Can Digital Retail & E-Commerce Boost Procter & Gamble's Volume?

Digital retail and e-commerce are becoming increasingly important levers for The Procter & Gamble Company PG as the consumer path to purchase shifts online and becomes more fragmented. With shoppers spending more time on digital platforms, ranging from large e-commerce marketplaces to retailer apps and social commerce, the company has a clear opportunity to reignite volume growth by meeting consumers where discovery and decision-making now happen. Unlike traditional retail, digital channels allow brands to influence shoppers closer to the point of purchase through targeted content, reviews and personalized recommendations, making them a powerful tool to convert intent into incremental units sold.

PG’s scale, data capabilities and brand equity position it well to benefit from this shift. By investing in richer product content, stronger digital shelf execution and retail media, the company can improve visibility and conversion for its core brands while also accelerating trial of innovations. E-commerce tends to favor brands with strong performance claims and trusted reputations, areas where PG has a competitive edge. In addition, digital channels support premiumization and larger pack sizes, which can help drive both higher usage and repeat purchases, supporting volume recovery even in a cautious consumer environment.

In the longer term, digital retail can also help PG expand household penetration and usage, which management has identified as critical for sustainable growth. Advanced analytics and AI-driven insights enable more precise targeting of consumers, better demand forecasting and faster feedback loops between innovation, marketing and execution. As retailers increasingly become media platforms and online sales continue to outpace brick-and-mortar growth, PG’s deep integration with e-commerce ecosystems can translate into stronger category growth. While digital alone will not solve all volume challenges, it is likely to be a meaningful accelerator that supports the company’s efforts to return to more balanced, volume-led growth.

Digital Retail & E-Commerce as a Volume Growth Catalyst for CHD and CL

Church & Dwight CHD and Colgate-Palmolive CL are increasingly leveraging digital retail and e-commerce as important growth drivers, as shifting consumer shopping behaviors create new opportunities to expand reach, accelerate trial and support sustained volume growth across their portfolios.

Digital retail and e-commerce represent a meaningful growth lever for Church & Dwight, particularly given its focused brand portfolio and strength in power brands such as Arm & Hammer, Trojan and Vitafusion. Online channels allow the company to efficiently reach targeted consumer segments, support faster trials of new products and scale emerging brands without the same level of in-store complexity faced in traditional retail. E-commerce also favors CHD’s innovation-led strategy, as clear benefit-driven messaging and strong consumer reviews can quickly translate into higher conversion rates and repeat purchases.

For Colgate, digital retail and e-commerce offer a strategic avenue to strengthen volumes across oral care, personal care and pet nutrition, especially in high-growth and emerging markets. Online platforms enable the company to deepen consumer engagement through education-focused content, subscription models and personalized recommendations, which are particularly effective in habit-driven categories like oral care. E-commerce also supports premiumization and trade-up within Colgate’s portfolio while expanding access in markets where traditional retail infrastructure may be less developed.

PG’s Price Performance, Valuation & Estimates

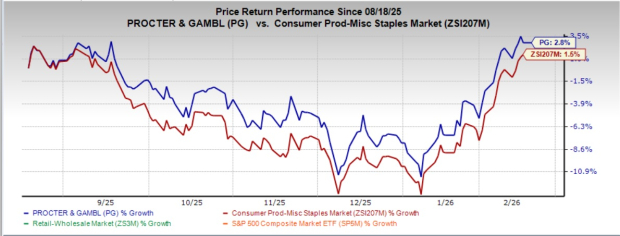

Procter & Gamble’s shares have gained around 2.8% in the past six months compared with the industry’s 1.5% growth.

Image Source: Zacks Investment Research

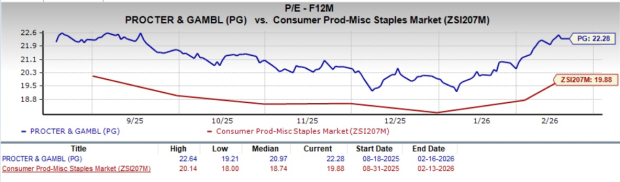

From a valuation standpoint, PG trades at a forward price-to-earnings ratio of 22.28X compared with the industry’s average of 19.88X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for PG’s fiscal 2026 and 2027 EPS indicates year-over-year growth of 2.2% and 4.7%, respectively. The company’s EPS estimates for fiscal 2026 and 2027 have moved southward in the past seven days.

Image Source: Zacks Investment Research

Procter & Gamble currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Beyond Nvidia: AI's Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren't likely to keep delivering the biggest profits. Little-known AI firms tackling the world's biggest problems may be more lucrative in the coming months and years.

SeeWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Procter & Gamble Company (The) (PG): Free Stock Analysis Report

Colgate-Palmolive Company (CL): Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com