Insider Buys: 3 CEOs Buying Shares

Investors closely monitor insider buys, as they can give hints surrounding the long-term picture.

But it’s critical to note that insiders have a longer holding period than most, and many strict rules apply to their transactions.

Recently, CEOs of several companies – Fifth Third Bancorp FITB Fidelity National Information Services FIS, and CSX CSX – have made splashes, acquiring shares. Let’s take a closer look at the transactions for those interested in trading like the insiders.

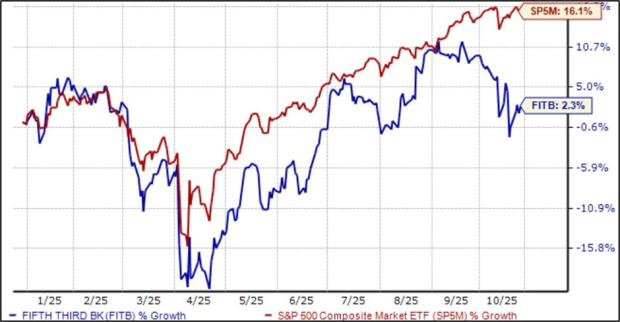

Fifth Third Bancorp

CEO Evan Bayh recently scooped up 3k FITB shares at a total transaction cost of just under $125k. Shares have underperformed YTD so far, gaining 2.3% compared to the S&P 500’s 16% gain.

Image Source: Zacks Investment Research

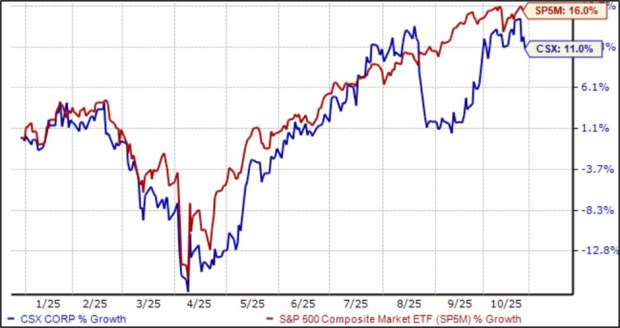

CSX

The CEO of CSX recently made a big splash, acquiring 55k shares at a total transaction value of roughly $2 million. Like FITB, shares have underperformed relative to the S&P 500 in 2025, gaining 11%.

Image Source: Zacks Investment Research

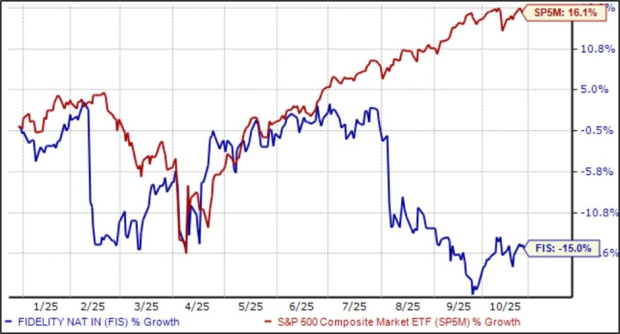

Fidelity National Information Services

The CEO of FIS recently bought roughly 900 shares at a total transaction cost of just above $60k. Shares have largely struggled in 2025, down 15% and widely underperforming.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Many investors closely monitor insider buys, seeking insights into the longer-term picture. The transactions shouldn’t be relied on for near-term performance, as insiders’ holding periods are longer than most, and many strict rules apply.

Rather, investors can see insider buys as an overall net positive concerning the longer-term outlook.

All large-cap stocks above – Fifth Third Bancorp FITB, Fidelity National Information Services FIS, and CSX CSX – have seen their respective CEOs make purchases over the last month.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fifth Third Bancorp (FITB): Free Stock Analysis Report

CSX Corporation (CSX): Free Stock Analysis Report

Fidelity National Information Services, Inc. (FIS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com