What's Supporting Western Digital's Gross Margin Momentum?

Western Digital Corporation’s WDC gross margin performance has strengthened meaningfully in the first two quarters of fiscal 2026. In the fiscal second quarter, Western Digital reported a gross margin of 46.1%, marking an improvement of 770 basis points (bps) year over year and 220 bps sequentially. This also came above the company’s guidance of 44-45%. The improvement was supported by a steady transition to higher-capacity drives and rigorous cost management across production facilities and the supply chain.

Management stated that incremental gross margin flow-through has been approximately 75%, reflecting the combined impact of stable pricing and declining costs on a per-terabyte basis. The company emphasized comfort with incremental margins well above 50%, citing consistent execution on both pricing and cost fronts.

In the third quarter, average selling prices per terabyte increased by low single digits, which management stated reflects the value delivered to customers through higher-capacity products and improved total cost of ownership. Long-term agreements and firm purchase orders with hyperscale customers were also noted as providing improved visibility and reinforcing pricing stability.

Cost reductions remain a key contributor to margin expansion. Western Digital’s ongoing success in driving down cost per terabyte, which declined roughly 10% year over year. This was linked to increased shipments of higher-capacity drives, operational efficiency in manufacturing and execution across the supply chain. In the fiscal second quarter, it shipped more than 3.5 million latest-generation ePMR drives, supporting up to 26TB CMR and 32TB UltraSMR capacities, underscoring strong customer adoption. The company shipped a total of 215 exabytes to customers, marking a 22% year-over-year increase.

Western Digital expects continued momentum in the fiscal third quarter, supported by sustained data center demand and further adoption of high-capacity drives. The company expects non-GAAP gross margin in the range of 47-48%. At the midpoint, this implies further year-over-year margin expansion. Western Digital expects non-GAAP revenues of $3.2 billion (+/- $100 million), up 40% year over year, at the midpoint.

Competitors’ Margin Expansion Strategies

Seagate Technology Holdings plc’s STX non-GAAP gross margin reached a record 42.2%, rising by about 210 bps quarter over quarter and roughly 670 bps year over year in the second quarter of fiscal 2026, driven by stronger adoption of Seagate's high-capacity nearline products and continued pricing initiatives, which together led to a modest sequential increase in revenue per terabyte, a trend expected to carry into the March quarter. For the fiscal third quarter, the company expects revenues of $2.9 billion (+/- $100 million). At the midpoint, this indicates a 34% year-over-year improvement. At the midpoint of revenue guidance, non-GAAP operating margin is projected to increase to approximately 30%.

Pure Storage, Inc.’s PSTG third-quarter fiscal 2026 non-GAAP gross margin came in at 74.1% compared with 71.9% in the prior-year quarter. The non-GAAP product gross margin was 72.9%, up from 67.4% due to more sales of high-performance FlashArrays, a bit more Portworx term-license revenue and increased hyperscaler shipments. The non-GAAP subscription gross margin was 75.5% compared with 77.4% a year ago. The non-GAAP operating margin was 20.3% compared with 20.1% in the prior-year quarter.

For the fourth quarter of fiscal 2026, Pure Storage expects revenues in the $1.02-$1.04 billion band, implying an increase of 17.1% at the midpoint from the year-ago level. The non-GAAP operating income is expected to be $220-$230 million, with around 47% year-over-year growth at the midpoint.

WDC Price Performance, Valuation and Estimates

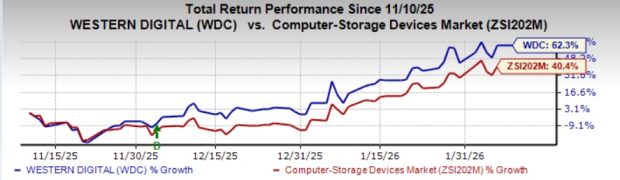

In the past three months, WDC’s shares have gained 62.3% compared with the Zacks Computer-Storage Devices industry’s growth of 40.4%.

Image Source: Zacks Investment Research

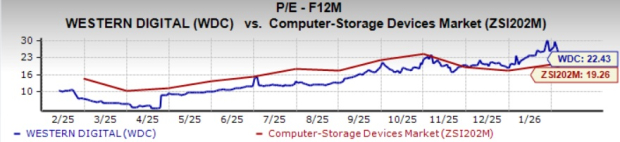

In terms of forward price/earnings, WDC’s shares are trading at 22.43X, up from the industry’s 19.26X.

Image Source: Zacks Investment Research

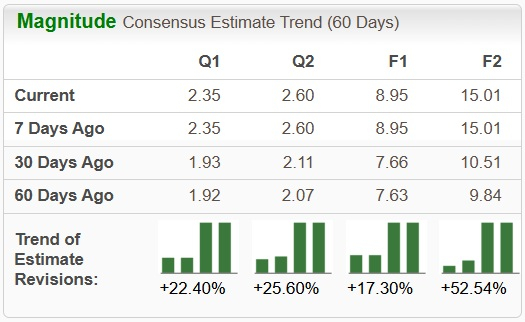

The Zacks Consensus Estimate for WDC’s earnings for fiscal 2026 has been marginally revised up 17.3% to $8.95 over the past 60 days.

Image Source: Zacks Investment Research

Currently, Western Digital sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Western Digital Corporation (WDC): Free Stock Analysis Report

Seagate Technology Holdings PLC (STX): Free Stock Analysis Report

Pure Storage, Inc. (PSTG): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com