Bull of the Day: Cameco (CCJ)

Cameco CCJ is one of the best pure-play nuclear-heavy AI energy stocks to buy.

The AI hyperscalers, the U.S. government, and other pillars of the global economy are kicking off a nuclear energy revival to fuel the power-hungry AI arms race while weaning off fossil fuels and becoming energy independent. This is why Wall Street is all-in on the AI energy trade.

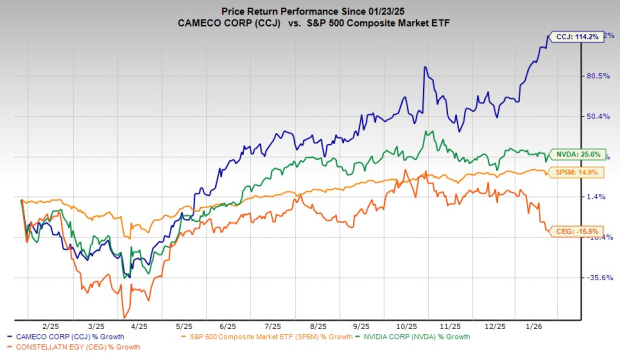

Cameco stock has soared 110% in the past 12 months, as part of a massive surge over the last five years, which helped it surpass its previous 2007 peaks. Its recent run saw CCJ outpace AI giant Nvidia and nuclear energy powerhouse Constellation Energy.

Wall Street piled into CCJ because of the increasingly critical role the Canadian uranium miner plays in the nuclear energy revival and, therefore, the AI arms race.

Image Source: Zacks Investment Research

CCJ is the second-largest uranium miner in the world and one of the only uranium stocks (fuel for nuclear reactors) that most U.S. retail investors can buy.

Uranium prices have skyrocketed over the last several years. Plus, demand is projected to outstrip supply for years as the U.S. attempts to quadruple nuclear capacity by 2050 while weaning off Russia and its sphere of influence, which dominates the nuclear fuel industry.

On top of all that, Cameco provides investors with long-term upside in nuclear energy construction through its 49% ownership stake in Westinghouse Electric.

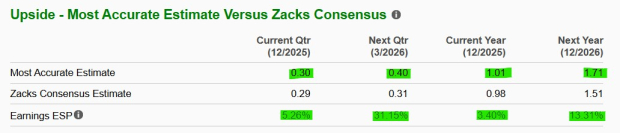

CCJ’s recent upward earnings revisions land it a Zacks Rank #1 (Strong Buy) right now.

CCJ: The Best Uranium, Nuclear, and AI Energy Stock to Buy?

Cameco is the second-largest uranium miner in the world, reportedly producing roughly 17% of global output according to the World Nuclear Association. The Canadian uranium miner is also a leading supplier of uranium refining, conversion, and fuel manufacturing services.

CCJ is one of the only large-scale uranium stocks that most regular U.S. investors can buy. The Saskatoon, Saskatchewan, Canada-headquartered firm’s importance to the U.S. is growing rapidly as it attempts to cut itself off from Russia and its sphere of influence, which dominates a large chunk of the uranium ecosystem.

The U.S. is trying to reshore many critical areas of the economy, including uranium mining, enrichment, and more. But restarting the U.S. uranium industry will take a long time after it lay dormant for decades, making Cameco vital.

The nuclear energy renaissance sent uranium prices to their highest levels in over 15 years in 2024. Despite a pullback, uranium prices have soared roughly 170% since the start of 2021. More importantly, uranium demand is set to outstrip supply for years to come.

Image Source: Zacks Investment Research

Bolstering its nuclear energy bull case further is Cameco’s 49% ownership of Westinghouse Electric—it closed the deal in late 2023 alongside Brookfield Renewable Partners (BEP), which owns the other 51%.

Westinghouse is one of the largest nuclear equipment and services businesses in the world. Its AP1000 nuclear reactors are the most recent large-scale reactors to come online in the U.S.

