Goldman's Strategic Shift Drives Growth & Operational Efficiency

The Goldman Sachs Group’s GS streamlining efforts have been underway for some time as it retreats from underperforming non-core consumer banking ventures and sharpens its focus on core businesses, including investment banking (IB), trading and asset management. This strategic pivot aims to strengthen revenue stability and operational efficiency.

Goldman’s focus on core businesses has started delivering improved financial performance and efficiency, highlighted by the strong first-half 2025 results and a positive outlook.

In the first six months of 2025, Goldman reported 10% year-over-year revenue growth and an annualized return on common equity of 14.9%. IB and global markets, particularly equities trading, were major drivers, benefiting from higher client activity and a rebound in deal-making activities. While asset and wealth management revenues dipped during this period due to a decline in equity and debt investments on the back of market uncertainty, management anticipates high-single-digit growth in the coming quarters.

Operational efficiency is also improving. Goldman’s efficiency ratio fell to 62% in the first half of 2025 from 63.8% a year earlier, reflecting ongoing cost-management and streamlining initiatives.

Focus on core businesses appears to be enhancing financial performance and positioning GS for sustained growth, signaling that its strategic streamlining may indeed be paying off.

Other Firms' Efforts to Streamline Operations

Citigroup C has been streamlining its operations and leadership to reduce bureaucracy, improve efficiency and align with its strategic goals. The bank is exiting consumer banking in 14 markets across Asia and EMEA, winding down operations in Korea and Russia, and preparing for an IPO in Mexico for its consumer and small- to medium-sized market banking. These actions free capital to invest in wealth management and investment banking, supporting Citigroup’s fee income growth.

Such optimization of management layers and reduction in functional roles, along with the bank’s consumer banking divestiture efforts, will drive $2-$2.5 billion of annualized run rate savings by 2026. Also, Citigroup expects revenues to grow at a compounded annual rate of 4-5% by the end of 2026.

Wells Fargo WFC has been making progress on various initiatives aimed at achieving cost efficiency. The company is actively engaged in cost-cutting measures, including streamlining organizational structure, branch closure and headcount reductions.

Driven by strategic efforts, Wells Fargo’s management expects non-interest expenses to be $54.2 billion in 2025, suggesting a dip from the $54.6 billion reported in 2024. This sustained decline is expected to enhance profitability, enabling greater investment in strategic growth areas and stronger shareholder returns in the upcoming period.

Goldman’s Price Performance, Valuation & Estimates

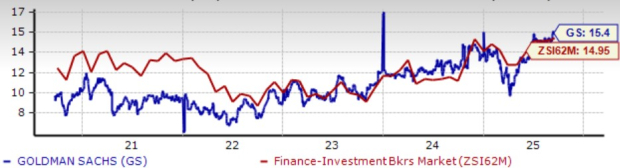

GS shares have gained 39.3% year to date compared with the industry’s growth of 29%.

Price Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

From a valuation standpoint, Goldman trades at a forward price-to-earnings (P/E) ratio of 15.4X, above the industry’s average of 14.9X.

Price-to-Earnings F12M

Image Source: Zacks Investment Research

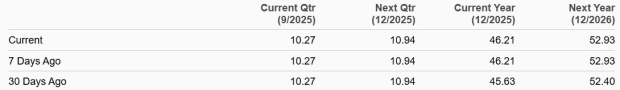

The Zacks Consensus Estimate for GS’s 2025 and 2026 earnings implies year-over-year rallies of 13.9% and 14.6%, respectively. The estimates for both years have been revised upward over the past 30 days.

Estimate Revision Trend

Image Source: Zacks Investment Research

Goldman currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS): Free Stock Analysis Report

Wells Fargo & Company (WFC): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com