Bear of the Day: Caesars Entertainment (CZR)

Caesars Entertainment CZR is one of the largest gaming and hospitality companies in the US.

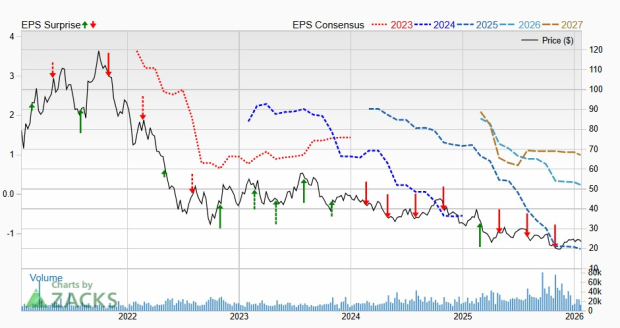

CZR stock has tanked off its post Covid-boom highs as its earnings outlook fades. Caesars Entertainment’s recent downward earnings revisions earn it a Zacks Rank #5 (Strong Sell).

Don’t Bet on Caesars Entertainment Stock Right Now?

Caesars Entertainment is a gaming and hospitality powerhouse. It owns, operates, and manages dozens of casinos, hotels, and resorts across the U.S., primarily under brands such as Caesars, Harrah's, Horseshoe, and Eldorado.

The company generates revenue from casino gaming (slots, table games, poker), hotel rooms, food and beverage services, live entertainment, conventions, and increasingly from online sports betting and iGaming through its digital segment.

Image Source: Zacks Investment Research

The current company was formed when Eldorado Resorts completed its acquisition of Caesars Entertainment in July 2020, creating what it called the largest casino and entertainment company in the U.S.

Company revenue has stagnated in the last few years as the Las Vegas giant deals with headwinds hitting the entire city. CZR’s earnings have been crushed as well.

Most recently, Caesars Entertainment posted an adjusted Q3 loss of -$0.27 a share, falling way short of our estimate for the third period in a row. It offered downbeat guidance again, citing setbacks such as “lower citywide visitation and poor table games hold” in Las Vegas and more.

Image Source: Zacks Investment Research

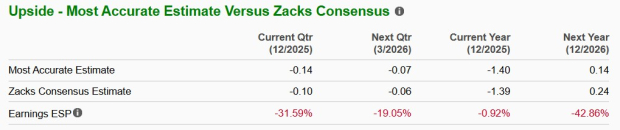

Caesars Entertainment's adjusted earnings estimates have fallen off a cliff during the last several years, with its FY26 estimate down 25% in the last few months.

Plus, its most accurate estimates came in 43% below its beaten-down consensus. This backdrop earns CZR a Zacks Rank #5 (Strong Sell) right now, signaling that investors likely want to stay away from the stock for the time being.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caesars Entertainment, Inc. (CZR): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com