Q4 Earnings: These Buy-Rated Stocks Crushed Expectations

The 2025 Q4 earnings cycle keeps rolling along, with a wide array of S&P 500 companies already delivering results. The period has yet again been one of resilience, with overall growth remaining strong.

But more specifically, this cycle, several buy-rated companies – Cardinal Health CAH and Palantir PLTR – posted results that were notably strong.

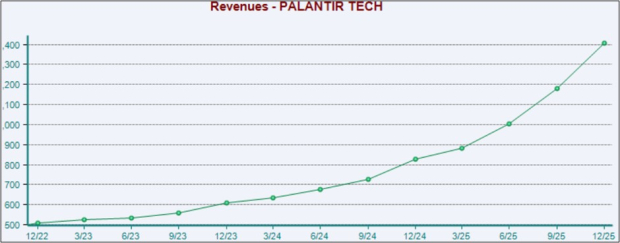

Palantir Growth Remains Stellar

Palantir again continued to fire on all cylinders throughout the period, with overall sales of $1.4 billion flying 70% year-over-year. U.S. results were rock-solid again, underpinned by both commercial and government strength. Specifically, U.S. sales totaled $1.1 billion, growing 93% year-over-year and an even more impressive 28% sequentially.

Further, Palantir closed more than $4.2 billion of total contract value (TCV) overall, up more than 130% from the year-ago period. And its consumer base keeps snowballing, with customer count surging 34% from the year-ago period.

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

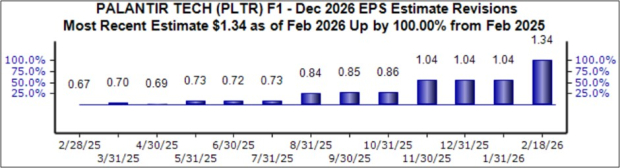

Shares have had a tough showing over recent weeks, with some profit-taking likely occurring after a massive run. While price action hasn’t been ideal, the company’s current fiscal year EPS outlook remains bullish, as shown below. The stock remains a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Cardinal Health Raises Guidance

Cardinal Health posted a double-beat relative to our consensus expectations, with sales soaring 18.8% from the year-ago period alongside a sizable 36.3% year-over-year growth rate in adjusted EPS.

Cardinal Health’s sales have seen great growth over recent periods after some stagnation throughout 2024, as shown in the chart below.

Image Source: Zacks Investment Research

Strength was primarily broad-based across its segments, with sales in Pharmaceuticals and Specialty Solutions climbing 19% year-over-year. Keep in mind that its Pharmaceuticals and Specialty Solutions accounts for the vast majority of its sales, contributing roughly 90%.

Cardinal Health raised its FY26 outlook following the strong quarter, now expecting adjusted EPS in a band of $10.15 - $10.35, with the midpoint suggesting 24.5% year-over-year growth. The updated outlook is reflected in positive earnings estimate revisions, as shown below. The stock sports a favorable Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Bottom Line

The 2025 Q4 earnings season continues to roll along, with the period largely positive and resilient.

And throughout the period, several buy-rated companies – Palantir PLTR and Cardinal Health CAH – posted very strong quarterly results.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH): Free Stock Analysis Report

Palantir Technologies Inc. (PLTR): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com