Circle's Non-Interest Revenues Accelerate: Can the Momentum Continue?

Circle Internet Group CRCL is making visible progress in reducing its dependence on interest-rate–driven reserve income as non-interest revenues scale rapidly. Other revenues surged to $29 million in the third quarter of 2025 from less than $1 million a year ago, supported by growing subscriptions, services and transaction fees, and strong momentum in subscription, services and transaction-based fees. Although still a small contributor, the rapid growth indicates an improvement in monetization depth across Circle’s infrastructure.

A key driver behind this shift is subscription and services revenues, which reached $23.6 million in the reported quarter, largely tied to blockchain network partnerships and platform infrastructure offerings. This revenue stream is structurally higher margin and more recurring than reserve income, improving the durability of earnings. Transaction revenues of $4.7 million indicate the initial monetization of payment flows as Circle expands its network.

Management’s decision to raise its full-year 2025 other revenue guidance to $90-$100 million indicates improving visibility into non-reserve income. Platform initiatives such as the Arc blockchain network and the Circle Payments Network support this outlook, as both are structured to generate recurring fees as adoption expands.

Despite reserve income remaining the largest contributor now, the faster growth in non-interest revenues suggests Circle is building a more durable, platform-oriented revenue base. The model may still be in its early stages, but signs of business model maturation are increasingly evident.

CRCL Faces Stiff Competition in Platform-Driven Model

Visa V and Mastercard MA represent a more advanced stage of the payment-network ecosystem, monetizing huge transaction volumes through fees, a structure Circle aims to gradually move toward while reducing reliance on reserve income.

Visa poses stiff competition to CRCL in a platform-driven model by monetizing payments through transaction fees, data processing and value-added services rather than balance-sheet risk. The company earns most of its revenues from processing and service fees that scale with payment volumes, generating $40 billion in fiscal 2025 revenues. Visa operates at a far larger global scale, with deep merchant acceptance and trusted infrastructure, whereas CRCL targets USDC-based programmable payments and growing fee-based transactions.

Mastercard competes with CRCL through a transaction- and services-driven platform rather than interest income. The company generates strong growth from value-added services like security, data and digital identity, which scale with network usage. This places Mastercard closer to CRCL’s platform vision, as both monetize infrastructure and APIs. Mastercard’s advantage lies in enterprise adoption, regulatory trust and immediate monetization of services at a global scale.

CRCL’s Share Price Performance, Valuation & Estimates

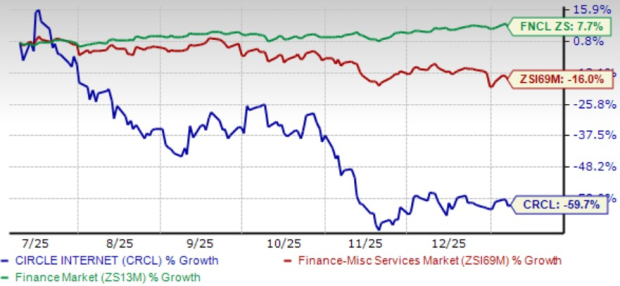

In the trailing six-month period, Circle’s stock has declined 59.7%, underperforming the broader Zacks Finance sector’s return of 7.7% and the Zacks Financial - Miscellaneous Services industry’s fall of 16%.

CRCL’s Six-Month Price Performance

Image Source: Zacks Investment Research

From a valuation standpoint, CRCL appears overvalued, trading at a forward 12-month price-to-sales ratio of 5.92, higher than the industry's average of 3.36. The company carries a Value Score of D.

CRCL’s Valuation

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for 2025 loss is pegged at 87 cents per share, unchanged over the past 30 days. The consensus estimate for 2026 earnings is currently pegged at 90 cents per share, down by a couple of cents over the past 30 days.

Image Source: Zacks Investment Research

Circle currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the "first wave" of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks' AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA): Free Stock Analysis Report

Visa Inc. (V): Free Stock Analysis Report

Circle Internet Group, Inc. (CRCL): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com