Earnings Winners: 2 Buy Rated Stocks Raising Guidance

The 2025 Q4 earnings season is rapidly flying by, with all Magnificent 7 members already delivering their results outside of beloved NVIDIA. The period has so far been positive, with growth remaining strong and a solid number of companies exceeding quarterly expectations.

Concerning some winners of the cycle so far, Boot Barn BOOT and Cardinal Health CAH both raised guidance in one way or another, with each also seeing favorable post-earnings reactions.

Boot Barn Sees Strong Margin Performance

Boot Barn posted strong results in its release, with sales climbing 16% year-over-year alongside a 5.7% charge higher in same store sales. The same store sales growth is particularly notable, telling us that its existing stores are seeing strong performance while it also continues to open new locations.

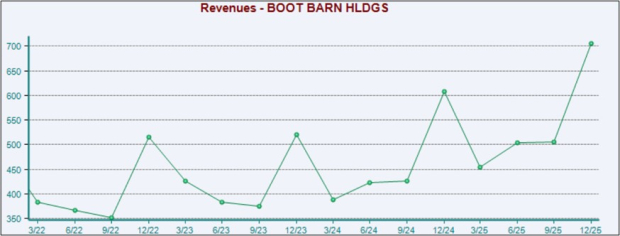

Below is a chart illustrating Boot Barn’s sales on a quarterly basis, with the recent $705.6 million print reflecting a quarterly record.

Image Source: Zacks Investment Research

Concerning store openings, the company opened 25 new locations throughout the periods, bringing its overall tally up to 514 at quarter end. BOOT also enjoyed an improved profitability picture, with its gross margin growing to 39.9% vs. a 39.3% print in the same period last year. Consumer-focused stocks, particularly retail, are often highly sensitive to margin performance, helping explain the strong post-earnings reaction and guide higher.

BOOT’s margins picture has remained positive for several periods now, seeing nice expansion off 2023 lows. Please note that the chart below is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Boot Barn now expects to open 70 new stores in its FY26, with sales also expected to reach a band of $2.24 - $2.25 billion. Same store sales growth is forecasted to be in a range of 6.5% - 7.5%, continuing its recent streak of momentum nicely.

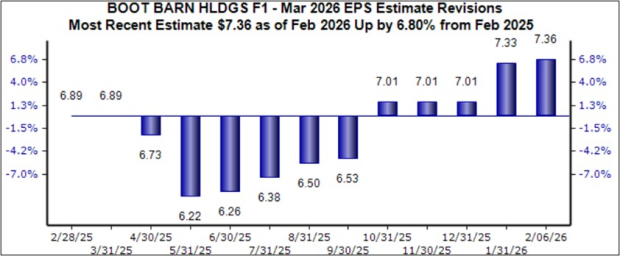

And to top it off, the stock sports the highly-coveted Zacks Rank #1 (Strong Buy), with EPS expectations notably bullish for the above-mentioned FY26.

Image Source: Zacks Investment Research

Cardinal Health Sees Broad Strength

Cardinal Health posted a double-beat relative to our consensus expectations, with sales soaring 18.8% from the year-ago period alongside a sizable 36.3% year-over-year growth rate in adjusted EPS.

Cardinal Health’s sales have seen great growth over recent periods after some stagnation throughout 2024, as shown below in the chart that illustrates CAH’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Strength was primarily broad-based across its segments, with sales in Pharmaceuticals and Specialty Solutions climbing 19% year-over-year. Its Global Medical Products and Distribution saw its sales grow 3% YoY, whereas its ‘Other’ segment (includes at-home solutions, OptiFreight Logistics, and Nuclear and Precision Health Solutions) saw a strong 34% year-over-year climb. It’s worth noting that its Pharmaceuticals and Specialty Solutions accounts for the vast majority of its sales, contributing roughly 90%.

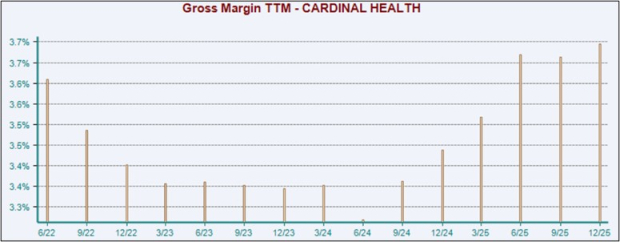

Similar to BOOT above, Cardinal Health has seen its margins recover nicely over recent periods, as shown below. Please note that the chart tracks margins on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Cardinal Health raised its FY26 outlook following the strong quarter, now expecting adjusted EPS in a band of $10.15 - $10.35, with the midpoint suggesting 24.5% year-over-year growth. The updated outlook is reflected in positive earnings estimate revisions, as shown below. The stock sports a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Putting Everything Together

Guidance upgrades are a common sign of near-term outperformance, particularly when a favorable Zacks Rank is involved. Both stocks above – Boot Barn BOOT and Cardinal Health CAH – have experienced just that, posting robust quarterly results and enjoying positive post-earnings earnings estimate revisions in addition to their strong post-earnings reactions.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH): Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com