NVIDIA Earnings: Key Metrics to Watch

The 2025 Q2 earnings cycle is slowly winding down, which has been resilient. A higher-than-average number of companies have exceeded both EPS and sales expectations, with growth also remaining solid.

And looming large this week is beloved NVIDIA NVDA, whose release is likely the most anticipated of the cycle. The tech titan’s release will be scrutinized heavily given its critical role in the AI ecosystem, with the results set to ripple across the entire market.

Importantly, the release will conclude the reporting period for the Mag 7 group, whose broader results have again shown significant growth. Below is a chart illustrating the earnings and growth rates of the Mag 7 group, with the growth expected to taper in the coming periods.

Image Source: Zacks Investment Research

But what can investors expect from NVIDIA? Let’s take a closer look at expectations and a few key metrics.

Key NVIDIA Metrics

Data Center sales of $39.1 billion throughout NVIDIA’s latest period reflected a 73% increase from the $22.5 billion mark in the same period last year, continuing its recent streak of outsized growth.

The Zacks Consensus estimate for Data Center sales stands firm at $40.9 billion, reflecting 55% growth from the year-ago figure of $26.3 billion. As shown in the chart below, which illustrates the company’s Data Center sales on a quarterly basis, growth remains rock-solid.

Image Source: Zacks Investment Research

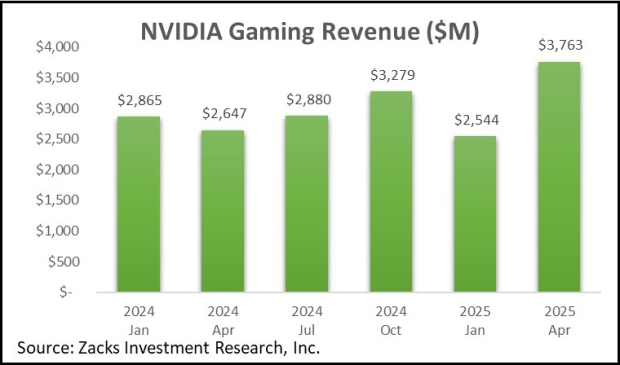

The company’s Gaming results, although now a much smaller part of its business, are also worth investors’ attention due to its dominant position in the gaming industry. Its cutting-edge Gaming GPUs are also getting a boost thanks to its advancements in AI capabilities, a key aspect to keep in mind as we increasingly wade into the AI era.

Our consensus estimate for Gaming sales stands at $3.8 billion, 35% higher than the year-ago figure of $2.9 billion. Below is a chart illustrating the company’s Gaming results on a quarterly basis.

Image Source: Zacks Investment Research

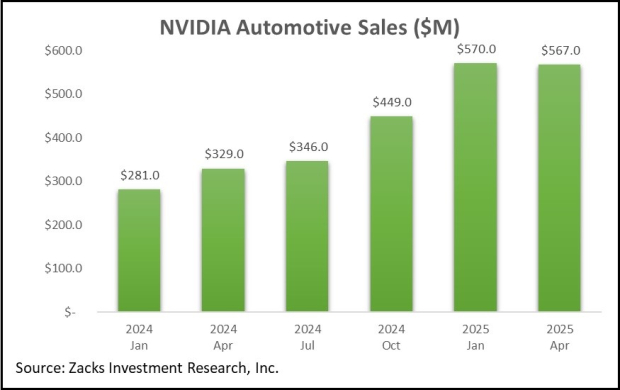

While the smallest, NVIDIA’s Automotive business has become its fastest-growing segment, posting 72% year-over-year sales growth throughout its latest period. Our consensus estimate for Automotive revenue stands at $573 million, good enough for a 65% climb from the year-ago period.

Despte not currently being a significant contributor, the long-term outlook for the Automotive segment remains notably bright, reflecting another potential future growth engine for NVIDIA.

Image Source: Zacks Investment Research

EPS and Sales Expectations

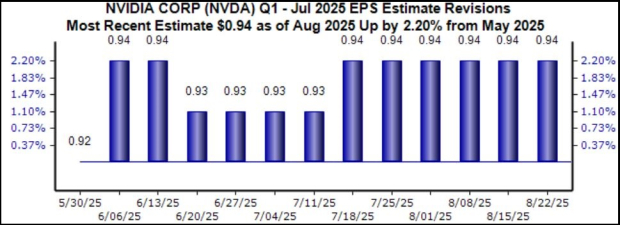

Both EPS and sales revisions have been stable over recent months, with the current $0.94 Zacks Consensus EPS estimate up just a few pennies since the beginning of June but suggesting 47% YoY growth. Expected sales of $46.0 billion reflect 55% YoY growth, with the estimated figure also up marginally across the same timeframe.

Below is a chart illustrating the EPS revisions trend since the beginning of June.

Image Source: Zacks Investment Research

The stability of the revision trends is a positive takeaway, especially following the release of results from other AI-related companies throughout the Q2 cycle.

Bottom Line

NVIDIA’s NVDA long-awaited Q2 release is nearly here, undoubtedly reflecting one of the most important of the cycle. EPS and sales expectations have largely remained stable, with the company again expected to post strong growth across key segments.

While Data Center results will be the big focus, its Gaming and Automotive results also deserve some attention as well, with the Automotive outlook notably bright. Its dominant stance among gamers also bodes favorably for the long-term outlook for its Gaming segment, with its dominance likely to be unrivaled for years.

Guidance will be critical regarding the post-earnings reaction, especially following recent talks of a ‘bubble’ within the AI trade. The stock’s 35% YTD gain heavily outpaces the S&P 500’s 10% charge higher.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com