a year-over-year increase of 4.9%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

For 2025, the Zacks Consensus Estimate for Allstate’s revenues is pegged at $68.54 billion, implying a rise of 6.5% year over year. However, the consensus mark for 2025 EPS is pegged at $29.81, implying a year-over-year increase of 62.7%.

Allstate has a robust history of surpassing earnings estimates, beating the consensus estimate in each of the last four quarters, with the average surprise being 47.3%. This is depicted in the figure below.

Q4 Earnings Whispers for Allstate

Our proven model predicts a likely earnings beat for the company this time around as well. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is precisely the case here.

ALL has an Earnings ESP of +6.59% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

What’s Shaping Allstate’s Q4 Results?

The Zacks Consensus Estimate and our model estimate for net premiums earned indicate 7.2% and 8.4% year-over-year growth, respectively. Net investment income is expected to have received an impetus from higher-yielding fixed-income securities. The Zacks Consensus Estimate for net investment income indicates 5.1% year-over-year growth from $833 million.

The consensus mark for underwriting income from Property-Liabilityindicates a 32% year-over-year increase. The combined ratio for Property-Liability is pegged at 82.7%, improving from 86.9% a year ago. This means a bigger portion of premiums remained with the company following claim payments.

The consensus mark for underwriting income from the Auto brand is pegged at $969.3 million compared with $603 million a year ago. The combined ratio in this line of business is pegged at 90.1%, improving from 93.5% in the year-ago quarter.

The factors stated above are expected to have positioned the company for not only a year-over-year growth but also an earnings beat. However, rising expenses are expected to have partially offset the positives.

Our model estimate for total costs and expenses indicates a more than 8% year-over-year increase due to higher operating costs and claims expenses. The Zacks Consensus Estimate for adjusted net income from the Protection Services business indicates a 0.7% year-over-year decline.

Other Stocks That Warrant a Look

Here are some other companies worth considering from the broader Finance space, as our model shows that these, too, have the right combination of elements to beat on earnings this time around:

Lincoln National Corporation LNC has an Earnings ESP of +1.34% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lincoln National’s bottom line for the to-be-reported quarter is pegged at $1.87 per share, which remained stable over the past week. The consensus estimate for Lincoln National’s revenues is pegged at $4.85 billion, a 4.8% year-over-year gain.

Assurant, Inc. AIZ has an Earnings ESP of +13.61% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Assurant’s bottom line for the to-be-reported quarter is pegged at $5.55 per share, which indicates 15.9% year-over-year growth. The consensus estimate for Assurant’s revenues is pegged at $3.28 billion, a 4.7% increase from a year ago.

American International Group, Inc. AIG has an Earnings ESP of +0.39% and a Zacks Rank of 3.

The Zacks Consensus Estimate for American International’s earnings for the to-be-reported quarter is pegged at $1.89 per share, indicating 45.4% year-over-year growth. The consensus estimate for revenues is pegged at $7.1 billion, signaling an increase of 3.7%. AIG has beaten earnings estimates in each of the past four quarters, delivering an average surprise of 15%.

Beyond Nvidia: AI's Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren't likely to keep delivering the biggest profits. Little-known AI firms tackling the world's biggest problems may be more lucrative in the coming months and years.

SeeWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln National Corporation (LNC): Free Stock Analysis Report

American International Group, Inc. (AIG): Free Stock Analysis Report

Assurant, Inc. (AIZ): Free Stock Analysis Report

The Allstate Corporation (ALL): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com