Bull of the Day: Archrock (AROC)

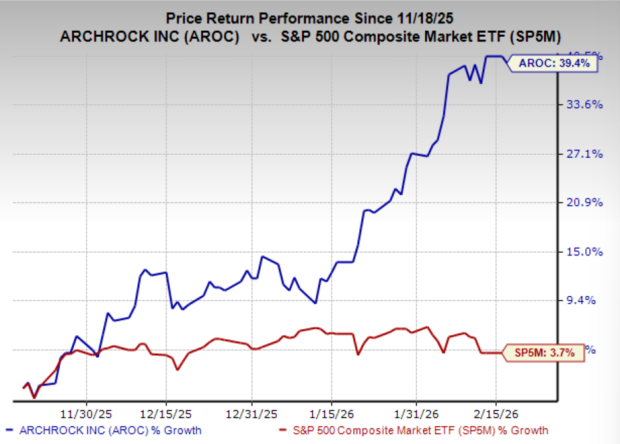

Markets appear to be undergoing a meaningful leadership transition, with several former winners rolling over while capital rotates into new areas of strength. Whether this shift proves temporary or marks the start of a longer regime change remains uncertain, but the performance gap so far this year is clear: technology has lagged while energy has emerged as the market’s strongest group. In environments like this, investors often benefit by focusing less on prediction and more on identifying stocks already demonstrating fundamental strength and positive relative performance.

One company that fits that profile is Archrock (AROC), a leading provider of natural gas compression services. The stock checks many of the key boxes investors seek, including a top Zacks Rank, a reasonable valuation, and strong price momentum supported by notable relative strength. Importantly, the opportunity is not just sector driven. Within energy, service-oriented businesses have recently shown particularly strong performance, and that industry tailwind makes Archrock stand out even more as a timely candidate for investors looking to align with current market leadership.

Image Source: Zacks Investment Research

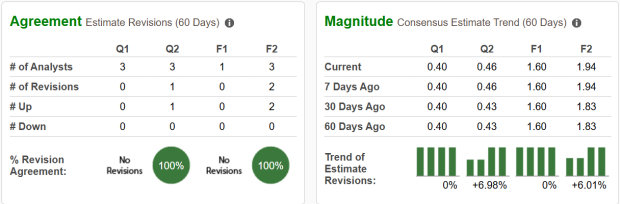

Archrock Shares Gain Amid Earnings Upgrades

Archrock shares have surged over the past three months, supported by both favorable energy sector tailwinds and a steady stream of upward earnings revisions. Over the last 30 days alone, consensus estimates for the upcoming quarter and full year have increased by roughly 7% and 6%, respectively, helping secure the stock a Zacks Rank #1 (Strong Buy).

Fundamentals continue to reinforce the bullish case. Revenue is projected to expand 28.7% this year before moderating to 6.3% growth next year, while earnings are expected to jump 52.4% this year and climb another 21.5% in the following period. That combination of strong near-term acceleration and continued forward growth highlights improving operating leverage and sustained demand for the company’s compression services.

Despite the sharp rally, valuation remains reasonable. Shares currently trade at about 16.8x forward earnings, which sits comfortably below the company’s 10-year median multiple of 20.5x and below both the broader industry and the overall market.

Image Source: Zacks Investment Research

AROC Stock Continuation Setup

After breaking out decisively toward the end of 2025, AROC extended its advance with a strong and persistent rally through the first six weeks of this year. While the broader market has experienced elevated volatility recently, energy stocks and particularly service providers, have shown notable resilience, helping Archrock maintain its leadership position.

On the chart, recent price action appears to be consolidating into a tidy bull flag pattern following the prior advance. Given the ongoing relative strength in both the energy sector and the services subsector, this type of orderly consolidation typically suggests the potential for trend continuation rather than exhaustion.

Traders watching the setup may view a decisive move above resistance near the $33 level as a potential confirmation signal for renewed upside momentum. Conversely, a breakdown below the roughly $31.50 support area would weaken the near-term technical picture and could justify waiting for a more favorable entry point to emerge.

Image Source: TradingView

Should Investors Buy Shares in AROC?

Archrock combines several traits that tend to support continued outperformance: rising earnings estimates, strong sector leadership, and a valuation that remains reasonable despite the recent rally. With energy services benefiting from sustained natural gas demand and infrastructure investment, the company’s compression-focused business model is well positioned to generate steady cash flow and earnings growth in the quarters ahead.

From a strategy perspective, investors looking to align with current market leadership may find AROC an attractive candidate, particularly if the stock confirms its technical setup with a breakout above resistance. Longer-term investors, meanwhile, may view periods of consolidation or modest pullbacks as potential opportunities to build exposure to a fundamentally improving energy services name.

As always, position sizing and entry timing matter, but with a top Zacks Rank, supportive industry trends, and constructive price action, Archrock offers a compelling combination of momentum and fundamental strength in today’s rotating market environment.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Archrock, Inc. (AROC): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com