Bear of the Day: Azenta (AZTA)

2025 was another turbulent year for Azenta AZTA stock, which fell more than 30% as the medical solutions provider struggled with ongoing sales weakness. Azenta’s struggles have been highlighted by both short-term performance issues and longer-term structural challenges.

The extended underperformance has led to reduced investor confidence and selling pressure, with Azenta appearing to lose its mojo regarding its services for drug development, clinical research, and advanced cell therapies.

Even with occasional rebounds, the overall momentum remains weak for Azenta stock, and analysts have expressed caution about the company’s ability to outperform going forward.

Image Source: Zacks Investment Research

Revenue Weakness & Market Uncertainty

Azenta’s challenges appear to be tied to fundamental business softness, especially in key revenue segments. Although Azenta was able to reach EPS expectations of $0.21 for its most recent fiscal fourth quarter and edged sales estimates of $156.67 million, the market's positive reaction was short-lived as its top line contracted from $170 million in the prior year quarter.

To that point, Azenta has had difficulties in regard to sustaining its annual revenue above $500 million, as shown below. Furthermore, Azenta has warned of continued uncertainty in the macro environment, particularly around capital spending from its customers, which typically includes biotech firms as well as gene and cell therapy companies.

Image Source: Zacks Investment Research

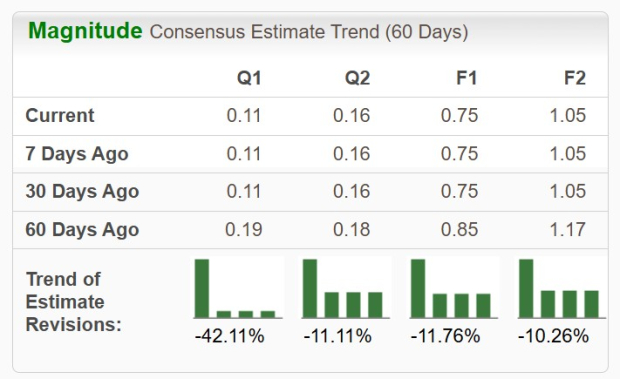

Declining EPS Revisions

Justifying the market’s concerns is that Azenta's current fiscal 2026 and FY27 EPS estimates have declined over 10% in the last 60 days, respectively.

And at $34 a share, Azenta stock still isn’t cheap in terms of its forward P/E multiple of 46X, a sharp premium to the benchmark S&P 500’s 26X despite vastly underperforming the broader market in recent years.

Image Source: Zacks Investment Research

Bottom Line

Until Azenta demonstrates sustained revenue growth or operational improvements, its stock may continue to face pressure. Correlating with such, AZTA currently lands a Zacks Rank #5 (Strong Sell) and has been a notable stock to avoid going into 2026.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Azenta, Inc. (AZTA): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com