Q3 Earnings Season: Retail Sector in Focus

Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

- For the 466 S&P 500 members that have reported Q3 results, total earnings are up +14.0% from the same period last year on +7.9% higher revenues, with 83.0% beating EPS estimates and 75.3% beating revenue estimates. The proportion of these 466 index members beating both EPS and revenue estimates is 65.9%.

- The Q3 earnings and revenue growth pace for these 466 index members represents an acceleration relative to what we have seen from this same group of companies in recent quarters. The proportion of these 466 index members beating EPS and revenue estimates is tracking significantly above the historical averages for this same group of companies.

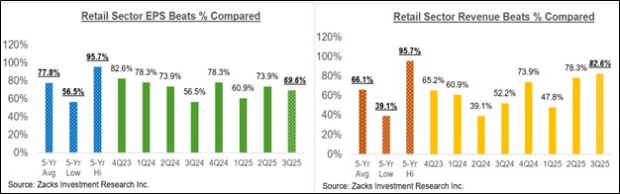

- For the Retail sector, we now have Q3 results from 76.7% of sector companies in the S&P 500 index. Total earnings for these companies are up +18.5% on +8.4% higher revenues, with 69.6% beating EPS estimates and 82.6% beating revenue estimates.

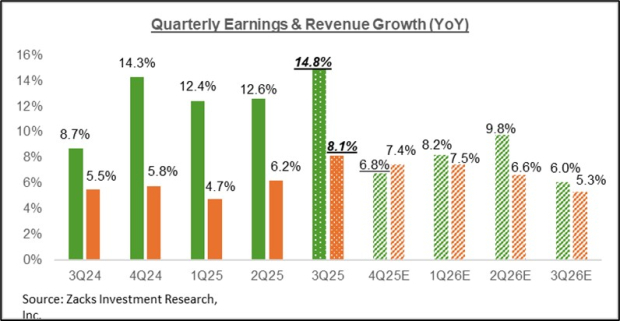

- Looking at 2025 Q3 as a whole, combining the actual results from the 466 index members that have reported with estimates for the still-to-come companies, total S&P 500 index earnings are expected to be up +14.8% from the same period last year on +8.1% higher revenues.

The Retail Sector – S&P 500 vs. S&P 600

We have a dedicated sector classification for the Retail sector instead of clubbing these companies in the Consumer Discretionary and Consumer Staples sectors. We believe that the stand-alone Zacks Retail sector enables a more nuanced, granular understanding of the space.

For reference, Zacks has 16 ‘economic’ sectors, including the Retail sector, which compares to 11 such sectors in the ‘official’ S&P classification system. In addition to the Retail sector, we also have dedicated sectors for Automobile, Construction, Aerospace/Defense, Transportation, and Business Services.

Please note that the Zacks Retail sector includes not only conventional brick-and-mortar operators like Target TGT and Home Depot HD, but also restaurant and ecommerce players like Amazon AMZN.

For the Retail sector in the S&P 500 index, we now have Q3 results from 23 of the 30 companies, or 76.7% of all the retailers in the large-cap index. For the small-cap S&P 600 index, we now have Q3 results from 23 of the 33 retailers, or 69.7% of the retailers in the index.

Total Q3 earnings for the Retail sector companies in the S&P 500 index that have reported are up +18.5% from the same period last year on +8.4% higher revenues, with 69.6% beating EPS estimates and 82.6% beating revenue estimates.

The comparison charts below put the Q3 EPS and revenue beats percentages for the large-cap index in a historical context.

Image Source: Zacks Investment Research

In order to put the Retail sector’s Q3 earnings and revenue growth rates in a historical context, we show below the growth rates with and without Amazon’s substantial contribution. Amazon’s Q3 earnings were up +29.3% from the same period last year on +11.9% higher revenues, though admittedly, the bulk of the e-commerce giant’s impressive growth pace is thanks largely to its cloud computing business.

Image Source: Zacks Investment Research

A couple of trends stand out in the Retail sector’s Q3 earnings season performance thus far. First, the group’s top-line performance is solid, both in terms of growth rates and beat percentages. Second, margins remain under pressure, though the pressure appears to be less severe than in other recent periods.

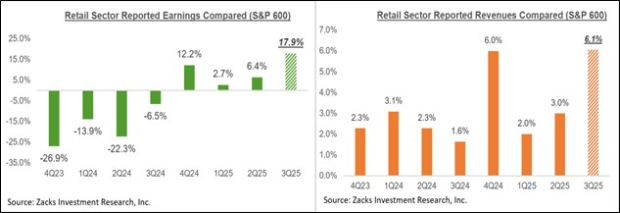

For the S&P 600 index, total earnings for the 69.7% of the sector’s members that have already reported are up +17.9% from the same period last year, on +6.1% higher revenues, with 60.9% beating EPS estimates and 69.6% beating revenue estimates.

The comparison charts below show the Q3 EPS and revenue beats percentages for these small-cap retailers in a historical context.

Image Source: Zacks Investment Research

The comparison charts below show the Q3 earnings and revenue growth rates for these small-cap retailers in a historical context.

Image Source: Zacks Investment Research

The Earnings Big Picture

Looking at Q3 as a whole, combining the actual results that have come out with estimates for the still-to-come companies, total earnings are on track to +14.8% on +8.1% revenue gains. We have consistently shown in this space how Q3 estimates have steadily increased since the quarter began.

The chart below shows expectations for 2025 Q3 in terms of what was achieved in the preceding four periods and what is currently expected for the next four.

Image Source: Zacks Investment Research

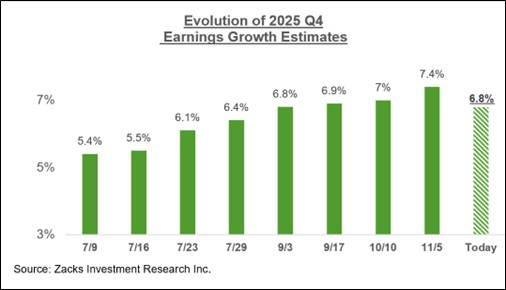

The chart below shows how estimates for the current period (2025 Q4) have evolved over the past few weeks.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture for the S&P 500 index on an annual basis.

Image Source: Zacks Investment Research

The revisions trend turned negative in recent days after staying positive earlier through the Q3 reporting cycle. We are seeing this with estimates for the current period, with Q4 estimates modestly down since the quarter got underway in October.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

The Home Depot, Inc. (HD): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com