Terreno Realty Announces Redevelopment Property Lease in Queens

Terreno Realty Corporation TRNO announced a full-property lease for a redevelopment property in Long Island City, Queens, NY, at a stabilized cap rate of approximately 5.7%. The move highlights its effort to enhance its property quality to meet tenants' growing demand.

The redeveloped property with one industrial distribution building spans around 48,000 square feet on 2.2 acres of land. The property is equipped with 10 dock-high and 14 grade-level loading positions with a total investment of $35.8 million. The redeveloped property is fully leased to a contractor and rigging provider commencing December 2025 and expiring August 2036.

Located at 49-10 27th Street, adjacent to the entrance to the Queens-Midtown Tunnel, the redeveloped property offers the much-needed advantages of ease of connectivity.

Terreno: In a Snapshot

Terreno Realty’s redevelopments are an integral part of its ongoing efforts to optimize its portfolio and enhance its financial performance. This month, the company announced that it has executed a lease for 117,000 square feet in Doral, FL, with an international freight forwarder and provider of customs brokerage, warehousing and inland transportation.

Moreover, the company remains focused on expanding its asset base in the six major coastal U.S. markets — New York City/Northern New Jersey, Los Angeles, Miami, San Francisco Bay Area, Seattle, and Washington, DC — as demand for industrial real estate space remains buoyant.

With a solid operating platform, a healthy balance sheet position and prudent capital management practices, TRNO seems well-positioned to capitalize on long-term growth opportunities.

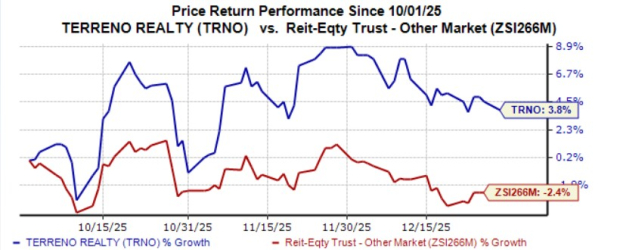

Shares of the company have risen 3.8% over the past three months against the industry’s fall of 2.4%. TRNO carries a Zacks Rank #2 (Buy) at present.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the broader REIT sector are Crown Castle CCI and Lamar Advertising LAMR, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for CCI’s 2025 FFO per share has been moved two cents northward over the past two months to $4.30.

The consensus estimate for LAMR’s 2025 FFO per share has been revised a cent upward to $8.19 over the past week.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Crown Castle Inc. (CCI): Free Stock Analysis Report

Lamar Advertising Company (LAMR): Free Stock Analysis Report

Terreno Realty Corporation (TRNO): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com