NRDS' Strategic Pivot: Diversifying Traffic, Deepening Monetization

NerdWallet, Inc. NRDS is making tangible progress in reshaping its growth engine by reducing the reliance on organic Google search and building a more diversified, controllable and higher-value revenue mix. Historically, organic search drove the majority of user acquisition, exposing the business to algorithm changes and volatility in high-value verticals like Credit Cards. Over the past year, management has taken deliberate steps to mitigate these risks by investing in alternative acquisition channels and deeper monetization strategies.

A key pillar of this transition is the expansion of performance marketing. NerdWallet is increasingly attracting high-intent users with predictable economics and clearer return on investment. Management noted that in third-quarter 2025, these efforts helped offset organic search pressure, particularly within Credit Cards, and small and medium-sized business (SMB) products.

At the same time, NerdWallet is beginning to benefit from AI-driven referral channels, including traffic originating from large language models (LLMs). Management highlighted that NerdWallet is now the most cited source among peers in LLM responses. While this traffic remains modest in volume, early data indicate meaningfully higher conversion rates than traditional organic search, positioning AI referrals as a potentially high-return on investment (ROI) acquisition channel over time.

Beyond traffic diversification, NerdWallet is also strengthening its monetization profile through vertical integration in financial services. Acquisitions such as Next Door Lending in mortgages, along with earlier SMB integrations, allow the company to participate further down the customer journey rather than solely acting as a top-of-funnel marketplace. This strategy materially improves economics, as evidenced by early mortgage brokerage results showing approximately 2 times revenues per lead compared with the traditional marketplace model. Deeper funnel participation also enhances data ownership, customer lifetime value and cross-sell opportunities across NerdWallet’s ecosystem.

Taken together, these initiatives point to a structurally more resilient business. By pairing diversified acquisition channels with higher-value monetization, NerdWallet is reducing the dependency on any single traffic source while expanding revenues per user. As these strategies scale, they should support more stable growth, improved margin durability and a stronger competitive position in an increasingly AI-driven discovery environment.

NRDS’s Price Performance, Valuation & Estimates

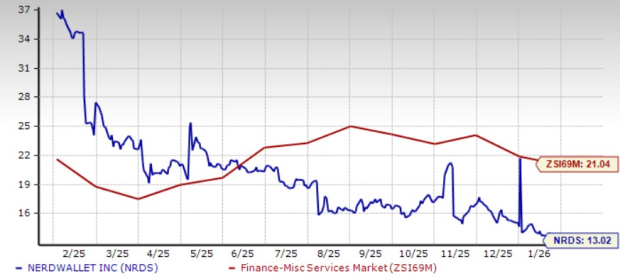

NerdWallet has gained 15.3% in the past six months, significantly outperforming its peers, LendingClub LC, FUTU Holdings FUTU and the industry as a whole. The industry has declined 20.3%, while LendingClub and FUTU Holdings have gained 8.4% and 6.4%, respectively, in the same period.

Price Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

From a valuation standpoint, NRDS trades at a 12-month forward price-to-earnings ratio of 13.02X, lower than the industry’s 21.04X. LendingClub and FUTU Holdings are trading at 10.38X and 14.89X, respectively.

Price-to-Earnings F12M

Image Source: Zacks Investment Research

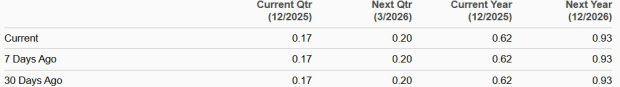

The Zacks Consensus Estimate for NRDS’ earnings for 2025 and 2026 reflects year-over-year rallies of 720% and 49.6%, respectively, over the past 60 days. Earnings Estimate for both years have remained unchanged over the past month.

Estimate Revision Trend

Image Source: Zacks Investment Research

NerdWallet currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

See Our Newest 5 Stocks Set to Double Picks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

LendingClub Corporation (LC): Free Stock Analysis Report

Futu Holdings Limited Sponsored ADR (FUTU): Free Stock Analysis Report

NerdWallet, Inc. (NRDS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com