Ryder System Grows Southeast Presence With Lebanon Expansion

Ryder System R is strengthening its Southeast presence with the opening of a new full-service truck rental and maintenance facility in Lebanon, TN, about 20 miles east of Nashville. The 7,000-square-foot site expands Ryder System’s footprint in one of the region’s fastest-growing logistics corridors. It also demonstrates the company’s commitment to supporting fleet customers with enhanced accessibility and service capabilities. Strategically located near I-40 and Highway 109, the facility provides convenient connections to regional and national transportation networks.

The new location features five maintenance bays, advanced diagnostic technology and full integration with RyderGyde, the company’s digital fleet management platform. This integration enables customers to access real-time maintenance updates, monitor vehicle status and optimize uptime. By combining technology-driven efficiency with hands-on service, Ryder System is improving fleet reliability and reinforcing its leadership in commercial vehicle maintenance and rentals across the Southeast.

Ryder System’s expansion aligns with Lebanon’s rapid economic and population growth, fueled by infrastructure investments and the city’s emergence as a logistics hub. Projects such as the 198-acre Cubes at Sparta Pike industrial park, adding millions of square feet of logistics-ready space. Ryder System is positioning itself to serve the growing transportation and distribution needs of businesses throughout the Nashville area. The new facility strengthens Ryder System’s ability to deliver comprehensive fleet solutions in one of the country’s most dynamic markets.

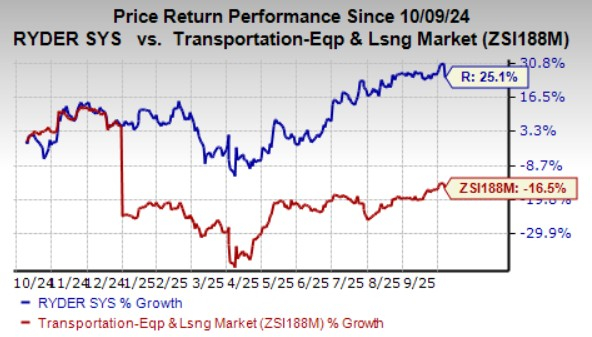

Share Price Performance

Shares of R have risen 25.1% in the past year, outperforming the 16.5% decline of the Transportation - Equipment and Leasing industry.

Image Source: Zacks Investment Research

Zacks Rank

R currently carries a Zacks Rank #4 (Sell).

Stocks to Consider

Investors interested in the Zacks Transportation sector may consider Delta Air Lines DAL and Wabtec WAB.

DAL currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

DAL has an encouraging earnings surprise history. Its earnings outpaced the Zacks Consensus Estimate in three of the trailing four quarters, missed once in the remaining one, delivering an average beat of 4.80%.

WAB currently carries a Zacks Rank #2.

Wabtec has an expected earnings growth rate of 17.59% for the current year. The company has an encouraging earnings surprise history. Its earnings topped the Zacks Consensus Estimate in three of the trailing four quarters, and missed in the remaining, delivering an average beat of 5.41%.

Beyond Nvidia: AI's Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren't likely to keep delivering the biggest profits. Little-known AI firms tackling the world's biggest problems may be more lucrative in the coming months and years.

See "2nd Wave" AI stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL): Free Stock Analysis Report

Ryder System, Inc. (R): Free Stock Analysis Report

Wabtec (WAB): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com