How Mastercard Is Diversifying Growth Beyond Card-Based Payments

Mastercard Incorporated MA is gradually transforming its role from a pure card-network operator to a more comprehensive technology and services platform. While payment volumes remain the backbone of its business, the company’s value-added services and solutions segment is becoming a key driver of growth, helping to diversify its revenue streams and strengthen client relationships.

MA’s value-added services (VAS) cover a range of offerings, including fraud prevention, cybersecurity, data analytics, loyalty programs, open banking and identity verification. These solutions empower banks, merchants, fintechs and governments to boost efficiency, minimize risks, enhance customer engagement and make more informed decisions, extending Mastercard’s relevance across the broader commerce and digital ecosystem.

Artificial intelligence is becoming a key player in Mastercard’s suite of VAS. It leverages AI and machine learning to enhance fraud detection, provide real-time risk assessments and streamline identity verification. This strategy is further strengthened by the acquisition of Recorded Future, which brings in advanced cyber threat intelligence and strengthens Mastercard’s capability to assist clients in navigating the increasing challenges of digital security.

Value-added services and solutions’ net revenues rose 21% year over year on a currency-neutral basis in the first nine months of 2025, driven by strategic buyouts and the strong performance of security and digital and authentication solutions, as well as customer acquisition, engagement services and pricing. Notably, the segment now accounts for nearly 40% of total revenues, underscoring its growing diversification beyond core payment processing.

As digital commerce and cross-border activity continue to expand, this services-led approach positions MA to drive growth beyond traditional card usage over the long term.

How Are Competitors Faring?

Some of MA’s competitors in the value-added services include Visa Inc. V and American Express Company AXP.

Visa is strengthening its platform by embedding services such as digital identity, fraud prevention, real-time payments infrastructure and advisory solutions. These initiatives not only help diversify revenue streams but also make its network essential for clients who are navigating the fast-changing world of payments.

American Express offers a range of valuable services, including real-time fraud monitoring, secure digital payment options, merchant analytics and loyalty support. These efforts not only enhance security and improve transactions but also help American Express build stronger connections with consumers and businesses around the globe.

Mastercard’s Price Performance, Valuation & Estimates

Over the past year, MA’s shares have gained 11.1% against the industry’s fall of 6.7%.

Image Source: Zacks Investment Research

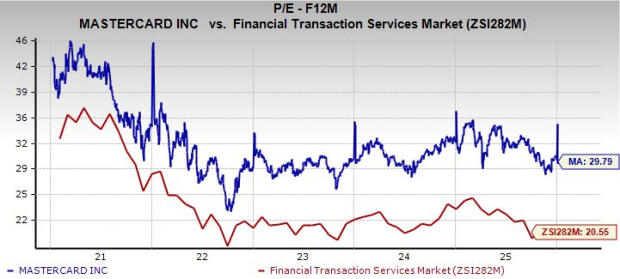

From a valuation standpoint, MA trades at a forward price-to-earnings ratio of 29.79, above the industry average of 20.55. MA carries a Value Score of D.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Mastercard’s 2025 earnings implies 12.5% growth from the year-ago period.

Image Source: Zacks Investment Research

Mastercard currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA): Free Stock Analysis Report

Visa Inc. (V): Free Stock Analysis Report

American Express Company (AXP): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com

Comments