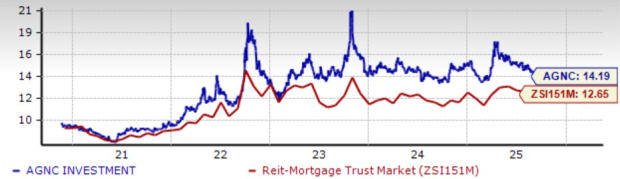

Does AGNC Investment's 14.2% Dividend Yield Look Sustainable?

One of the most closely watched aspects of AGNC Investment Corp.’s AGNC financial profile is its dividend policy. This publicly traded mortgage real estate investment trust (mREIT) offers attractive long-term returns and a high dividend yield that appeals to income-focused investors.

Income-seeking investors have a large appetite for REIT stocks, as U.S. law requires REITs to distribute 90% of their annual taxable income as dividends. AGNC has a record of paying monthly dividends, currently yielding a staggering 14.2%. This is impressive compared with the industry’s average of 12.7% and attracts investors as it represents a steady income stream.

Dividend Yield

Image Source: Zacks Investment Research

Dividends aside, AGNC has a share repurchase plan in place. In October 2024, the company’s board of directors terminated the existing stock repurchase plan and replaced it with a new plan authorizing it to repurchase up to $1 billion of common stock through Dec. 31, 2026. As of Sept. 30, 2025, full authorization was available for repurchase. It plans to buy back shares only when the repurchase price is lower than the then-current estimate of tangible net book value per common share. This buyback strategy aims to mitigate stock price volatility and enhance shareholder value over time.

The company enjoys a decent financial position. As of Sept. 30, 2025, AGNC Investment’s liquidity, including unencumbered cash and Agency MBS, was $7.2 billion, up from $6.4 billion in the prior quarter. Given this, AGNC’s capital distribution plan seems sustainable.

Moreover, with relatively lower mortgage rates, operational and funding pressures may ease, expanding net interest spreads. This could boost AGNC Investment's profitability and enhance its ability to maintain, or even increase, its dividend in the near term.

How AGNC Competes With NLY & ABR in Terms of Dividends

AGNC Investment’s peers, such as Annaly Capital Management, Inc. NLY and Arbor Realty Trust, Inc. ABR, have also been focusing on maintaining shareholder returns through consistent dividend payouts.

Annaly’s dividend yield is currently a staggering 13.4%. In the past five years, Annaly has increased its dividends once. As of Sept. 30, 2025, the company held $8.8 billion in total assets available for financing, including $3.9 billion in cash and unencumbered Agency MBS, which can readily provide liquidity in times of adverse market conditions. This will support Annaly's capital distribution in the future.

On the other hand, Arbor Realty has a dividend yield of 12.6% and a payout ratio of 98%. However, its liquidity position remains comparatively weak. As of Sept. 30, 2025, Arbor Realty had cash and cash equivalents of $423.4 million against long-term debt of $5.9 billion. Such a narrow liquidity cushion raises concerns about the sustainability of its capital distribution in the long term.

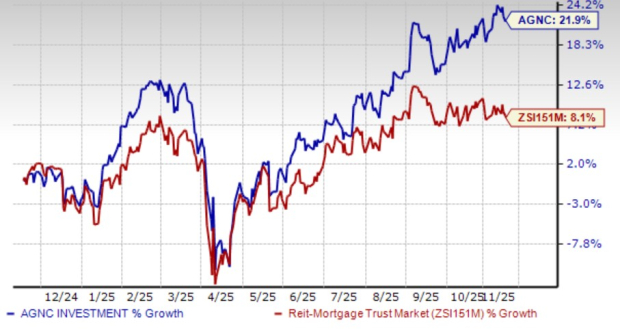

AGNC Investment’s Price Performance, Valuations & Estimates

Over the past year, AGNC shares have gained 21.9% compared with the industry’s rise of 8.1%.

Price Performance

Image Source: Zacks Investment Research

From a valuation standpoint, AGNC trades at a forward price-to-tangible book (P/TB) ratio of 1.2X, above the industry’s average of 1X.

Price-to-Tangible Book TTM

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for AGNC’s 2025 and 2026 earnings has remained unchanged over the past seven days.

Estimate Revision Trend

Image Source: Zacks Investment Research

The company currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AGNC Investment Corp. (AGNC): Free Stock Analysis Report

Arbor Realty Trust (ABR): Free Stock Analysis Report

Annaly Capital Management Inc (NLY): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com