Westinghouse secured a substantial U.S. government contract to assist in the construction of 10 new large-scale nuclear reactors. The nuclear reactor company also offers upside in the small modular reactor (SMR) space via its next-gen AP300 reactors, which are competing alongside upstarts such as Oklo.

Why Investors Must Buy AI Energy and Nuclear Stocks

Nuclear energy could be the backbone of the entire growth, AI-driven economy at some point in the next few decades, just ask the AI hyperscalers and the U.S. government.

Electricity demand is set to grow ~25% by 2030 and ~75% by 2050, driven by AI data center expansion, electrification, reshoring, and more.

This is where nuclear power comes in. It’s been providing 50% of America’s carbon-free electricity for decades. Most importantly, nuclear power plants provide baseload power (unlike solar and wind), operating at full capacity ~93% of the time, making them the most reliable energy source by far, according to the U.S. Energy Department.

This is why Amazon, Meta, and the other AI hyperscalers are securing long-term nuclear power agreements.

Image Source: Zacks Investment Research

Meta META kicked off 2026 by landing three new nuclear energy deals to expand its efforts to power its AI growth. And we already touched on the U.S. government’s goal of quadrupling nuclear capacity by 2050.

Global data center infrastructure spending is expected to reach ~$7 trillion by 2030, with $1.3 trillion of this spending going toward power generation and the broader energy industry.

Buy CCJ Stock and Hold Forever

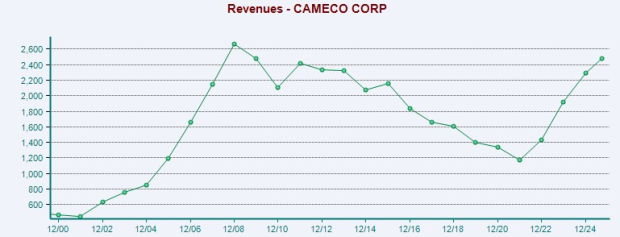

Cameco is projected to grow its adjusted earnings by 100% in FY25 and 55% in 2026. The uranium miner’s recent upward earnings revisions earn it a Zacks Rank #1 (Strong Buy), with its most accurate 2026 estimate 13% above consensus.

Its revenue expansion outlook shows it’s on track to return to its 2007 highs in the near future.

Image Source: Zacks Investment Research

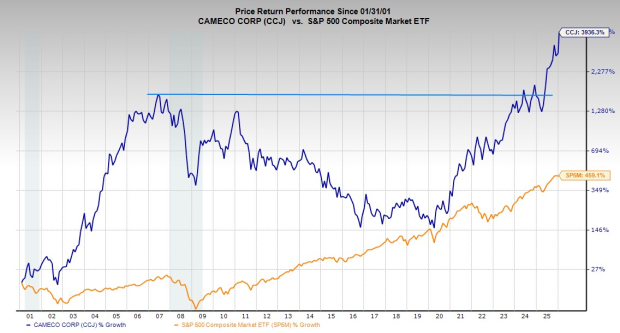

Cameco stock has crushed the S&P 500 over the past 25 years, having soared nearly 4,000% vs. the benchmark’s 460%. This run includes a 850% surge in the last five years and a 115% run in the past 12 months.

CCJ has outclimbed AI chip giant Nvidia NVDA and nuclear energy powerhouse Constellation Energy CEG in the last year to help it meaningfully overtake its 2007 highs.

Despite its market-crushing run, Cameco trades at an 85% discount to its highs, below the S&P 500, and in line with the Energy sector in terms of its price/earnings-to-growth (PEG) ratio at 1.3.

The uranium stock could be a bit overheated in the short run after its recent charge to all-time highs, overtaking its October peaks.

Market timing is, however, exceedingly difficult. Investors might want to start a position in Cameco now and then add to their stockpile the next time it pulls back to a key moving average.

No matter what happens in the short run in terms of volatility or a well-deserved drawdown, Wall Street loves the uranium miner and nuclear reactor play. Twelve of the 17 brokerage recommendations Zacks has for Cameco are “Strong Buys,” next to four “Buys,” and one “Hold.”

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Constellation Energy Corporation (CEG): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Cameco Corporation (CCJ): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com