Is Colgate's Supply-Chain Resilience Providing Competitive Edge?

Colgate-Palmolive Company CL entered 2026 with improved momentum after navigating a volatile 2025, marked by raw-material inflation, incremental tariffs and uneven category growth. Despite these pressures, the company delivered record net sales and free cash flow in 2025, underscoring the strength of its operating backbone. A key driver for the company is supply-chain resilience.

In 2025, the company’s gross margin faced headwinds from higher raw and packaging costs, including tariff impacts, which more than offset pricing and savings initiatives. However, the fourth quarter showed sequential improvement, with funding-the-growth initiatives and disciplined revenue management contributing meaningfully to margin support. Cost containment also supported Base Business SG&A leverage in the fourth quarter, reinforcing operational discipline.

Colgate’s newly announced Strategic Growth and Productivity Program (SGPP) is central to this resilience. Management noted that the program is designed to simplify the organization, increase speed and efficiency, and provide resources to execute its 2030 strategy while supporting dollar-based EPS growth. By streamlining its organizational structure and improving responsiveness, Colgate aims to drive faster decision-making while unlocking productivity savings to reinvest in innovation and advertising. This combination of cost discipline and reinvestment flexibility is critical in a lower-growth, inflation-sensitive environment.

Colgate expects moderate raw and packaging inflation in 2026 but still anticipates gross-margin expansion, supported by pricing, revenue growth management and productivity initiatives. That forward outlook strengthens the thesis.

Beyond cost control, Colgate’s supply-chain strength enables consistent product availability, faster innovation rollouts and effective omni-channel execution — critical advantages in oral care and pet nutrition. In an environment of moderate category growth and persistent input pressures, Colgate’s ability to balance efficiency, agility and reinvestment suggests its supply chain is not just resilient, but strategically differentiating.

CL’s Zacks Rank & Share Price Performance

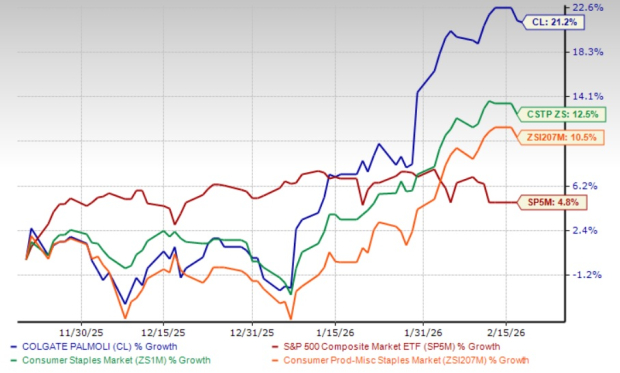

Shares of this Zacks Rank #3 (Hold) company have rallied 21.2% in the past three months, outperforming both the industry and the broader Consumer Staples sector, which rose 10.5% and 12.5%, respectively. The stock also outpaced the S&P 500’s growth of 4.8%.

CL Stock's 3-Month Performance

Image Source: Zacks Investment Research

Is CL a Value Play Stock?

Colgate currently trades at a forward 12-month P/E ratio of 24.3X, which is higher than the industry average of 19.72X and the sector average of 18.06X. This valuation positions the stock at a premium relative to both its sector and industry peers, suggesting that investors may be pricing in stronger growth prospects, brand strength or operational efficiency compared with competitors.

Image Source: Zacks Investment Research

Stocks to Consider

BJ's Wholesale Club Holdings, Inc. BJ emerged as one of the preferred destinations for shoppers when it comes to essentials and other items. The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for BJ's Wholesale’s fiscal 2025 sales and earnings suggests growth of 4.3% and 7.7%, respectively, from the year-ago reported figures. BJ delivered a trailing four-quarter earnings surprise of 10.3%, on average.

National Vision Holdings, Inc. EYE is one of the leading and rapidly growing optical retailers in the United States. The company currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for National Vision’s current financial-year sales and earnings indicates growth of 5.3% and 34.6%, respectively, from the year-ago reported numbers. EYE delivered a trailing four-quarter earnings surprise of 21%, on average.

Ollie's Bargain Outlet Holdings, Inc. OLLI is a value retailer of brand-name merchandise at drastically reduced prices. The company currently has a Zacks Rank of 2.

The Zacks Consensus Estimate for Ollie's Bargain’s current financial-year sales and earnings implies growth of 16.7% and 17.7%, respectively, from the previous year’s reported numbers. OLLI delivered a trailing four-quarter earnings surprise of 5.2%, on average.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Colgate-Palmolive Company (CL): Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ): Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI): Free Stock Analysis Report

National Vision Holdings, Inc. (EYE): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com