Can AngloGold Ashanti's Augusta Buyout Aid Further Growth?

AngloGold Ashanti plc AU closed the Augusta Gold Corp acquisition on Oct. 25, boosting its footprint in the Beatty District of Nevada, which is in one of the most significant emerging gold districts in the United States.

Per the agreement, AngloGold Ashanti funded the deal with cash at a price of C$1.70 (roughly $1.24) per share of common stock. This implies an equity value of C$152 million (approximately $111 million).

The deal closed following the approval by Augusta Gold shareholders at a special meeting held on Oct. 20, 2025. The deal adds a construction-ready permitted, feasibility-stage project, the Reward project, to AngloGold Ashanti’s portfolio. In September 2025, Augusta Gold announced that the Reward Project is set to commence production within 12 months of full-scale construction. Augusta Gold aims to achieve low-cost production of 150,000 ounces of gold per annum in Nevada by 2027.

AU will also acquire the Bullfrog deposit and the tenements surrounding the properties, strengthening its position in a major U.S. gold district, enabling the company to undertake integrated development. The adjacent properties will significantly add to AU’s mineral resources.

Acquisitions by AngloGold Ashanti’s Peers

Coeur Mining, Inc. CDE recently inked a deal to acquire New Gold Inc. NGD to form one of the largest all-North American precious-metals producers. New Gold and Coeur Mining combined are projected to produce 900,000 ounces of gold, 20 million ounces of silver and substantial copper output in 2026. New Gold and Coeur Mining together are expected to leverage their strong financial position to accelerate investment in several high???return organic growth opportunities.

Newmont Corporation NEM acquired Newcrest Mining Limited to create an industry-leading portfolio with a multi-decade gold and copper production profile in the most favorable mining jurisdictions globally. The combination of Newmont and Newcrest is expected to deliver significant value for its shareholders and generate meaningful synergies. Newmont has achieved $500 million in annual run-rate synergies, following the Newcrest buyout.

AU’s Price Performance, Valuations & Estimates

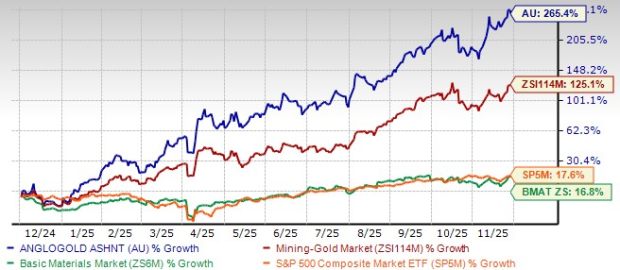

AngloGold Ashanti’s stock has appreciated 265.4% in a year’s time, outperforming the Zacks Mining – Gold industry’s 125.1% rally. During this time, the Basic Materials sector has risen 16.8%, whereas the S&P 500 has grown 17.6%.

Image Source: Zacks Investment Research

AngloGold Ashanti is currently trading at a forward 12-month earnings multiple of 13.33 X, slightly discount compared with the industry average of 13.42X. The stock has a Value Score of B.

Image Source: Zacks Investment Research

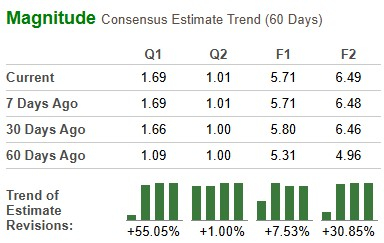

The Zacks Consensus Estimate for AU’s 2025 sales is pegged at $9.67 billion, indicating a 66.9% year-over-year surge. The consensus mark for the year’s earnings stands at $5.71 per share, suggesting a year-over-year upsurge of 158.3%.

The Zacks Consensus Estimate for 2026 sales implies a 13.3% year-over-year dip. The same for earnings indicates growth of 13.7%. However, EPS estimates for 2025 and 2026 have been trending north over the past 60 days, as seen in the chart below.

Image Source: Zacks Investment Research

AU currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newmont Corporation (NEM): Free Stock Analysis Report

AngloGold Ashanti PLC (AU): Free Stock Analysis Report

New Gold Inc. (NGD): Free Stock Analysis Report

Coeur Mining, Inc. (CDE): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com