Will Amazon Stock Keep Rebounding This Year?

On the surface, the price performance of Amazon AMZN stock has been very respectable. After all, AMZN is only 9% from a 52-week and all-time high of $242 a share (post-split basis).

That said, the rebound in AMZN has been subpar after President Trump’s Liberation Day tariffs rattled the broader market earlier in the year.

Rebounding +15% in the last six months, Amazon stock is now virtually flat in 2025, being the worst performer out of its "Mag 7" big tech peers, just behind Apple’s AAPL YTD gains of over +1% with Nvidia’s NVDA +35% leading the way.

Keeping this in mind, investors may be wondering if Amazon stock is being overlooked at the moment and if AMZN will keep rebounding.

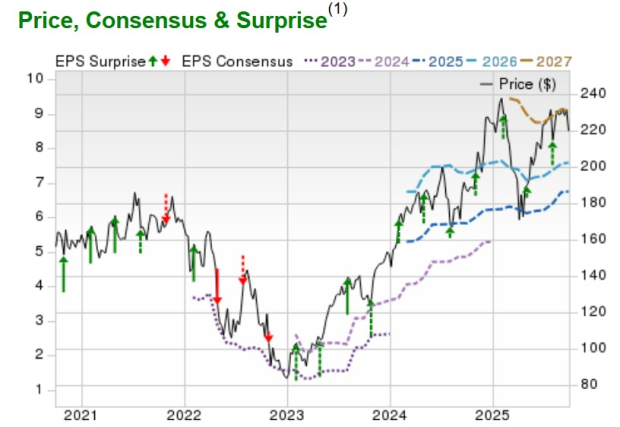

Image Source: Zacks Investment Research

AI is Streamlining Amazon’s Businesses

As illustrated by the price, consensus, and surprise chart above, Amazon has now exceeded EPS expectations for 11 consecutive quarters. Furthermore, Amazon has posted a very impressive average EPS surprise of 22.98% in its last four quarterly reports.

Most appealing and correlating with this exceptional operational performance is that Amazon is leveraging artificial intelligence in nearly every facet of its business, as depicted below.

1. Enhancing Customer Experience

Amazon has integrated generative AI into Alexa, making interactions more natural and context-aware. Also boosting Amazon’s core e-commerce business, generative AI is providing smarter product listings, with engagement being further boosted by AI-generated ads that create lifestyle-themed visuals.

2. Revolutionizing E-Commerce Operations

AI-powered robots: Operating over 750,000 intelligent robots in its warehouses, Amazon has optimized inventory movement and storage while improving efficiency and safety.

Predictive analytics: Amazon is using AI to forecast demand and manage global inventory, reducing waste and improving delivery speed.

3. Driving Innovation Through AWS

Amazon Bedrock: Fully managed generative AI platform that allows developers to access top-tier machine learning models through a single application programming interface (API), including Anthropic’s Claude, Meta Platforms META Llama, and Amazon’s Titan model.

4. AI in Everyday Services

Amazon One: Futuristic, frictionless way to make payments and verify identity, with customers using their palm thanks to AI-powered biometric recognition.

AI in Amazon pharmacy and logistics: AI streamlines prescription fulfillment and delivery routing, making services faster and more reliable.

AMZN Broker Recommendations

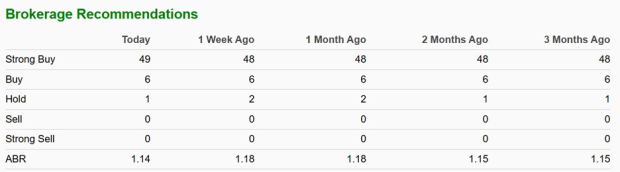

Not to be confused with the Zacks Rank, brokers do appear to be bullish on Amazon’s outlook and AI endeavors. Derived from 56 brokerage firms, Amazon currently has an average brokerage recommendation (ABR) of 1.14 on a scale of 1 to 5 (Strong Buy to Strong Sell).

Image Source: Zacks Investment Research

AMZN Average Zacks Price Target

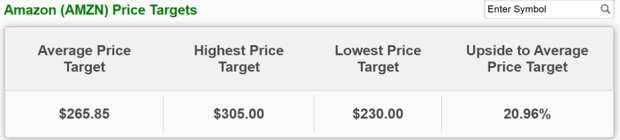

Based on short-term price targets offered by 53 analysts, the Average Zacks Price Target of $265.85 a share suggests 21% upside for Amazon stock.

Image Source: Zacks Investment Research

AMZN Technical Analysis

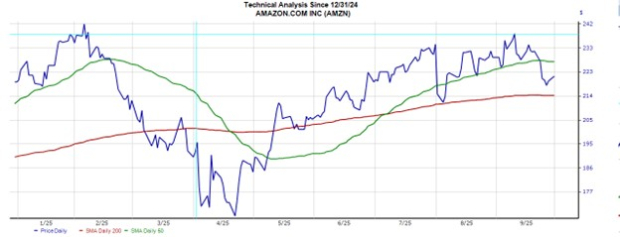

Although Amazon stock isn’t in a perceived downtrend, AMZN has recently fallen below its 50-day simple moving average (SMA), which is currently at $225, as illustrated by the green line.

While this often indicates a short-term bearish signal, AMZN has shown resistance above its 200-Day SMA (red line) of $212 and has avoided the perceived transition of a long-term uptrend to a downtrend.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

Buyer exhaustion may be the culprit for Amazon’s stagnant stock performance, as the bullish trade for AMZN has lost steam. For now, Amazon stock lands a Zacks Rank #3 (Hold). However, it's noteworthy that a buy rating could be on the way as EPS revisions have continued to trend higher for fiscal 2025 and FY26.

One presumption here is that analysts may be taking note of how AI is streamlining Amazon’s operations, and at 32X forward earnings, AMZN can certainly justify a modest premium to the benchmark S&P 500’s 25X with double-digit EPS growth in the forecast for the foreseeable future.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com