Bull of the Day: Broadcom (AVGO)

Broadcom Company Overview

Zacks Rank #1 (Strong Buy) stock Broadcom (AVGO) is a tech giant that is dominant in the semiconductor and software industries. Broadcom’s two main businesses provide the hardware (semiconductors) and the virtual software that allows modern data centers to run smoothly. Below is a breakdown of Broadcom’s two main business segments:

1. Semiconductors (~60% of revenues): AVGO’s “Tomahawk” and “Jericho” chips are the industry standard for directing traffic within massive data centers. The company’s custom AI accelerators (ASICs) are designed specifically for hyperscalers. Meta Platforms (META) and Alphabet (GOOGL) use AVGO technology to power their data centers. Additionally, AVGO chips power smartphones like Apple’s (AAPL) iPhone.

2. Infrastructure Software: Through Broadcom’s $69 billion VMware acquisition, AVGO is a leader in the private cloud business. Banks, government agencies, and other large entities rely on AVGO for software and cybersecurity.

The Data Center Buildout Super Trend

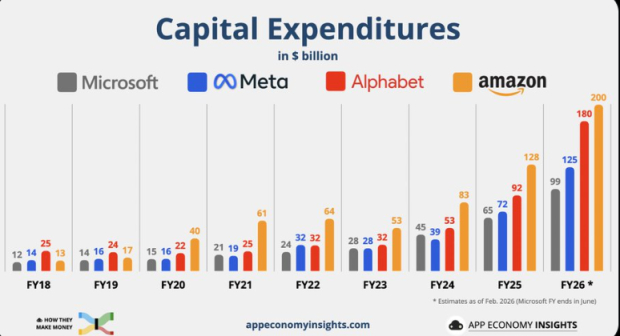

The race for AI supremacy among big tech companies has led to the largest industrial buildout in history. While the AI data center buildout has been unprecedented thus far, guidance from big tech companies suggests that CAPEX spending will only increase over the next few years. As an AI “pick and shovel” play, AVGO is perfectly positioned to capitalize on this spending.

Image Source: APP Economy Insights

Broadcom Provides an Alternative to Nvidia

Nvidia (NVDA) remains the undisputed leader in semiconductor chips. However, Nvidia’s chips are expensive and are often sold out. Although Nvidia is likely to continue to dominate, companies like Google are decoupling and de-risking their AI spending by leveraging Broadcom’s cheaper and more efficient ASIC technology.

Broadcom has High-Margin, Recurring Revenue

High-margin recurring revenue is the holy grail for growth stocks. Broadcom’s subscription-based software segment provides predictable cash flow and juicy margins.

Image Source: Zacks Investment Research

Robust Growth Outlook

Zacks Consensus Analyst Estimates suggest that Broadcom will grow in the high double-digits for the foreseeable future.

Image Source: Zacks Investment Research

Meanwhile, AVGO has beaten Zacks Consensus Estimates for 20 consecutive quarters.

Image Source: Zacks Investment Research

Bullish Technicals

AVGO shares have trended strongly over the past year, up 45%. After a quick test of the 200-day moving average, buyers stepped in, suggesting that the trend remains very much intact.

Image Source: TradingView

Bottom Line

With its "Strong Buy" Zacks Rank and an impressive 20-quarter streak of exceeding earnings expectations, Broadcom stands as a uniquely diversified powerhouse in the technology sector. As we move deeper into 2026, the company is perfectly positioned to capture the next wave of infrastructure spending, from the "insatiable demand" for custom AI accelerators among hyperscalers like Alphabet and Meta to the high-margin stability of its VMware software ecosystem. While the stock has already rewarded investors with significant gains, the combination of a record $73 billion backlog and industry-leading operating margins suggests that the bull case is far from over. For investors seeking a blend of aggressive AI growth and defensive software recurring revenue, AVGO remains a premier candidate for any long-term portfolio.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com