Bull of the Day: Vale (VALE)

Spiking 20% in the last three months, Vale VALE is a top momentum stock that investors will want to pay attention to heading into the new year.

Headquartered in Brazil, Vale has multinational operations and is suitable for portfolio diversification. Offering exposure to one of the leading emerging markets, Vale is among the world’s largest mining companies with a market capitalization of $58.64 billion.

Vale’s core operations include the production of iron ore, iron ore pellets, copper, and nickel, along with manganese, ferroalloys, gold, silver, and cobalt.

Image Source: Zacks Investment Research

Vale’s Improved Operational Performance

Major management changes, including the appointment of its new CEO, Gustavo Pimenta, have helped Vale move past ethical and environmental disasters such as the 2015 dam collapse at its mining site in the small town of Mariana, Brazil.

This is also the synopsis as to why Vale stock has traded at suppressed levels, but has seen a rejuvenation to a new 52-week high of $13 a share on gains of nearly 50% in 2025.

Image Source: Zacks Investment Research

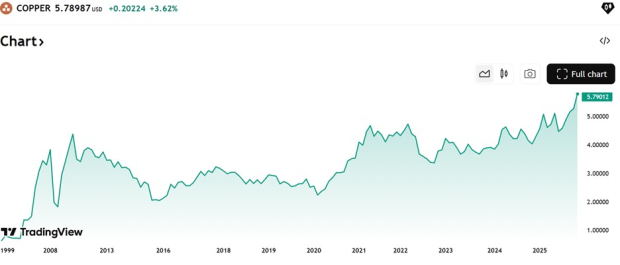

Pimenta is doing more than just changing Vale’s image, with the company shedding its non-core and lower-margin production of fertilizer, coal, and steel to focus on its strengths in iron ore, nickel, and copper production. This streamlined strategy has helped to improve long-term stability and profitability at the right time, especially considering copper prices are near all-time highs of over $5 per pound.

Furthermore, Vale has reported some of its highest production numbers since 2018, producing 94.4 million metric tons of iron ore and 90.8 million tons of copper in Q3 2025. For miners, higher production generally boosts revenue expectations and investor interest.

Image Source: TradingView

Vale’s Attractive Valuation & Dividend

Vale stock also looks cheap in terms of valuation, trading at just 6X forward earnings with EPS now expected to increase 10% in fiscal 2025 and projected to rise another 1% in FY26 to $2.02. More reassuring is that FY25 and FY26 EPS estimates have continued to trend higher over the last quarter, as shown below.

Plus, annual sales projections are heading toward $40 billion, with Vale stock trading at the often preferred level of less than 2X forward sales. And as a reminder of Vale’s earnings potential, we are not too far removed from the mining leader posting record EPS of $5.40 in 2021 on annual sales of $54.5 billion.

Image Source: Zacks Investment Research

The salsa on top that makes Vale stock a hot pick right now is its nearly 7% annual dividend yield.

Image Source: Zacks Investment Research

It’s noteworthy that when including dividends, Vale’s total return over the last decade is still an eye-catching 600%.

Image Source: Zacks Investment Research

Bottom Line

After a tremulous period of time, Vale has started to reward investors who have stayed the course, and the company’s turnaround points to more upside. The risk-to-reward has remained favorable, as Vale stock stands out with an “A” Zacks Style Scores grade for both Value and Momentum in addition to its Zacks Rank #1 (Strong Buy) rating being attributed to the positive trend of EPS revisions.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VALE S.A. (VALE): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com