Bear of the Day: Eagle Materials Inc. (EXP)

Eagle Materials Inc. EXP builds heavy construction products and light building materials that are critical for both road construction as well as commercial and residential construction.

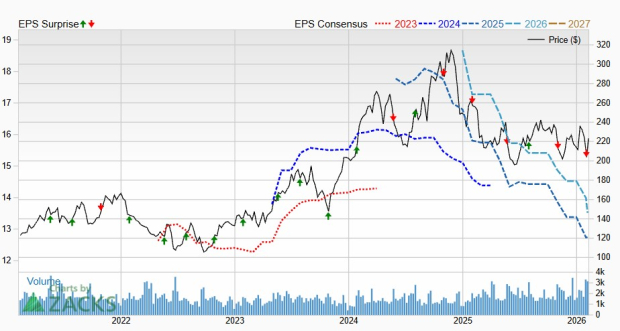

Eagle Materials’ earnings outlook faded again after it reported its Q3 fiscal 2026 results on January 29, landing EXP a Zacks Rank #5 (Strong Sell). The company’s recent downward revisions are part of a long-term negative earnings revision trend over the past year-plus.

Should Investors Stay Away from EXP Right Now?

Eagle Materials is a leading U.S. manufacturer of heavy construction products and light building materials. The Dallas, Texas-headquartered company primarily makes Portland Cement, which is critical for building roads and highways. It also makes Gypsum Wallboard that's a vital cog in residential, commercial, and industrial construction.

Eagle Materials has posted impressive growth over the last roughly 15 years, and its long-term upside remains strong. It is facing some near-term headwinds that are negatively impacting its earnings. On top of that, its sales growth is slowing a bit after a huge run, weighed down by a ‘challenging’ residential construction market.

Image Source: Zacks Investment Research

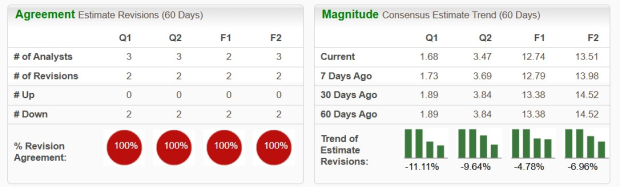

EXP’s Q4 FY26 earnings estimate has dropped 11% since its late January earnings release. Its FY26 estimate is down 5% as well, with its 2027 outlook 7% lower. These recent downward revisions land the stock its Zacks Rank #5 (Strong Sell) right now.

The construction products giant’s recent negative revisions prolong its long-term downward trend. This backdrop might mean that investors want to stay away from Eagle Materials in the short term until it provides upbeat bottom-line guidance.

Image Source: Zacks Investment Research

Long-term, however, Eagle Materials remains a stock to watch given its exposure to upside across the U.S. infrastructure boom and more. And the U.S. housing market is likely to bounce back at some point.

Its CEO touched on that in his Q3 earnings comments, noting that "federal, state, and local spending on public infrastructure projects and private non-residential construction remained elevated, supporting strong demand for our Heavy construction products."

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eagle Materials Inc (EXP): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com