Xylem Exhibits Strong Prospects Despite Persisting Headwinds

Xylem Inc. XYL is gaining from solid momentum across most of its businesses. The Measurement & Control Solutions (M&CS) segment is benefiting from robust demand for advanced metering infrastructure solutions like smart and energy metering and strong backlog execution. Growth in the transport application business, driven by the increased infrastructure projects in the United States, is aiding the Water Infrastructure segment’s performance. Strong momentum in the treatment applications business, supported by increasing capital projects in emerging markets, also bodes well.

Recovery in the Applied Water segment, supported by higher demand for commercial building solutions applications, including pumps, valves and dispensing equipment, holds promise for the segment. Also, a strong pipeline of capital projects and strength in dewatering and services across utility and power end markets are aiding the performance of the Water Solutions and Services segment.

Xylem solidified its product portfolio and leveraged business opportunities through asset additions. In April 2025, it acquired Vacom Systems, a wastewater treatment company specializing in non-fouling, non-scaling evaporator and crystallizer systems. The buyout enhanced Xylem’s capabilities in providing sustainable water solutions. In December 2024, the company completed the acquisition of a majority stake in Idrica. The inclusion of Idrica’s technology offers growth opportunities for Xylem and will enable it to penetrate new markets and deliver intelligent solutions to its customers.

XYL’s commitment to rewarding shareholders through dividends and share buybacks is encouraging. In the first nine months of 2025, the company paid dividends of $293 million, up 11.4% year over year. Xylem also bought back shares worth $14 million in the same period. In February 2025, the company hiked its dividend by 11%.

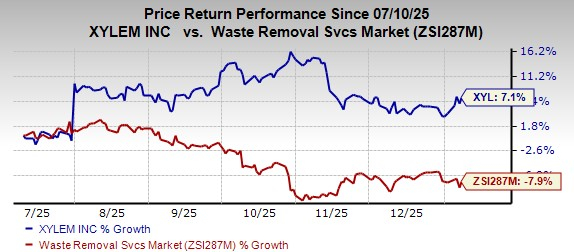

Price Performance of XYL

In the past six months, this Zacks Rank #3 (Hold) company’s shares have risen 7.1% against the industry’s 7.9% decline.

Image Source: Zacks Investment Research

However, high costs pose a threat to Xylem’s bottom line. The company’s cost of revenues increased 3.6% in the first nine months of 2025 due to high raw material, labor, freight and overhead costs. In the first nine months of 2025, its selling, general and administrative expenses were up 2.4% due to additional operational expenditure from the acquisition of Evoqua.

Xylem has a significant presence in the international markets. As a result, its financial performance is subject to various risks like the foreign currency exchange rate, interest rate fluctuations and hyperinflation in some foreign countries. The increased value of the U.S. dollar relative to the local currencies of the foreign markets may affect the company’s top line in the quarters ahead.

Stocks to Consider

Some better-ranked companies are discussed below:

DNOW Inc. DNOW presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

DNOW delivered a trailing four-quarter average earnings surprise of 43.5%. In the past 30 days, the consensus estimate for DNOW’s 2025 earnings has remained steady.

Nordson Corporation NDSN presently carries a Zacks Rank #2 (Buy). NDSN delivered a trailing four-quarter average earnings surprise of 2.2%.

In the past 30 days, the consensus estimate for Nordson’s fiscal 2026 earnings has increased 2.3%.

Montrose Environmental Group, Inc. MEG presently carries a Zacks Rank of 2. MEG delivered a trailing four-quarter average earnings surprise of 78.2%.

In the past 30 days, the consensus estimate for Montrose Environmental’s 2025 earnings has remained steady.

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the "first wave" of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks' AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nordson Corporation (NDSN): Free Stock Analysis Report

Xylem Inc. (XYL): Free Stock Analysis Report

Montrose Environmental Group, Inc. (MEG): Free Stock Analysis Report

DNOW Inc. (DNOW): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com