Lamb Weston Streamlines Global Footprint to Improve Efficiency

Lamb Weston Holdings, Inc. LW has announced changes to its global manufacturing footprint, beginning with plans to close its Munro facility in Argentina and shift production for Latin America to its newer plant in Mar del Plata. The company also disclosed plans to temporarily curtail a production line in the Netherlands. Together, these moves reflect ongoing efforts to manage costs and improve operational efficiency across regions.

LW Aligns Capacity With Strategy

These steps go in tandem with Lamb Weston’s broader “Focus to Win” strategy, which centers on executional discipline, cost savings and prioritizing markets and assets. On its recent earnings call, the company emphasized active efforts to better balance supply and demand across its manufacturing network, particularly outside North America.

International operations continue to face a challenging backdrop. In Europe, the company has pointed to softer restaurant traffic and pricing pressure following a strong potato crop, alongside the effects of added industry capacity. The temporary curtailment of a Netherlands production line aligns with previously stated plans to address underutilization and manage inventories while maintaining service levels.

LW Balances Near-Term Pressures and Long-Term Returns

The restructuring comes as this Zacks Rank #5 (Strong Sell) company navigates a mixed operating backdrop. Volumes have been rising, supported by customer wins and share gains, but pricing and mix pressures—particularly internationally continue to weigh on Lamb Weston’s profitability. Management has been focused on improving manufacturing efficiency, procurement and overhead, while remaining flexible in a volatile demand environment.

Conclusion

The announced plant closure and capacity curtailment highlight Lamb Weston’s continued focus on execution and cost control amid uneven international conditions. By streamlining its manufacturing footprint and investing in newer assets, the company is seeking to improve efficiency while positioning its global network to support sustainable growth over the long term.

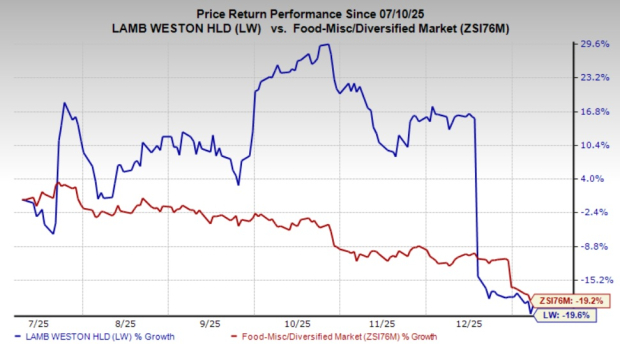

Shares of LW have tumbled 19.6% in the past six months compared with the industry’s decline of 19.2%.

Image Source: Zacks Investment Research

Better-Ranked Stocks

Mama's Creations, Inc. MAMA manufactures and markets fresh deli-prepared foods in the United States. At present, It sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Mama's Creations’ current fiscal-year sales and earnings implies growth of 39.9% and 44.4%, respectively, from the year-ago figures. MAMA delivered a trailing four-quarter earnings surprise of 133.3%, on average.

United Natural Foods, Inc. UNFI engages in the distribution of natural, organic, specialty, produce and conventional grocery and non-food products. It currently carries a Zacks Rank #1. United Natural Foods delivered a trailing four-quarter earnings surprise of 52.1%, on average.

The Zacks Consensus Estimate for United Natural Foods’ current fiscal-year sales and earnings implies growth of 1% and 187.3%, respectively, from the year-ago figures.

McCormick & Company, Incorporated MKC manufactures, markets and distributes spices, seasoning mixes, condiments and other flavorful products to the food industry. It carries a Zacks Rank #2 (Buy) at present. MKC delivered a trailing four-quarter earnings surprise of 2.2%, on average.

The Zacks Consensus Estimate for McCormick’s current fiscal-year sales and earnings implies growth of 1.6% and 2.4%, respectively, from the year-ago figures.

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the "first wave" of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks' AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McCormick & Company, Incorporated (MKC): Free Stock Analysis Report

United Natural Foods, Inc. (UNFI): Free Stock Analysis Report

Lamb Weston (LW): Free Stock Analysis Report

Mama's Creations, Inc. (MAMA): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com