Robinhood: From Discount Broker to Fintech Powerhouse

Robinhood: A Fintech Leader

Zacks Rank #3 (Hold) stock Robinhood Markets, Inc (HOOD) first garnered attention for becoming the first stockbroker to offer commission-free equity trading. This simple, yet unheard of idea transformed Robinhood from an obscure start-up into one of the most popular stock brokers worldwide. While clients pay zero commissions on equity trades, Robinhood makes money through payment for order flow (PFOF). PFOF is compensation that HOOD receives for routing customer orders through a particular market maker. Additionally, Robinhood generates revenue through margin lending, stock lending, and investing customer cash deposits.

Although HOOD shares got off to a rough start after its 2021 IPO (falling from ~$35 to $6), they have recovered amid massive top-and-bottom-line growth and currently trade above $100.

Image Source: TradingView

Robinhood: A Fintech Innovator

While many legacy broker management teams get bogged down by being risk-averse, cumbersome regulations, and politics, Robinhood has become the foremost innovator in the fintech space with its innovative CEO, Vlad Tenev, at the helm. Below are three ways Robinhood is diversifying and growing its business:

1. Entry into Crypto & Options Markets: Robinhood is rapidly expanding beyond equity trading and into an all-in-one financial platform. HOOD entered the options and crypto businesses recently, and so far, each has taken off. Robinhood also recently launched prediction markets.

2. The Tokenization Frontrunner: Today, investors want to trade stocks at anytime. Through creating derivative “tokens” that mimic real-world assets, Robinhood users will soon be able to trade more than 200 popular assets 24/7 – providing a significant edge over its competitors.

3. Robinhood Gold: A premium subscription service that allows customers to enjoy benefits like higher interest on uninvested cash. Gold subscribers recently reached an all-time high of 3.9 million, providing a stable, recurring revenue stream.

Why You Should Buy Robinhood Stock

HOOD is Experiencing Explosive Growth

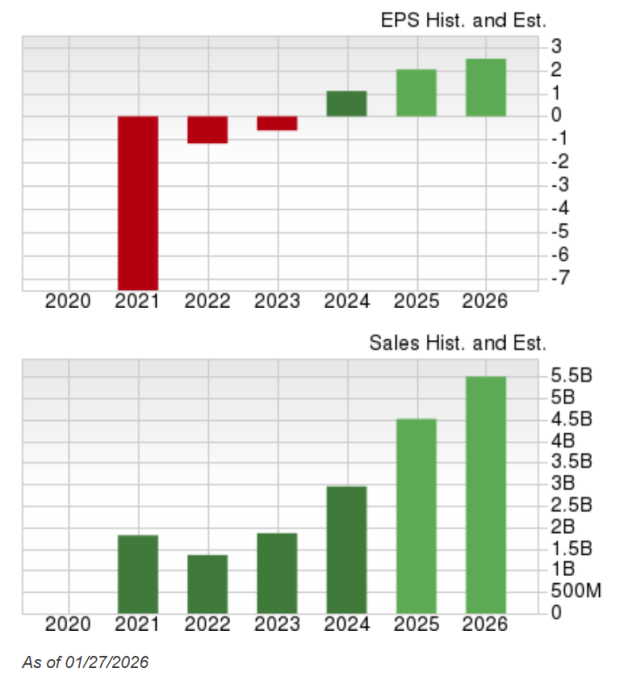

Robinhood has proven itself as a consistent, high-growth stock company. Zacks Consensus Estimates anticipate continued double-digit revenue and EPS growth through 2026.

Image Source: Zacks Investment Research

Robinhood Consistently Crushes Wall Street Expectations

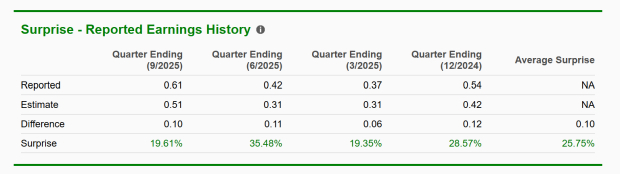

Despite Robinhood’s success, Wall Street analysts continue to undervalue the company. Over the past four quarters, HOOD has beaten Zacks Consensus Estimates by a 25.75% margin on average.

Image Source: Zacks Investment Research

HOOD Technicals Lineup

The 200-day moving average has been a favorable area for investors to scoop up HOOD shares over the past few years. Shares are approaching the 200-day moving average again, offering investors another high-reward-to-risk opportunity.

Image Source: TradingView

Bottom Line

Robinhood has evolved from a disruptive startup to a multifaceted financial titan. By continuously breaking down barriers, HOOD has created a loyal customer base that legacy brokers struggle to replicate.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Robinhood Markets, Inc. (HOOD): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com