Bear of the Day: Badger Meter (BMI)

Badger Meter Company Overview

Zacks Rank #5 (Strong Sell) stock Badger Meter (BMI) is a leader in the water technology sector. The Milwaukee, WI-based company specializes in smart meters that measure flow and quality of water, oil, chemicals, and other fluids. Badger Meter’s products are best-known for their accuracy, long-lasting durability, and valuable and timely measurement data. BMI’s business falls into three major categories:

1. Utility Water: The utility water product line consists of mechanical or static water meters and related radio and software technologies used by water utilities to generate water and wastewater revenue. Roughly 70% of water meters installed in the United States have converted to some form of radio solution technology.

2. Flow Instrumentation: This product line primarily serves water applications. The product line consists of meters, valves, and other sensing devices for measuring and controlling the volume of liquids and gases flowing through pipes or pipelines, such as water, air, and steam.

3. Connectivity & IoT: BMI’s ORION product enables utilities to monitor data remotely, eliminating the need to send a technician out for every issue.

Badger Meter’s Costs are Rising

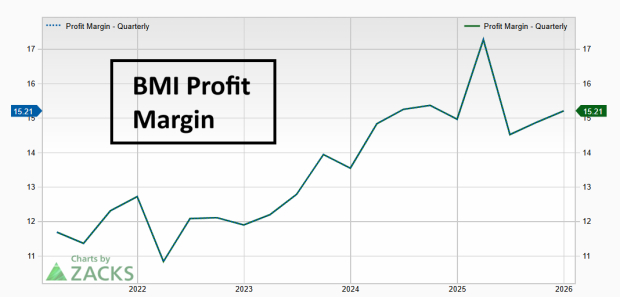

Because Badger Meter operates internationally, the company is experiencing negative impacts from global tariffs and trade conditions. Additionally, elevated copper and component prices are creating a potential gross margin headwind into 2026. Profit margins have shrunk from 17% to 15% over the past year, and this trend is likely to continue.

Image Source: Zacks Investment Research

Badger Meter Faces Mounting Competitive Pressures

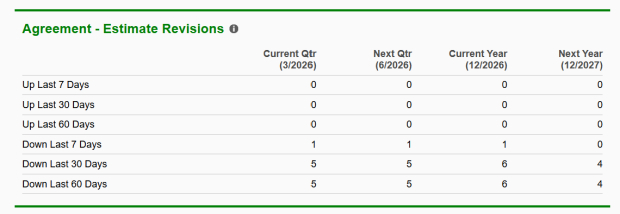

While BMI remains the dominant player in its industry, the company faces mounting competitive pressure from rivals such as Honeywell (HON) and Itron (ITRI). Meanwhile, several Wall Street analysts tracked by Zacks Investment Research have lowered earnings estimates for 2026 and 2027 – a troubling trend.

Image Source: Zacks Investment Research

BMI Technicals are Deteriorating

Over the past year, BMI shares have underperformed dramatically, falling ~30%. Additionally, shares are below the key moving averages and are forming a bear flag pattern.

Image Source: TradingView

Bottom Line

Despite its established leadership in water technology and a robust suite of smart-metering solutions, Badger Meter faces a challenging road ahead through 2026. The combination of intensifying competition and the persistent pressure of rising component costs has created a difficult environment for margin growth.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON): Free Stock Analysis Report

Badger Meter, Inc. (BMI): Free Stock Analysis Report

Itron, Inc. (ITRI): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com