Walmart Earnings: The Newest 'Tech' Stock?

Of course, Walmart WMT isn’t actually classified as a technology stock, though it’s certainly been behaving like one over the last several years, particularly as it continues to build out its online/digital e-commerce platform.

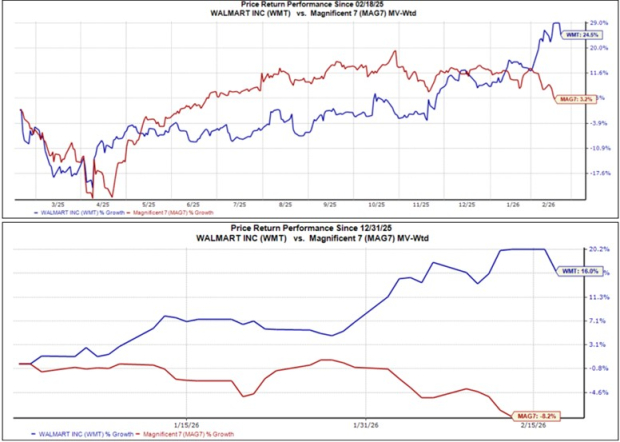

Interestingly enough, the stock has actually outperformed the beloved Magnificent 7 group as a whole both over the last year and YTD, as shown below.

Image Source: Zacks Investment Research

Walmart Earnings Loom

Walmart shares have benefited nicely from recent quarterly results, with its digital business regularly showing strong growth and enabling it to pursue additional growth avenues through advertising.

The stock headlines the reporting docket this week, with the overall schedule including several consumer-focused digital companies as well. EPS and sales revisions for the quarter to be reported have largely remained stable since the beginning of 2026, with the $189.9 billion sales estimate suggesting 5.2% year-over-year growth, while the current $0.73 Zacks Consensus EPS estimate implies 10.6% YoY growth.

While the revenue estimate is down a hair overall since the beginning of last December, the stability here since the beginning of 2026 remains a positive takeaway nonetheless.

Image Source: Zacks Investment Research

The implied growth rates here are also impressive given Walmart’s already-massive size and its retail nature, with the margins picture also remaining bright and showing clear improvement since 2023. Please note that the chart below tracks margins on a trailing twelve-month basis, not actual reported values.

Image Source: Zacks Investment Research

It's reasonable to expect the company to discuss its digital efforts heavily in the release, continuing the recent trend we’ve become accustomed to. In addition to the digital efforts, Walmart also sits in a pretty spot concerning its consumer base, with higher-income households able to trade down in periods of distress, while lower and middle-income households find its lower-priced products attractive nearly year-round.

Other Consumer Stocks Reporting

In addition to Walmart WMT, we’ve got eBay EBAY on the reporting docket as well. EBAY revisions have largely mirrored that of Walmart, with both EPS and sales revisions remaining stable and positive over recent months.

Image Source: Zacks Investment Research

The estimates for eBay imply 9% EPS growth on 11.6% higher sales, painting a decently strong growth picture overall. The performance disparity between both Walmart and eBay remains quite wide in 2026 so far, as shown below.

Image Source: Zacks Investment Research

Walmart reports on Thursday before the open, whereas eBay reports on Wednesday after the close. Favorable digital results from Walmart would definitely keep sentiment positive from a fundamental standpoint, though the big run over the past year could bring about some profit-taking. Both stocks currently carry a Zacks Rank #3 (Hold).

Beyond Nvidia: AI's Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren't likely to keep delivering the biggest profits. Little-known AI firms tackling the world's biggest problems may be more lucrative in the coming months and years.

SeeWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com