PLSE Shares Positive First-in-Human nPulse Cardiac Catheter Data

Pulse Biosciences PLSE recently announced late-breaking data from its first-in-human feasibility study of the nPulse Cardiac Catheter System using Nanosecond Pulsed Field Ablation energy. Presented at the 31st Annual AF Symposium 2026 in Boston, the study showed effective atrial fibrillation treatment in a cohort of 150 patients, with short procedural durations and minimal incidence of adverse effects. Among evaluable patients, the study reported 100% procedural success at six months and 96% at one year post-procedure.

Management stated that the dataset represents a significant development for the company, underscoring a strong combination of workflow efficiencies and clinical outcome improvements. Study findings support the safety profile, efficacy, lesion quality and procedural speed of the nPulse Cardiac Catheter Ablation System, positioning the platform as a differentiated first-in-class technology with potential best-in-class performance. Management announced plans to initiate pivotal IDE studies that will expand patient treatment in Europe and the United States.

Likely Trend of PLSE Stock Following the News

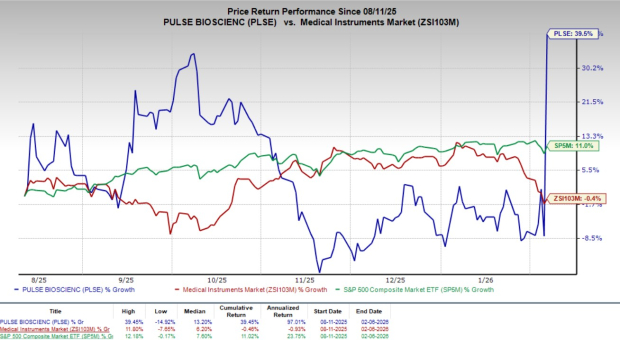

Shares of PLSE have gained 51.6% since the announcement on Thursday. Over the past six months, shares of the company have climbed 39.5% against the industry’s 0.4% decline. However, the S&P 500 has risen 11% during the same time frame.

In the long run, Pulse Biosciences’ encouraging first-in-human feasibility data for its nPulse Cardiac Catheter System is likely to strengthen the company’s clinical and commercial outlook. High procedural success rates, low serious adverse incidents and short procedure times support the platform’s safety, efficacy and workflow advantages, positioning the technology as a differentiated entrant in the expanding pulsed field ablation market. Positive physician feedback and continued patient enrollment across European centers enhance clinical validation and adoption prospects. The planned initiation of a pivotal IDE study in the United States represents a key regulatory and commercialization milestone, which could accelerate market entry, improve investor sentiment and expand long-term revenue opportunities for the company.

PLSE currently has a market capitalization of $1.41 billion.

Image Source: Zacks Investment Research

More on the nPulse Cardiac Catheter Feasibility Study

Key study outcomes demonstrated a 100% procedural success rate at six months among evaluable patients and a 96% success rate at one year. Procedural metrics included an average of 16.1 applications per procedure. Total procedure and fluoroscopy times were 65 ± 28 minutes and 9.8 ± 5.8 minutes, respectively, and left atrial dwell time was 21.0 ± 13.3 minutes. Safety findings showed a low 1.3% incidence of serious adverse events related to the primary endpoint.

The ongoing first-in-human trial is designed to assess the initial safety and efficacy of the nPulse Cardiac Catheter System for AF treatment (NCT06696170). 165 patients have been treated across nine European centers, including sites in Prague, Hasselt and Rome. Patients in the initial treatment cohort have been evaluated by remapping at approximately three months and rhythm outcomes at six and twelve months post-ablation, forming a comprehensive dataset for early performance assessment.

Dr. Vivek Reddy, Director of Cardiac Arrhythmia Services at Mount Sinai Fuster Heart Hospital, noted that the six- and twelve-month results indicate a favorable safety profile and durable pulmonary vein isolation (PVI) using the nPulse Cardiac Catheter Ablation System, suggesting potential to improve atrial fibrillation treatment. He added that the system’s conformable catheter design, differentiated energy delivery and zero-rotation workflow support efficient procedures and competitive performance relative to other AF feasibility studies.

According to Dr. David Kenigsberg, Chief Medical Officer, Electrophysiology at Pulse Biosciences, the study outcomes position the nPulse Cardiac Catheter as a potential first-in-class platform for atrial fibrillation treatment, with PVI results exceeding typical recurrence expectations. He noted that the nanosecond PFA energy platform, integrated with 3D mapping, may enable precise and durable pulmonary vein isolation.

Industry Prospects Favoring the Market

Going by the data provided by Precedence Research, the pulsed field ablation market is valued at $1.6 billion in 2026 and is expected to witness a CAGR of 33.2% through 2033. Factors like the rising prevalence of arrhythmias, the demand for minimally invasive cardiac interventions and the adoption of tissue-selective, non-thermal ablation technologies are driving the market’s growth.

Other News

In December 2025, Pulse Biosciences announced that the FDA had approved an Investigational Device Exemption (IDE) for its nPulse Cardiac Catheter Ablation System, enabling initiation of the NANOPULSE-AF clinical study for the treatment of paroxysmal atrial fibrillation. The single-arm, multicenter, prospective study will evaluate the primary safety and effectiveness of the nsPFA catheter system in patients with recurrent, drug-resistant symptomatic PAF. The study is expected to enroll up to 145 patients across approximately 30 sites, including three international centers.

PLSE’s Zacks Rank & Stocks to Consider

Currently, PLSE carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Veracyte VCYT, Intuitive Surgical ISRG and Masimo Corporation MASI.

Veracyte, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 51 cents, which surpassed the Zacks Consensus Estimate by 59.4%. Revenues of $131.8 million beat the Zacks Consensus Estimate by 5.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

VCYT has an estimated earnings recession rate of 3% for 2026 compared with the industry’s 17.4% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 45.1%.

Intuitive Surgical, sporting a Zacks Rank #1 at present, reported fourth-quarter 2025 adjusted EPS of $2.53, beating the Zacks Consensus Estimate by 12.4%. Revenues of $2.87 billion surpassed the Zacks Consensus Estimate by 4.7%.

ISRG has an estimated long-term earnings growth rate of 15.7% for 2026 compared with the industry’s 12.7% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 13.2%.

Masimo, currently carrying a Zacks Rank #2 (Buy), reported a third-quarter 2025 adjusted EPS of $1.32, which surpassed the Zacks Consensus Estimate by 10.9%. Revenues of $371.5 million beat the Zacks Consensus Estimate by 1.3%.

MASI has an estimated long-term earnings growth rate of 17.1% compared with the industry’s 12.7% rise. The company’s earnings beat estimates in the trailing four quarters, the average surprise being 12.4%.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Masimo Corporation (MASI): Free Stock Analysis Report

Veracyte, Inc. (VCYT): Free Stock Analysis Report

Pulse Biosciences, Inc (PLSE): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com