Bear of the Day: Avantor (AVTR)

Identifying weak stocks to avoid, or potential short candidates, is often more straightforward than finding the next big winner. The equity market is intensely competitive, and many listed companies ultimately delist over the long-term. While some investors search for accounting issues or speculative bubbles when hunting for shorts, the more reliable approach is usually simpler: focus on businesses facing slowing demand, deteriorating fundamentals, or structural headwinds.

To surface these types of names, I typically begin with a screen in the Zacks Stock Screener. My baseline filters include a Zacks Rank #5 (Strong Sell), negative five-year trailing sales growth, and share price performance lagging the broader market. This straightforward process consistently highlights companies showing signs of sustained operational pressure. One stock that recently surfaced from that screen is Avantor (AVTR). With declining sales trends, downward earnings revisions, and persistent price weakness, the setup suggests a name investors may want to approach with caution or avoid altogether.

Image Source: Zacks Investment Research

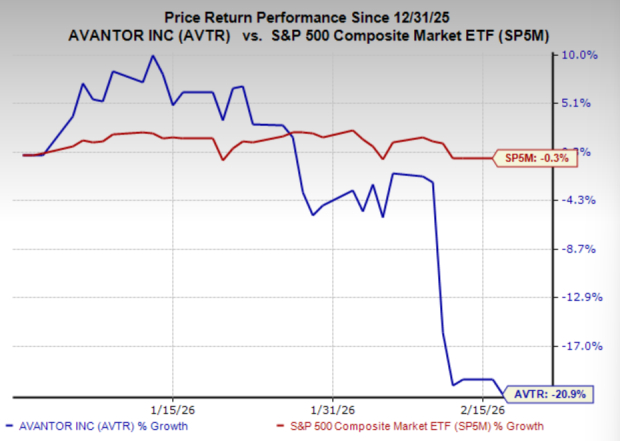

Avantor Shares Plummet Amid Deteriorating Fundamentals

Avantor’s fundamental outlook remains under pressure. Over the past four years, annual revenue has fallen roughly 13%, declining in each consecutive year during that period. Profitability has weakened as well, with net margins compressing from about 12% to 9%, reflecting both softer demand and operating pressure. Consensus forecasts call for sales to slip another 0.7% this year, followed by only a modest 2.4% rebound next year, which is hardly the type of growth profile that typically supports sustained share-price strength.

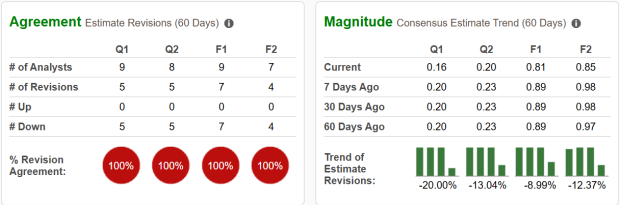

At the same time, the earnings outlook has steadily deteriorated. Analysts have been revising estimates lower since 2022, and the cuts have continued recently across multiple timeframes. Over just the past week, consensus projections for the current quarter have dropped about 20%, while full-year estimates have fallen roughly 9%. This pattern of persistent downward revisions has pushed Avantor into a Zacks Rank #5 (Strong Sell), reinforcing the negative fundamental trend surrounding the stock.

Image Source: Zacks Investment Research

Should Investors Avoid AVTR Stock?

Given the combination of declining revenue, margin compression, and persistent earnings downgrades, Avantor currently lacks the fundamental momentum that typically supports durable stock performance. Companies facing multi-year sales pressure and ongoing estimate cuts often struggle to regain investor confidence, as each revision lower tends to reset expectations and weigh on valuation multiples.

While sharp selloffs can sometimes create turnaround opportunities, the key signal to watch is stabilization in both sales trends and analyst revisions. At present, neither has clearly materialized. Until the company demonstrates consistent demand improvement, margin recovery, or a sustained halt in estimate reductions, the risk-reward profile appears unfavorable compared to other opportunities in the market.

For investors focused on capital preservation, AVTR may be better viewed as a name to avoid for now rather than one to aggressively accumulate.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avantor, Inc. (AVTR): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com